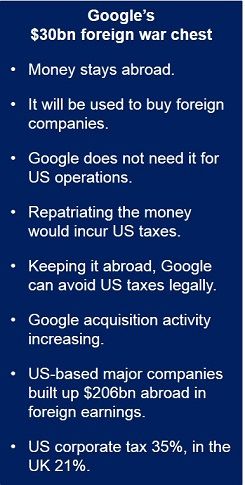

A 30 billion dollar Google acquisition fund stays overseas, Google informed in a letter to regulators. By keeping its foreign-earned money abroad, Google avoids paying US taxes on it.

British media today speculated that Google will spend a large chunk of its foreign war chest in the UK, which is one of the largest global centers for technology start-ups outside the US.

Rising global competition means the company needs more money for deals, Google wrote in a letter to the US Securities and Exchange Commission (SEC) on December 20th, 2013.

Google needs the money for foreign acquisitions

Google wrote:

“We continue to expect substantial use of our offshore earnings for acquisitions as our global business has expanded into other product offerings like mobile devices.”

“It is reasonable to forecast that Google needs between $20 to $30 billion of foreign earnings to fund potential acquisitions of foreign targets and foreign technology rights from U.S. targets in 2013 and beyond.”

Google acquisitions increasing

Despite growing criticism for parking its cash overseas to avoid taxes, Google has been increasing its acquisition activity. On January 14th this year it bought Nest Labs, a home automation company for $3.2 billion.

In 2014 it also acquired Bitspin, Impermium, DeepMind Technologies, SlickLogin, spider.io, Green Throttle, Titan Aerospace, Rangespan, Adometry, Appetas, Stackdriver, Quest Visual and Divide.

In response to an SEC’s question regarding its plans for reinvesting its foreign-sourced earnings, Google wrote “In the past few years we have completed significant acquisitions with the individual deal size increasing in more recent years, and this trend is likely to continue in future years.”

Bloomberg Businessweek says, after examining data from the securities filings from 307 corporations, that $206 billion in foreign earnings were added by the biggest US-based companies to their stockpiles of overseas profits in 2013.

In a filing in February, Google said that if the $30 billion were needed for its US operations, it would have to pay US taxes to repatriate the money. “However, our intent is to permanently reinvest these funds outside of the U.S. and our current plans do not demonstrate a need to repatriate them to fund our U.S. operations.”

Google told the SEC that it had planned to buy a foreign company valued at $4bn to $5bn, but eventually walked away from the deal. Google did not name the company.

Had the takeover gone through it would have been Google’s second-largest purchase ever, after the $12.4 billion it paid for Motorola Mobility in 2012 and sold to Levono later.

Does Google plan to diversify?

According to executives at other US-based tech companies, there are not that many appealing, large-scale tech companies outside the US available for purchase, especially in the Internet industry.

Does this mean Google will move away from its core search business when the acquisition campaign goes into full gear? We have already seen moves into high-altitude balloons and driverless cars.

US tax system keeps money abroad

The US Corporate tax system encourages companies to keep their foreign-earned money abroad, says the Council on Foreign Relations.

The last time the US tax system underwent a major overhaul was nearly thirty years ago. Lawmakers across both parties are calling for a reduction in the corporate tax rate as well as taxing overseas profits differently so that more money comes back home.

Many of the US’ competitors, such as the UK, have much lower rates of corporate tax, but collect proportionally more money than the US government does. Corporate tax in the US stands at 35%, compared to just 21% in the UK.