Shares in Abercrombie & Fitch surged by more than 25% on Friday after the fashion retailer reported better than expected third quarter results.

Profit more than doubled on a successful cost cutting campaign and same-store sales dropped by far less than expected.

The fashion retailer has been struggling over the past few years as it adjusts to rapidly changing consumer tastes and rising competition from the likes of Zara and H&M.

Abercrombie sales have dropped for 11 consecutive quarters. However, over the past two quarters the pace of decline has slowed down, a sign that perhaps business is improving.

In an effort to turn the company around Abercrombie has revamped its brand, through hiring top designers from Tommy Hilfiger and Ralph Lauren and changing the music and lighting at its stores.

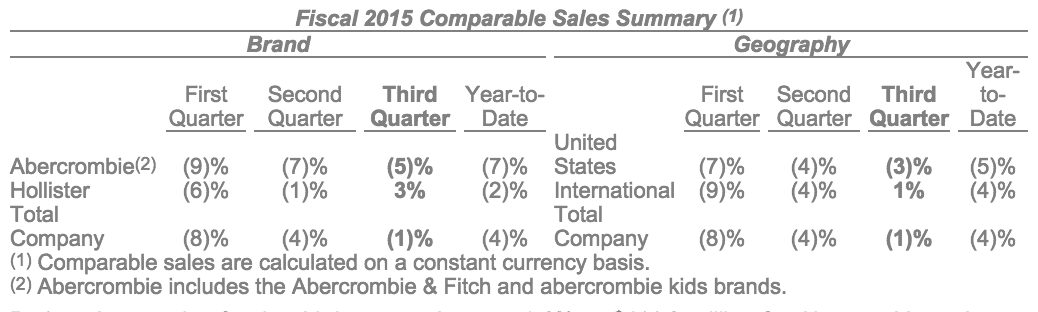

Abercrombie & Fitch – Third Quarter Results:

Source: Abercrombie & Fitch – Earnings Disclosure

Total revenue dropped 3.6 percent to $878.6 million while net income attributable to Abercrombie more than doubled to $41.9 million.

Comparable store-sales only declined 1 percent in the third quarter, less than what analysts had expected, of 2.4 percent, according to the research firm Consensus Metrix. On a sequential basis, comparable sales trends improved across all brands and geographies.

For the fourth quarter of fiscal 2015, the company expects comparable sales to be approximately flat and continued adverse effects from foreign currency exchange rates.

Arthur Martinez, Abercrombie Executive Chairman, commented on the results

Martinez said:

“Our third quarter results exceeded our expectations coming into the quarter and provide the strongest validation yet that our initiatives are working. We have seen positive customer response to the actions we have been taking on a number of fronts.

We saw continued sequential improvement in comparable sales, led by positive comparable sales for our Hollister brand and across our international business. Our gross margin rate increased substantially year-over-year, as promotional frequency and intensity were moderated. Expense management remains aggressive. As a result, adjusted operating income improved meaningfully on a constant currency basis. Inventories remain well controlled.

We recognize that we still have much to achieve. We remain intensely focused on our strategic initiatives and evolving our brands’ positioning and assortments, as well as improving our customer’s experience.

As we look ahead in the fourth quarter, there are mixed signals in the sector and we remain cautious; however, we are confident that the work we are doing is laying the foundation for long-term profitability and growth.”

Shares surge

Shares in Abercrombie surged 25 percent on Friday, closing at $24.37, the biggest gain in three years. In after hours trading shares rose to 24.54.