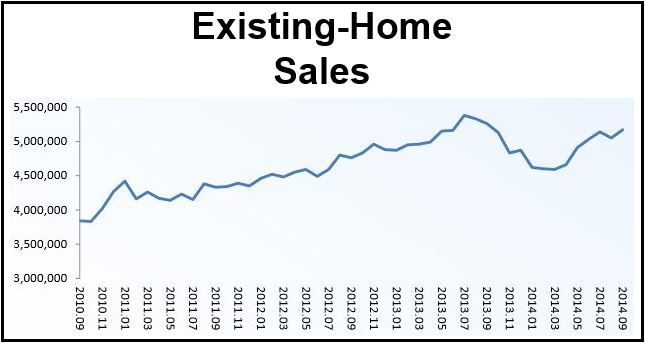

Existing-home sales in the US in September picked up after declining marginally in August, says the National Association of Realtors (NAR). Gains were seen across the country except for the Midwest, the report informs.

Existing-home sales, which include completed transactions of condominiums, townhomes, single-family homes, and co-ops, rose by 2.4% to a seasonally-adjusted annual rate of 5.17 million in September, compared to 5.05 million the month before.

September existing-homes sales are rising at their fastest pace this year, but are still 1.7% below September 2013’s 5.26 million-unit level.

The strong demand for buying that started in the spring has continued into the fall, the NAR says.

(Data Source: National Association of Realtors)

(Data Source: National Association of Realtors)

NAR’s Chief Economist, Lawrence Yun, said:

“Low interest rates and price gains holding steady led to September’s healthy increase, even with investor activity remaining on par with last month’s marked decline. Traditional buyers are entering a less competitive market with fewer investors searching for available homes, but may also face a slight decline in choices due to the fact that inventory generally falls heading into the winter.”

The average price for an existing-home in the US in September was $209,700, which represents a 5.7% increase on September 2013. Year-over-year prices have increased for 31 successive months.

At the end of September total housing inventory declined by 1.3% to 2.3 million existing homes available for sale, representing a 5.3-month supply.

Even though there were fewer houses on the market in September, unsold inventory was still 6% higher than in September 2013 (2.17 million available for sale).

Twenty-four percent of all transactions were all-cash payments, which was higher than August’s 23%, but considerably lower than September 2013’s thirty-three percent.

Fourteen percent of all purchases were made by individual investors, who account for many cash sales, compared to 12% in August and 19% in September last year. Sixty-three percent of all investors made all-cash purchases in September.

The average commitment rate for a 30-year, conventional, fixed-rate mortgage increased by 4.16% in September compared to 4.12% in August, according to Freddie Mac. In spite of the marginal increase, interest rates are 33 basis points less than in September 2013 (4.49%).

Mr. Yun said:

“Economic instability overseas is leading to volatility in the stock market and is causing investors to seek safer bets, which will likely keep interest rates in upcoming weeks hovering near or below where they are now. This is welcoming news for consumers looking to buy, although they could temporarily become more cautious by less certain economic conditions.”

Only 29% of purchasers in September were first-time buyers, a proportion that has remained the same for three consecutive months. For 17 of the last 18 months, first-time buyers have represented less than 30% of the total.

Foreclosures and short sales (distressed homes) increased marginally in September to 10% from 8% the month before, which was a smaller figure compared to 14% in September 2013. Foreclosures and short sales made up 7% and 3% (respectively) of all sales. Foreclosures are when the lender takes back a property because the borrower has defaulted.

NAR President, Steve Brown, said:

“An appraisal is an important part of the home buying and selling process. With foreclosures and short sales falling closer to average levels, appraisers will have fewer distressed sales in their list of comparables when determining home valuations.”

When considering whether to offer a mortgage, the lender (bank) will order an appraisal – to evaluate how much a home is worth.