Alberta oil producers face worsening economic conditions as oil prices continue sliding. Even the larger companies have joined their smaller rivals in expecting budgets to shrink drastically and profits to plummet.

Companies such as Canadian Natural Resources Ltd. and Suncor Energy Inc., whose extraction costs are among the highest in the world, saw their share prices plunge to three-year lows on Friday.

At OPEC’s November meeting in Vienna there was no plan to cut production. The decision to do nothing sent oil falling even further.

If prices continue sliding, North American oil producers will suffer much more severely than their Middle Eastern counterparts.

Many believe that is why OPEC, led by Saudi Arabia, decided to keep production at its current level. If prices stay low or fall further, US and Canadian shale oil companies will go bust, supply will decline, and prices will eventually go up again – so the theory goes.

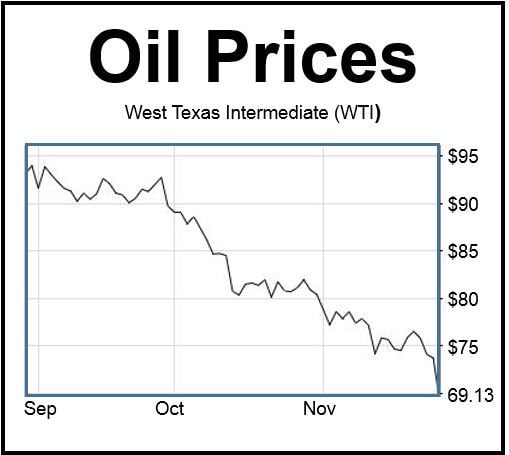

Would a further fall in oil prices spell the end of the North American shale boom? (Chart: Nasdaq)

Another conspiracy theory is that the US is conspiring with the Saudis to keep oil prices low in order to squeeze Russia’s economy further. Russia is highly dependent on oil and natural gas exports.

As far as Alberta is concerned, even the giants are going to have to cut their spending plans.

The Canadian benchmark price – Western Canada Select (WCS) – has dropped by more than one third since June’s peak, as have Brent Crude and West Texas Intermediate (WTI). On Friday, WCS traded at $55.94, while Brent fell -8.4% and WTI -8.1%.

Toronto’s S&P/TSX Composite Index Energy Sector Index was -5.1% down on Friday, hitting a three-year low.