Apple’s second quarter results for 2014 posted a profits increase to $10.4 billion, or $11.62 per diluted share, compared to $9.5 billion or $10.09 per diluted share in the same quarter one year ago.

Apple’s fiscal year 2014 is from September 29, 2013 through September 28, 2014.

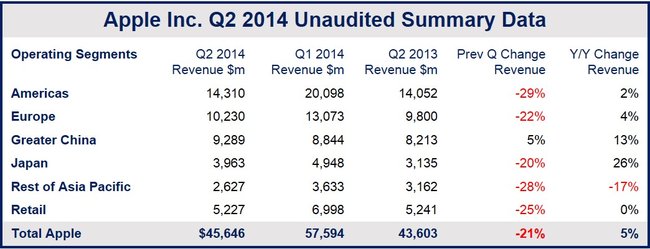

The technology giant posted Q2 2014 revenue of $45.6 billion compared to $43.6 billion in Q2 2013. Gross margin reached 39.3% in the second quarter 2014 versus 37.5% in the year-ago quarter.

Sixty-six percent of Apple’s revenue consist of international sales.

Apple Inc., with headquarters in Cupertino, California, is considered by many to be the best startup company of all time.

Apple announces share buyback

Apple Inc. also stunned investors by announcing the approval of another $30 billion in share buybacks. As part of its Capital Return Program, the company expects to use a total of $130 billion in cash by the end of calendar 2015.

The tech company also raised its quarterly dividend by 8%, and has declared a dividend of $3.29 per common share, which will be paid on May 15th, 2014. The Apple Board says it plans to raise its dividend on a yearly basis. The firm wrote in a press release “With annual payments of $11 billion, Apple is among the largest dividend payers in the world.”

Since August 2012, Apple says it has spent $66 billion on its capital return program.

In after-hours trading Apple shares rose more than 7%.

Two-thirds of Apple’s revenue comes from international sales.

iPhone sales surprise analysts

Analysts had been expecting a particularly steeper decline in post-holiday buying of iPhones, which make up more than half of Apples revenue.

Sales of iPhones declined by 14% in Q2 2014 compared to Q1 2014, as shoppers postponed spending awaiting the launch of new models. However, sales were 17% higher than in Q1 2013.

“We’re very proud of our quarterly results, especially our strong iPhone sales and record revenue from services. We’re eagerly looking forward to introducing more new products and services that only Apple could bring to market.”

Mr. Cook added that Q2 2014 was Apple’s best ever non-holiday quarter.

Peter Oppenheimer, Apple’s CFO, said:

“We generated $13.5 billion in cash flow from operations and returned almost $21 billion in cash to shareholders through dividends and share repurchases during the March quarter. That brings cumulative payments under our capital return program to $66 billion.”

Apple guidance for third quarter

Apple provided the following guidance for Q3 2014:

- Revenue within the $36bn-$38bn range.

- Gross margin between 37% and 38%.

- Operating expenses forecast from $4.4bn to $4.5bn.

- Other income (expense) of $200m.

- 26.1% tax rate.

iTunes doing well

There are now nearly 800 million iTunes accounts, compared to 575 million in June 2013, and most of them have credit cards of file. iTunes software and services income increased by 11% in Q2 2014 compared to Q2 2013, reaching $4.6 billion, a quarterly record.

Mr. Cook said:

“iTunes software and services revenue continue to grow at a double-digit rate, thanks to an incredible ecosystem and our very large, loyal and engaged customer base. With its strong momentum in growing profitability, iTunes is a very important driver of our business not only here in the United States, but around the world. We now have an almost 800 million iTunes accounts, most of these with credit cards. This is a staggering number.”