The ECB slashes rates, surprising analysts, to bolster economic growth and prevent a Eurozone slide into a deflationary spiral. The ECB Governing Council reduced its three main interest rates:

- The interest rate on the main refinancing operations of the Eurosystems (benchmark rate) will be reduced to 0.05%, a decrease of 10 basis points.

- The marginal lending facility’s interest rate will go down to 0.30%, a decrease of 10 basis points.

- The deposit facility interest rate will be reduced deeper into negative territory to (minus) -0.20%, a reduction of 10 basis points.

In all three cases, the new rates will be effective from September 10th, 2014.

The ECB’s Governing Council is concerned that the worsening economic outlook for the Eurozone will undermine any economic momentum it has, and could dampen private investment. Add to this the heightened geopolitical risks in Ukraine and the Middle East, and the potential damage to business and consumer confidence is considerable, it added.

The ECB now forecasts 0.9% GDP (gross domestic product) growth for the Eurozone this year, and 1.6% in 2015. In the second quarter, GDP flatlined.

Its forecast for inflation this year, which is currently running at 0.3%, has been reduced to 0.6%. The ECB expects it to increase to 1.1% next year, which will still be well below its 2% target.

ECB to start buying assets

Mario Draghi, President of the ECB (European Central Bank) informed today that the Governing Council agreed to start buying non-financial private sector assets, i.e. it will buy packages of bank loans.

The unprecedented move falls short of the large-scale asset purchases many economists have been urging to boost the Eurozone’s economy.

Mr. Draghi added that the Eurozone’s central bank will also start purchasing asset-backed securities, i.e. bundles of loans that banks issue to households and businesses. It will also purchase covered bonds, which are similar to asset-backed securities in that they consist of bank loans.

If it has to, the ECB will take further measures, a clear indications that Mr. Draghi and colleagues are willing to consider quantitative easing – the purchasing of government bonds or other assets.

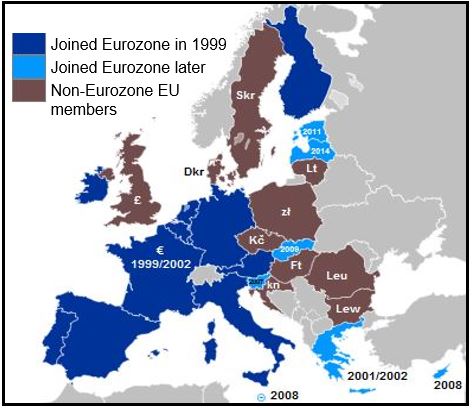

The UK, Denmark and Sweden chose to stay out of the Eurozone, but are European Union members. The other countries in brown will eventually adopt the Euro as their currency.

ECB to start printing money?

“As our measures work their way through to the economy they will contribute to a return of inflation rates to levels closer to 2%. Should it become necessary to further address risks of too prolonged a period of low inflation, the Governing Council is unanimous in its commitment to using additional unconventional instruments within its mandate.”

“Unconventional instruments” refers to printing money, just as the Bank of England and the US Federal Reserve have.

While claiming that today’s decision was voted through with a “comfortable majority”, Mr. Draghi admitted that it was not unanimous.

Video – ECB slashes rates to record low

In this Wall Street Journal video, Paul Hannon and Katie Martin discuss the ECB’s policy decisions.