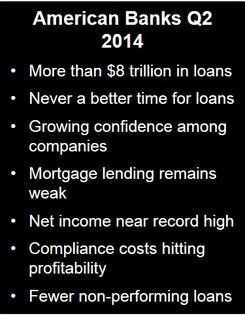

In the second quarter of 2014, the American banking industry continued to improve, says the American Banking Association (ABA), driven by a steep increase in business loans and a significant improvement in the quality of bank portfolios.

James Chessen, ABA chief economist, said:

“Banks are well positioned to continue their role as critical economic drivers, supporting job growth and business expansion. Banks have ample capacity and are ready and willing to meet increased loan demand as business and consumer confidence improves.”

Bank lending hits record

In Q2, banks held a record more than $8 trillion in loans on their books. Over the past twelve months, there has been a double-digit increase in lending, reflecting growing confidence, with companies more willing to consider expansion in a growing economy.

Mr. Chessen says he sees a natural association between companies being willing to borrow and more rapid job creation. So far this year, about 210,000 new jobs have been created each month.

With currently very low interest rates, there has never been such a good time for businesses to borrow and expand their operations.

Mr. Chessen said:

“Rates are low, and a highly competitive marketplace ensures banks will offer a broad menu of options when it comes to structuring loans.”

Even though total lending grew year-over-year by $377 billion, residential mortgage lending remains sluggish. Mortgage lending is being held back by new regulatory requirements, and will probably continue to suffer for some time, the ABA believes.

Greater earnings, but also higher compliance costs

Even though net income among US banks is reaching a record high, profitability is lower than it was before the crisis, as institutions try to address the mountain of compliance and regulatory costs that bear down heavily on the bottom line. Bank earnings have been supported by expense cuts.

Mr. Chessen commented:

“While institutions continue to monitor every dime to ensure costs remain firmly under control, there is a limit on how far that can go. Business confidence and willingness to expand will be critical going forward, and will have a direct impact on both future earnings and the direction of the broader economy.”

Improved asset quality

The number and volume of non-performing and past-due loans continue to decline.

Although US banking is not back to “normal levels”, the strong loans currently being put on books, plus the reduction in problem loans suggest bank asset quality has improved significantly.

Since the peak at the beginning of 2010, the current level of non-performing loans has fallen by 56%. Net charge-offs dropped to the lowest level since Q3 2007.

High-Quality Capital Continues to Grow

Mr. Chessen said:

“Capital in the industry is at record levels, and banks have been steadily building high-quality – or tangible equity – capital quarter after quarter. Banks continue to build strong reserves of high-quality capital, which now stands 42 percent higher than 2008 levels. Regulators have categorized 99.8 percent of banks as well-capitalized, which means their capital levels are at least 25 percent higher than minimum standards.”

With total industry capital at nearly $1.7 trillion today, the ABA believes American banks are well equipped to withstand virtually any type of financial shock.

Add to this the reserves that banks have set aside for possible loan losses, and the industry has a total buffer worth $1.8 trillion protecting it.