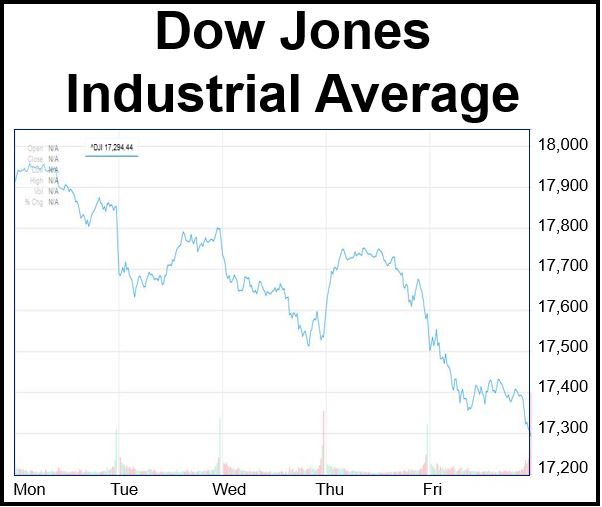

The Dow Jones Industrial Average declined by 3.8% in one week, its steepest one-week fall since November 2011, despite the US economy doing well and a string of positive data coming out of the country. Fund managers said they and their clients are becoming increasingly anxious.

From Monday to Friday, $1.2 trillion were wiped off global equities.

Investors have become jittery with oil prices hitting five-year lows and disappointing Chinese economic data.

US crude oil stayed below $60 dollars per barrel during the whole week; it went below $58 for the first time since May 2009. Brent crude fell below $63.

China’s factory output growth fell to 7.2% (annually) in November from 7.7% in October, which was lower than analysts had expected. Add to this two quasi-moribund major economies – the Eurozone and Japan – and the global picture starts looking bleak.

Standard & Poor’s 500 (S&P) fell by 3.5% in the week, its sharpest decline since May 2012. Nasdaq dropped by 1.2%, finishing at 4,653.60.

Source: Yahoo Finance.

Investors were taken by surprised. Only a week ago they were all smiles as the Dow looked set to hit the 18,000 level.

Historically, December is the best month of the year for large-cap stocks. Many had expected another strong week would follow.

Traders in shares are starting to realize that while the steep fall in oil prices is great for most households, it often has a negative impact on financial markets and the overall economy. US shale-oil producers, for example, who are mostly heavily in debt, will have to scale back production, hiring, and investment before oil prices start picking up again.

The high-yield corporate bond market is likely to suffer as a higher number of companies fail to survive the oil-price crash, and debt restructurings grow.

Sixteen percent of all US junk bonds today come from energy companies. Experts had warned that if oil falls to $60 per barrel, a sizable proportion of this debt would default.

European stocks had a bad week too

The share index of the 100 largest companies on the London Stock Exchange, the FTSE 100, fell by 2.49%, its worst week in three years. A total of £110 billion vanished from the UK stock exchange.

Germany’s DAX fell 2.72%, France’s CAC40 was 2.77% down, while Italy’s FTSE MIB saw stocks decline by 3.13%.

There was also concern in the European Union about the Greek fragile political situation. Greece’s coalition government, which faces a parliamentary vote later this month, says it has not yet gained enough support to prevent its collapse.