With consumer prices increasing at their lowest rates in four years, experts fear that a European deflation risk will undermine its fragile recovery.

This week also saw the euro slide against the dollar, as well as persistently high unemployment rates in the euro area.

Inflation in the euro zone dropped to 0.7% (annualized) in October, the last time it was below that percentage was in November 2009. For the last nine months, inflation has been well below the European Central Bank’s ceiling of 2%.

The European Central Bank (ECB) may decide to inject money into the system, however, this may have no impact on consumer prices. It could reduce interest rates further, but they are already very near zero. Financial analysts suggest that the ECB might completely change or ignore its definition of price stability.

European deflation may harm economic recovery

If European consumer prices slow down even more, it could escalate into a deflationary negative spiral that may put an end to its current fragile economic recovery.

After six quarters of recession, the 17 countrys of the euro zone have finally returned to economic growth. However, in many member nations unemployment is still extremely high and bank lending is shrinking.

In an interview with Bloomberg, Greg Fuzesi, who works at JPMorgan in London, said “The ECB has become unusually tolerant of low inflation, even by its own standards. The argument for inaction is becoming more stretched, however. The refinancing rate cut is the simplest option in the near term.”

Unemployment in Europe high

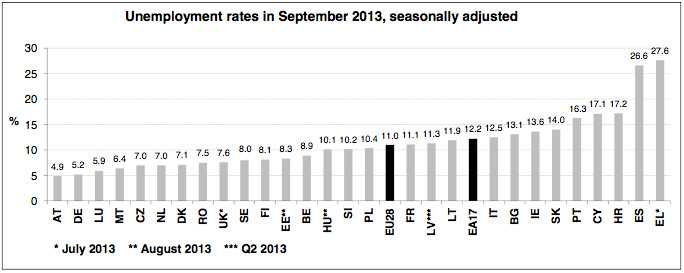

According to Eurostat, the statistical office of the European Union, the euro area (EA17) unemployment rate stood at 12.2% in September while that for the 28 European Union members (EU28) was 11%. In September 2012 unemployment was 11.6% and 10.6% respectively.

(EA17 = the 17 EU member states that use the euro as their currency. EU28 = the 28 member states of the European Union. Nine European member states do not use the euro as their currency).

In the Eu28 there were 26.872 million adults unemployed in September 2013, 19.447 million of them in the euro area. Unemployment rose by 61,000 in the EU28 in September compared to August – 60,000 of that total was just in the euro area.

There were 978,000 more people unemployed in September 2013 compared to September 2012 in the EU28 (996,000 in the euro area).

The highest recorded unemployment rates were in:

- Greece 27.6%

- Spain 26.6%

The lowest recorded unemployment rates were in:

- Austria 4.9%

- Germany 5.2%

- Luxembourg 5.9%

Unemployment rose in 16 EU member states and fell in 11.

Unemployment in the United States in September stood at 7.2% compared to 7.3% in August 2013 and 7.8% in September last year. In the United Kingdom unemployment was 7.6% in September.

Euro slides against the dollar

Fueled by expectations that the ECB will reduce interest rates possibly during its meeting next week, the euro’s fall against the dollar was the steepest in over a year.

The US Federal Reserve commented that it plans to keep its stimulus package going despite economic improvements in the US economy. The Federal Reserve says it wants to see a more sustained and solid fall in unemployment before reducing the $85 billion that is injected into the financial system each month.

The Wall Street Journal quotes UBS, which said “We now expect an ECB rate cut for Nov. 7.” UBS had previously predicted no changes until the end of 2015.

Currency traders, betting on an earlier-than-expected tapering of the US stimulus package, reacted to the detriment of the British pound which fell to its lowest level against the dollar since July this year. However, the pound gained against the euro.

Currency exchange rates at the moment (Nov 2nd, 2013) stand at:

- $1.35 = €1

- £1 = €1.17

- £1 – $1.60

The Brazilian real has a difficult week ahead after the government budget deficit August figures triggered concerns that the country may have its credit rating cut. Brazil’s Central Bank reported a budget deficit for August 2013 of 22.9 billion reais (plural of real is reais), higher than the 19.3 billion economists had forecast. Brazil’s budget deficit stands at 3.3% of GDP.

One month ago, European Central Bank President, Mario Draghi described the euro zone’s economy as “weak, fragile and uneven.”