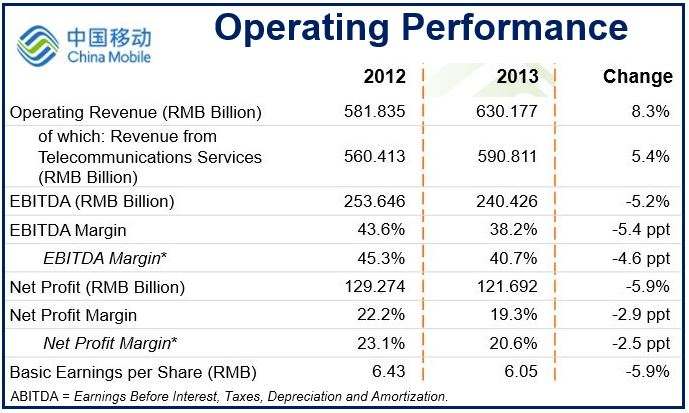

Profits at China Mobile, the largest mobile network service provider in the world, fell by 5.9% to 121.8 billion yuan ($19.5 billion). Many China Mobile subscribers are using WeChat, the free mobile messaging app service provided by Tencent Holdings, resulting in fewer pay-for text SMS messages.

The company’s last quarter profits stood at 30.3 billion yuan ($4.9 billion). Text and multimedia messages brought in 6.5% less revenue in 2013 (41.3 billion yuan or $6.6 billion).

China Mobile has more than 760 mobile phone (of all types) customers and a domestic market share of 61.2%. It has over 190 3G customers.

(Source: China Mobile)

The Chinese market is huge

China, already the world’s largest smartphone market with over 500 million mobile internet users, has a rapidly growing market.

WeChat’s effect on China Mobile’s revenue is similar to WhatsApps’ effect on mobile phone networks in other parts of the world. Rather than pay for SMS text messaging and sending pictures, users are opting in ever-growing numbers for other free-to-use messaging apps. WhatsApp was bought by Facebook for $19 billion in February this year.

Charging for sending text and picture messages used to be a lucrative source of income for mobile phone networks.

The WeChat app, known locally as Weixin, already has more than 355 monthly active users.

China Mobile expanding 4G service

China Mobile says it plans to expand its 4G service, and announced it is to spend 22% (225.2 billion, $36 billion) more on continued handset subsidies and its 4G service.

The company wrote, regarding supporting future development and providing for shareholders:

“The Board believes that the Company’s industry-leading profitability and healthy cash flow generating capability will be able to provide sufficient support to its future development, while providing shareholders with a favorable return.”

China Mobile trying to re-invent itself

Analysts say China Mobile will probably have further falls in profits as the Chinese government plans to add sales tax (VAT) to mobile phone networks, plus the company’s increased spending plans and the subsidies it will be paying out on iPhone purchases.

Apple Inc. is anxiously watching the Chinese market to see how many of its iPhones China Mobile sells. It should not be long before iPhone sales in China overtake those in North America, experts have been saying. So far, however, China Mobile executives have suggested that sales are well below expectations.

China Mobile Chairman Xi Guohua says that the majority of their 1.34 million 4G users have an iPhone, “It’s just been getting started for one or two months. So far it’s hard to tell how that will affect our business,” he added.

In order to continue thriving, China Mobile needs to re-invent itself in the mobile internet environment.

Despite WeChat siphoning off lucrative sources of revenue, the company points out that a growing number of people will start using mobile apps, which in turn means consuming larger amounts of data.

Revenue from data services increased by 24% to 206.9 yuan ($33 billion) in 2013. However, voice income, which makes up the largest part of sales, declined by 3.4% to 355.7 billion yuan ($57 billion).

China Mobile says in 2013 “increased its market share in 3G services with a net growth of 104 million customers.”

Regarding the commercialization of 4G, China Mobile wrote:

“The large scale commercialization of 4G has officially ushered in the mobile Internet age, which is characterized by smart devices, wireless broadband and cloud computation. The communications operators have entered into a period of data traffic operations, where the increase in data traffic will become the most important driver of growth.”

“This has provided the Company with greater opportunities and broader room for development, and enables the Company to remain optimistic in the mid-to-long term development prospects.”

Regarding China Mobile’s 2013 full-year report, Bloomberg quoted Tucker Grinnan, a Hong Kong-based analyst with HSBC Holdings Plc, who wrote in an email “Disappointing numbers..and weak guidance.”