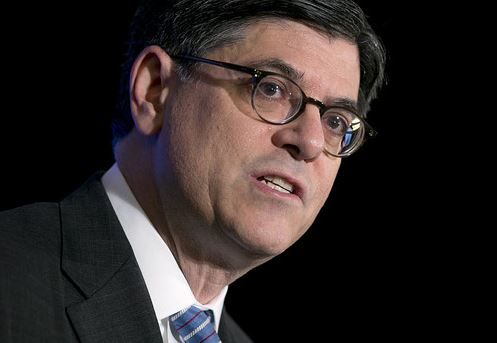

Treasury Secretary Jacob Lew, on behalf of the US, said China, Japan and Europe were not delivering enough support to boost growth in their economies. He spoke at a session of the policy-setting committee on Saturday at the 2014 IMF-World Bank Annual Meetings in Washington D.C.

Mr. Lew said European policymakers must concentrate on recalibrating policies to tackle persistently weak demand.

He said Japan faces an uncertain future with weak growth for 2014 and 2015. Although the Bank of Japan’s monetary policy is helping break the deflationary cycle and supporting growth, budget reductions need to be carefully calibrated, Mr. Lew warned. The Japanese government needs to “move decisively to implement requisite growth-boosting structural reforms,” he added.

Although not mentioning Germany specifically, it was evident that his description of Europe’s reluctance to take greater measures to stimulate growth were directed at the region’s largest economy. Several EU member states, such as France and Italy, have also complained at Germany’s refusal to do more.

Jacob Lew believes it is time for Germany to start spending more money.

Mr. Lew said nations with large trade surpluses and fiscal flexibility must do more to kick start economic growth. Germany and China have the largest trade surpluses in the world.

Europe

Mr. Lew said, regarding the Eurozone:

“European leaders should focus on recalibrating policies to address persistent demand weaknesses in the near-term and boost potential growth over the medium to long term; demand and structural supply side reforms should go hand-in-hand to catalyze stronger growth. Indeed, at the recent G-20 meeting of Finance Ministers and Central Bank Governors in Australia, members intensified their call for boosting domestic demand in Europe, as part of an appropriate policy mix – fiscal, monetary, and structural.”

A growing number of economists in Europe are calling for a shift away from the German led policies of cutting deficits to boosting investment expenditure. They warn that the Eurozone risks becoming stuck in a Japanese-style prolonged period of economic stagnation.

Mr. Lew praised the performances of the British, Canadian and Australian economies, which have seen robust growth this year.

China and emerging markets

Although Chinese economic growth has slowed somewhat, it still remains strong. However, Mr. Lew warned that risks to China’s economic health have increased and the country continues facing the challenge of rebalancing the economy to consumption-led growth.

Regarding China, Mr. Lew said:

“China has ample space to adjust policies to support growth if needed. It is critical that Chinese leaders implement reforms that move the country toward a market-determined exchange rate and address financial sector risks.”

He added that several emerging economies need to introduce much-needed structural reforms to support potential growth. They also require greater exchange flexibility, which could help them better withstand external shocks.

The G-7 and G-20 nations must adhere unwaveringly to their exchange rate commitments, Mr. Lew emphasized. The G-7 nations “should stand by their commitment to orient fiscal and monetary policies toward domestic objectives using domestic instruments and not target exchange rates,” he said.

The G-20 members, on the other hand, “should move more rapidly toward more market-determined exchange rate systems and exchange rate flexibility reflecting underlying fundamentals, avoid persistent exchange rate misalignments, refrain from competitive devaluation, and not target exchange rates for competitive purposes,” he concluded.