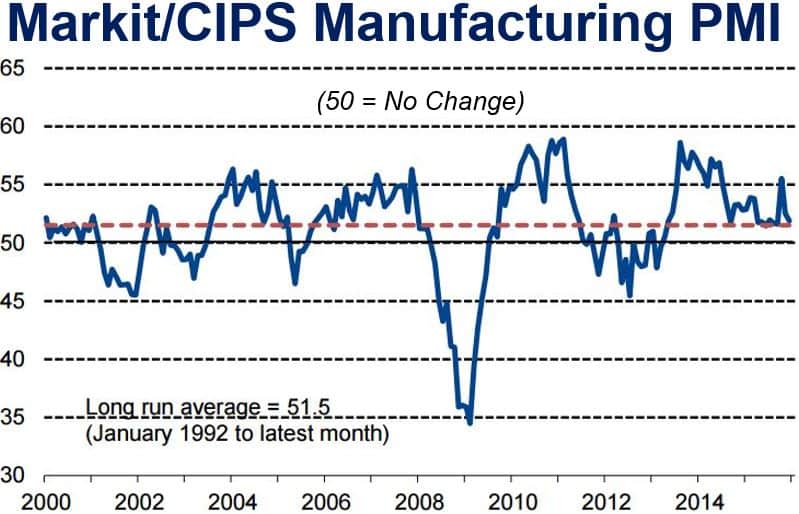

British factories ended 2015 worse than analysts had expected, according to the Markit/CIPS UK Manufacturing PMI for December, which was released on Monday, 4th January. PMI stands for Purchasing Managers’ Index, an indicator of the economic health of a country’s manufacturing sector.

UK Manufacturing PMI stood at 51.9 in December, compared to 52.5 in November. Output and new order growth slowed further in December. The Markit/CIPS report showed that performance as a whole in 2015 was below that seen in 2014.

Any reading over 50 indicates manufacturing growth. However, PMI has been shrinking since October. PMI has now slipped back towards its long-run survey average of 51.5.

After peaking in October 2015, UK Manufacturing PMI is back to its long-run average of 51.5. (Image: markiteconomics.com)

After peaking in October 2015, UK Manufacturing PMI is back to its long-run average of 51.5. (Image: markiteconomics.com)

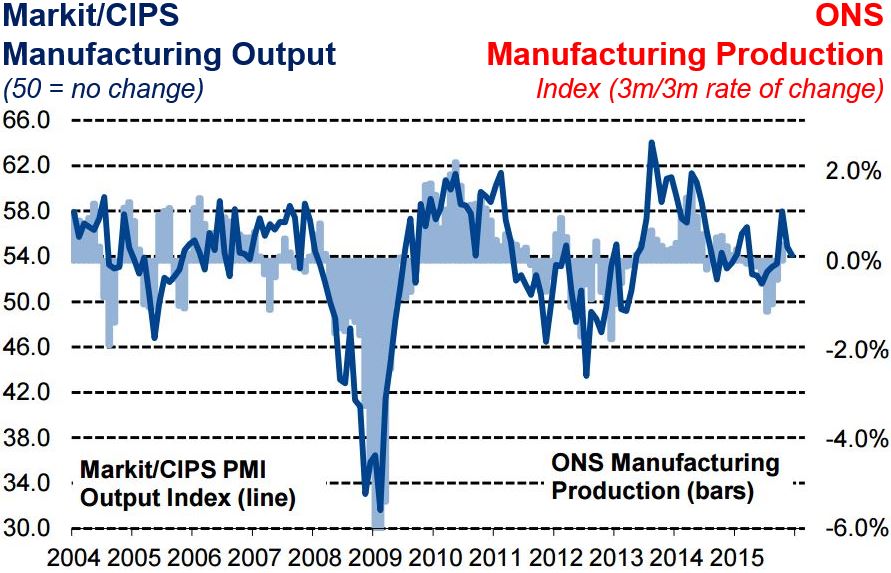

Over the fourth quarter of 2015 as a whole, the average readings of headline PMI, New Orders Index, Output Index, Employment Index and New Export Orders Index were all above their corresponding averages.

UK factories did better in 2014 than 2015

However, in each case, averages over the whole of 2015 were below those achieved in 2014.

Put simply, British manufacturing had a better year in 2014 than in 2015.

Total manufacturing production increased for the third consecutive month in December, supported by greater intakes of new business from both domestic and foreign clients.

As has been the case for a while, the prime driver of production and new order growth was the consumer goods sector, even though its rate of expansion over the month weakened.

According to the report, similar slowdowns were also seen at intermediate and investment goods producers.

ONS stands for Office for National Statistics (Image: markiteconomics.com)

ONS stands for Office for National Statistics (Image: markiteconomics.com)

Employment figures

Total employment in December grew for the 30th time in the last 32 months, after no change in November.

Even though the rate of job creation was only mild, the growth nonetheless remained broad-based. Greater employment was seen across the investment, intermediate and consumer goods sectors, and among both SMEs (small and mid-sized enterprises) and large-sized companies.

Greater employment also helped clear backlogs of work – a further reduction in stocks of finished goods was registered.

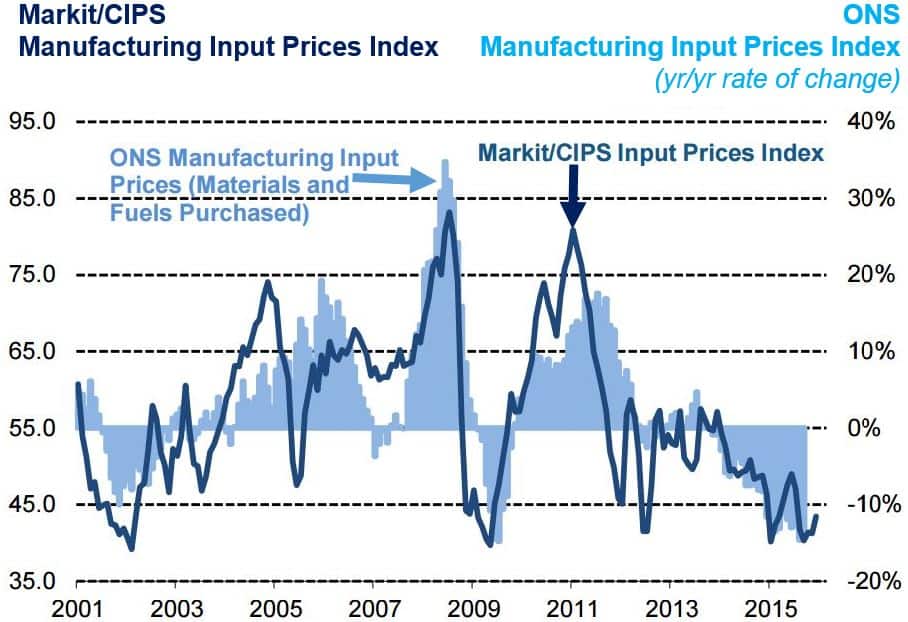

Input prices and output charges

There was a continued sharp fall in average input prices in December, albeit the least-steep in the last five months. Lower costs were mainly due to the fall in crude oil prices, as well as some other commodities.

According to the report “There was also some mention of exchange rate factors contributing to the reduction.”

(Image: markiteconomics.com)

(Image: markiteconomics.com)

Some of the lower purchasing costs passed through to customers in the form of lower output charges. However, the report authors described the rate of deflation as ‘only marginal’.

Senior Economist at Markit, Rob Dobson, said:

“The UK manufacturing sector ended 2015 on a disappointing note, with its rate of growth slowing further from October’s recent high back down towards the stagnation mark. This suggests that industry will make, at best, only a marginal positive contribution to broader economic growth in the final quarter of the year.”

“Although this would be an improvement on the second and third quarters, it does also suggest that manufacturing output over 2015 as a whole may be below the level achieved in 2014. With the latest revisions to official data also suggesting that GDP growth earlier in the year was softer than previously thought, the emphasis has really shifted to other sectors of the economy if the rate of expansion for the year as a whole is to come in close to the OBR forecast as outlined in the Autumn Statement.”

“The December manufacturing PMI data also suggests that cost pressures remain heavily on the downside and this is driving modest reductions in average factory gate selling prices. If this ongoing mix of subdued growth and weak price pressures remains prevalent elsewhere in the economy, the Bank of England will likely continue to push any potential rate increase later into 2016.”

Group Chief Executive Officer at the Chartered Institute of Procurement & Supply, David Noble, said:

“A muted end to the year with more subdued levels of production and the weakest level of expansion reported for three months. Any rise in production was attributed to new orders from domestic but also export markets as the sector saw an increase in demand from the States, Singapore and China, as well as Europe.”

“Stock levels were reduced for the tenth successive month as firms made efforts to improve on work backlogs.”

“Staffing levels also improved, from last month’s stagnant position, and this month more jobs were created across all sub-sectors and at both SMEs and larger companies. Falling input prices improved business margins as many firms seemed reluctant to pass on savings to clients to make up any perceived losses suffered earlier in the year.”