Deutsche Bank AG is in the middle of a slow motion car crash, and it will likely take Germany’s Chancellor Angela Merkel down with it when it dies. What used to be Europe’s strongest financial institution is in serious trouble and is sinking deeper by the minute. Its shares have been in a perpetual downward slide for the past twelve months.

On Monday, Deutsche Bank AG shares touched €10.7 – a new low – compared to €27 one year ago. In 2007, its share price reached €146.52, i.e. in just nine years its stock price has declined by 92.7%.

If modern history is anything to go by, major banks are always bailed out by the taxpayer – it happened all over Europe, North America, Japan and Australia during the 2008 global financial crisis. So, in Germany’s case it will happen again, won’t it? Perhaps not, this time.

Does Angela Merkel really mean it? Would she just sit by and look on as her country’s largest financial institution collapsed?

Does Angela Merkel really mean it? Would she just sit by and look on as her country’s largest financial institution collapsed?

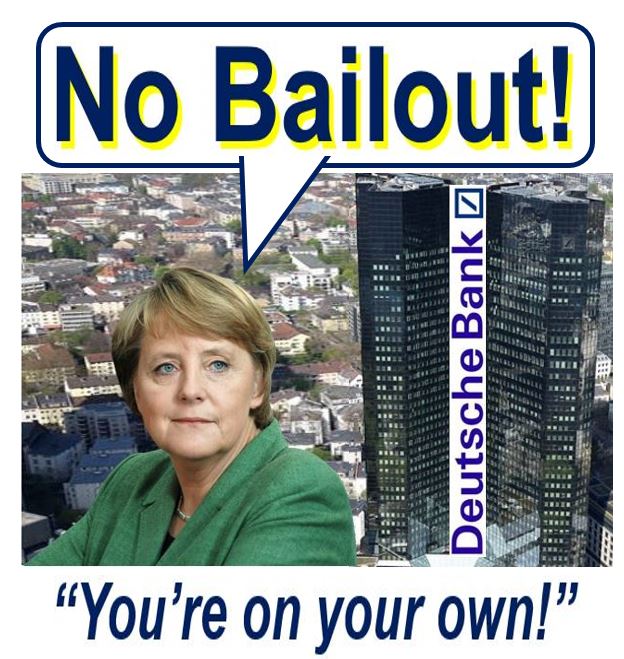

No bailout for Deutsche Bank, says Merkel

Mrs. Merkel said during the weekend that there is no way the German taxpayer is going to fork out money to save Deutsche Bank if it goes belly up.

Of course, these are only words from a lawmaker. We know that politicians commonly say one thing today and do completely the opposite tomorrow. Would she really let Germany’s largest financial institution crash, and watch all the other banks and related firms in Frankfurt and the rest of the country panic or go down with it?

Following her comments regarding no bailout money from the taxpayer, Deutsche’s share price immediately took a 6.1% nosedive. It had already been the focus this month after the US Department of Justice sought $14 billion to settle claims related to the sale of mortgage-backed securities.

Mrs. Merkel also said during the weekend that she is not going to intervene on the bank’s behalf in order to try to reduce the fine.

Deutsche Bank AG today is but a shadow of its former self. However, it is still a huge company. It employs more than 100,000 workers and operates in over 70 countries. In 2009, it was the world’s largest foreign exchange dealer. (Image: adapted from Yahoo Finance)

Deutsche Bank AG today is but a shadow of its former self. However, it is still a huge company. It employs more than 100,000 workers and operates in over 70 countries. In 2009, it was the world’s largest foreign exchange dealer. (Image: adapted from Yahoo Finance)

Deutsche Bank – a very bad year

Deutsche Bank AG, the Frankfurt-based global banking and financial services giant, has been floundering for a very long time. Two months ago it announced a steep fall in profits and revenues. In February this year, its co-CEO John Cryan issued a statement reassuring everybody – investors and staff – that the company was rock solid after its share price had declined steeply.

Experience tells us, especially since the global financial crisis, that CEOs tend to make such statements just before everything falls apart.

Other banks and financial institutions that Deutsche Bank AG deals with are going to become extremely jittery about dealing with it, now that Mrs. Merkel said there will be no bail out. As we saw just eight years ago, loss of confidence is the kiss of death, regardless of how big a bank might be.

What about Merkel and the euro?

If Deutsche Bank does crash, it will leave a giant vortex in its wake that will take several financial institutions with it, and probably Mrs. Merkel and the mighty euro as well.

Bloomberg Markets quoted Michael Woischneck, a senior equities manager at Lampe Asset Management in Dusseldorf, Germany, who said:

“The drama around Deutsche Bank puts the European financial sector in the spotlight once again. It makes you wonder what the situation is like at other banks with significant capital-markets activities.”

“We’re also entering a quarter with a lot of political event risks, and I’d expect big swings in volatility.”

Almost as a prelude to how one major bank can bring others down with it, today Britain’s Lloyds Banking Group Plc and BNP Paribas SA saw their share prices fall by over 3%. For much of the banking sector in Europe’s stock exchanges, today was a bad day.

Optimism turned to pessimism

Europe was all full of optimism last week, with investors riding the happy wave created by the central-bank stimulus. A reminder of the pathetic state of some of the region’s largest lenders soon turned that sentiment into a feeling of gloom.

There is a growing feeling among members of the public in Europe and North America that perhaps it is best to just let the loss-making banks fall and die off. Others would then be able to emerge, lessons would be learned, and history would not keep repeating itself.

Financial institutions in London, New York and every other financial centre around the world are again paying their top executives exorbitant bonuses which are in no way linked to performance – some of these companies are still making huge losses and are only alive thanks to the taxpayer. In the eyes of the public, they have not learned anything from what happened in 2008.

Video – Deutsche Bank won’t pay $14bn fine

Deutsche Bank AG says it won’t pay the full $14 billion fine imposed by the US Department of Justice. It says it will fight the massive demand, which dates back to the sub-prime scandal that led to the 2008 global financial crisis.