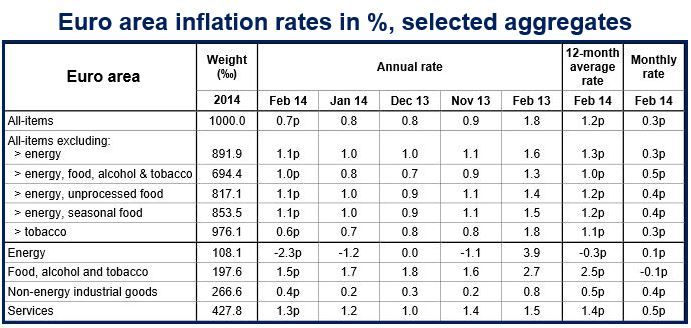

Euro area inflation declined further away from the European Central Bank’s 2% target, increasing concerns that the trading bloc may be entering an economically damaging period of deflation. The Euro area inflation rate (annualized) was 0.7 percent in February, compared to 0.8% in January, according to figures published today by Eurostat, the statistical office of the European Union.

February’s inflation rate for the whole of the European Union (EU) was 0.8%, versus 0.9% the month before.

The Euro area (or Eurozone) includes just 18 EU Member States that use the euro as their national currency; some EU members, such as the UK and Denmark, have their own currencies, so they are not in the Euro area.

The Euro area’s greatest price increases came from tobacco with a gain of 0.08 percentage points, electricity and restaurants/cafes (0.06 percentage points each). Transport fuels, telecommunications, and heating oils, on the other hand, had the biggest declines, falling 0.1 and 0.07 percentage points respectively.

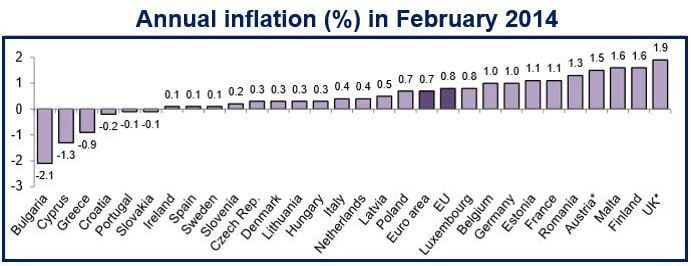

Prices fell in some countries

The following EU Member States registered price falls for February – Slovakia, Portugal, Croatia, Greece, Cyprus and Bulgaria. The greatest annualized price gains were seen in the UK (1.9%) and Finland (1.6%).

According to the European Central Bank (ECB), the risk of deflation is very small, it adds that the Euro area is recovering well from a long period of recession.

(Source: Eurostat)

At the end of 2011, Euro area inflation stood at 3% and started to drop. By January 2013, it had fallen below 2%. The ECB has lowered interest rates and done everything it can to boost economic growth and bring inflation nearer to 2%.

While succeeding somewhat regarding the economy, inflation continues to position itself far from the 2% target.

(Source: Eurostat)

Why is deflation undesirable?

Deflation refers to falling prices. When consumers expect prices to fall they wait, they do not spend now but prefer to postpone purchases, because they expect lower prices later on.

Lower consumer spending affects retailers whose sales drop. Retailers consequently buy less from wholesalers, who in turn reduce their orders with manufacturers. In time all three sectors of the economy start laying people off because of weaker demand.

People with loans also become worse off. If there is some inflation your monthly mortgage payments become relatively cheaper as your salary increases. However, if prices fall so will wages, while monthly mortgages payments remain the same, meaning they will take up a higher percentage of your income.

During a long period of deflation consumers spend less, there is less business activity, unemployment may rise, and people and businesses take out fewer loans.

According to the ECB, inflation should gradually rise to about 1% by the end of this year, and will reach the 2% target in 2016.

The ECB predicts that the Eurozone’s GDP (gross domestic product) will grow by 1.8% annually in 2016.

Written by [google_authorship]