Abenomics – definition and meaning

We use the term Abenomics to describe the Keynesian economic policies of the late Japanese Prime Minister Shinzō Abe (1954-2022). Essentially, Abenomics says that strict monetary policies can tackle Japan’s long-term deflationary problem. Specifically, Mr. Abe believes that his policies will lead to economic growth. Furthermore, he insists they will lead to greater exports, more jobs, and higher wages.

The term is a portmanteau (a linguistic blend of words) of ABE and EcoNOMICS. Similarly, Clintonomics and Reaganomics refer to the policies that US Presidents Reagan and Clinton used.

Ironically, Mr. Abe, who is right of center, has opted for a Keynesian left-wing policy rather than a monetarist one.

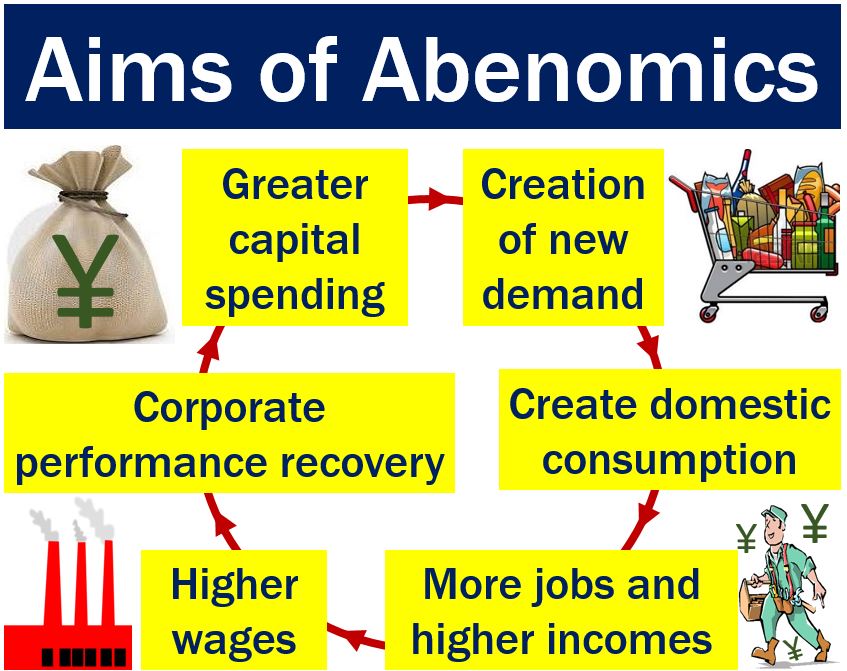

The goal of Abenomics

The objective of Abenomics is to increase Japanese annual Gross Domestic Product (GDP) growth. GDP growth and inflation have been very low for decades in Japan.

The Economist says that Abenomics is a “mix of **reflation, government spending and a growth strategy designed to jolt the economy out of suspended animation that has gripped it for more than two decades.”

** Reflation refers to measures that governments or central banks take to boost demand. Their aim is to boost GDP growth and inflation. Examples include 1. Fiscal Policies such as lowering taxes and increasing spending (that the government implements). 2. Monetary Policies such as changing the money supply and altering interest rates (that the central bank implements).

Abenomics aims to bolster consumer confidence and spending by improving the purchasing power of the Japanese yen. Through its aggressive monetary easing, Abenomics also seeks to enhance liquidity in the financial markets, aiming to stimulate investment and consumption across the various sectors of the economy.

Lack of decisive action by central bank

Economists blame Japan’s central bank – the Bank of Japan – for the current problem. They say it did not fully embrace the seriousness of the situation. Additionally, it failed to implement the necessary policies properly.

However, with Abe in power, the Bank of Japan has begun to embrace these policies.

According to Hugh Patrick’s report, titled – Abenomics: Japan’s New Economic Policy Package – Abenomics is based on three arrows, which are:

- Dramatically expansive monetary policy,

- fiscal stimulus, and finally,

- structural reforms to achieve better economic growth in the longer term.

Kick-starting Japan’s economy

Shinzō Abe addressed Japan’s two decades of stagnation through economic reforms. He hoped that his policy would kick-start the economy out of its deflationary difficulties. Mr. Abe increased the money supply. Additionally, he tried to make the country more competitive by encouraging private investment.

Japan’s central bank printed additional currency – between 60 trillion yen to 70 trillion yen. The extra money made Japanese exports more appealing.

The following reforms helped make Japanese firms more competitive:

- making it easier to fire workers,

- modernizing the agricultural sector, as well as

- restructuring the pharmaceutical and utility industries.

Huge stimulus package

Mr. Abe was at the forefront of a stimulus package of 20.2 trillion yen ($210 bn). The stimulus package – greater government spending – focused on infrastructure.

Mr. Abe immediately announced a ¥10.3 trillion stimulus program. He then appointed Haruhiko Kuroda as the head of the Bank of Japan.

In June 2014, Mr. Abe some of new policies comprising the third arrow of Abenomics. This arrow was the most important and difficult one to implement. As well as corporate tax rate cuts, it also included the liberalization of the healthcare and agriculture sectors.

Encouraging women to find jobs

Furthermore, the government implemented changes to the investment strategy of the Government Pension Investment Fund. To encourage women to find work, as well as improving their career opportunities, Mr. Abe did away with spousal tax exemption.

One of Abe’s most prominent structural reform plans was the decision to join the Trans-Pacific Partnership (TPP). TPP is a proposed free trade agreement between the United States and eleven other countries in Asia and the Americas. However, this plan has been affected by the US President Donald Trump’s strong opposition to the deal.

President Trump pulled out of TPP soon after winning the US elections.

Tax increase

Japan’s Chief Cabinet Secretary, Yoshihide Suga, said in September 2014 that his country was going to be deciding on its next consumption tax increase from 8 to 10 percent. The tax increase would be implemented on or after December 8. As soon as this came into effect, then a further economic stimulus package would probably be rolled out.

The main policies of Abenomics included:

- Inflation targeting at a 2% annual rate

- Correction excessive yen appreciation

- Negative interest rates

- Quantitative easing

- Expanding public investment

- Buying operations of construction bonds by Bank of Japan (BOJ)

Has it been effective?

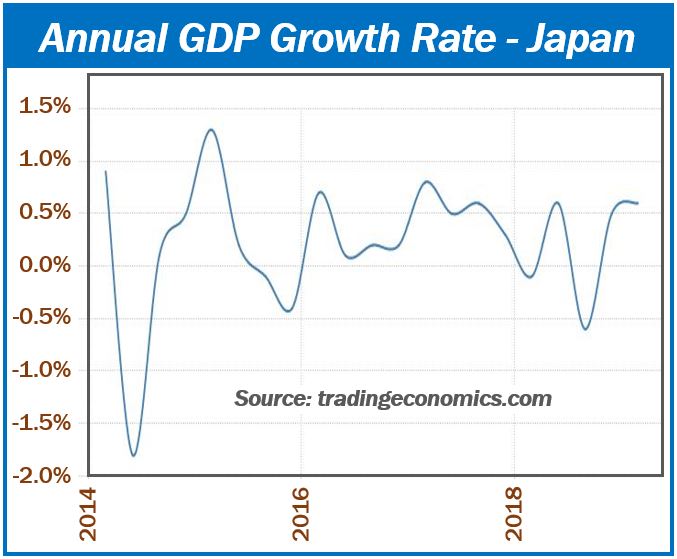

Most of the advanced economies, with the exception of the United States, have been experiencing sluggish economic growth over the last five years.

It is difficult to determine whether Abenomics has worked. GDP growth in Japan over the past five year has been weak.

However, we don’t know whether things would have been worse during that period without Mr. Abe’s economic measures.

How can Abenomics help the economy?

In a nutshell, Abenomics should help manufacturers export more, which will increase corporate earnings.

Since the end of 2012 the yen has fallen by a significant percent against the dollar. This yen depreciation has helped manufacturers perform better. If manufacturers sell more abroad, exports rise.

As corporate earnings increase then there will be higher wages. If wages go up, private consumption will subsequently rise, which will hopefully help Japanese markets thrive. In this context, consumption refers to what consumers do – consume (buy) goods and services.

Is Abenomics working?

Abenomics appears to have had some effect. Deflation appears to have gone. However, inflation is still well below the central bank’s target of 2% per year.

Comments by economists and journalists regarding Abenomics have been both positive and negative. The International Monetary Fund (IMF) dropped its growth forecast for Japan in April, 2014. IMF economists stated that Japan needs to follow through with its promised reforms.

In addition, many politicians and analysts have criticized the lack of successful TPP negotiations.

In theory, Abenomics sounds like a good plan to help kick-start the Japanese economy. Yet, Japan’s real GDP contracted at an annual rate of 6.8 percent in Q2 2014. The economic contraction followed an April tax hike. It was the largest economic shrinkage since 2011 – after the Tōhoku earthquake and tsunami.

In August 2014, real wages per worker dropped by 2.6% compared to 2013. This real wage decline represented the 14th consecutive month of a year-on-year fall in real wages.

There are also reports suggesting that the third arrow of Abenomics may take years to land.

The Forbes October 1 Alert, dated October 1, by Oriental Economist editor Richard Katz’s , provided details of very weak August household spending results, down 4.7% year-on-year. The household spending decline was the fifth consecutive month of year-on-year contractions.

Standard & Poors’ chief global economist Paul J. Sheard wrote a report called “Parting of the Ways in the Global Economy,” which stated that “ending deflation in Japan is not just a simple matter of somehow pushing up some price indices. It requires changing the whole equilibrium of the economy–away from self-reinforcing deflationary expectations and behavior toward mildly inflationary ones.”

He added:

“The role of the BOJ, helped by the government, is to coordinate a change in inflation expectations of all the agents in the economy: households, firms, and investors. The problem is that, being a coordination game, these economic agents need to move more or less together. Failure to do so could lead to a policy trap and the deflation equilibrium proving to be surprisingly sticky.”

At the September 2014 G20 meeting, the U.S. pointed out Japanese ‘underperformance’, despite the recent policy changes made by Abe. At the meeting, the U.S. singled out Japan for failing to stimulate its domestic economy. U.S. Treasury Secretary Jack Lew said “the global economy continues to underperform.” Mr Lew added that this was “particularly true in the euro area and Japan.”

Results in 2014

The Japanese economy shrank by -7.1% in Q2 2014, according to revised data from The Cabinet Office – the steepest contraction in five years. Analysts say that Mr. Abe’s policies to stimulate growth have boosted corporate profits. However, these profitshave not yet trickled down to boost consumer spending.

Mr. Abe wants to delay the second sales tax increase (to 10%) scheduled in 2015. He called an early election to get a mandate to do this – which he snapped easily.

Following his win Mr. Abe said:

“My Abenomics policies are still only half-way done. I am aware that there are still a lot of people who are still not feeling the benefits. But it’s my duty to bring [the benefits] to those very people, and I believe this election made that clear.”

Results in 2016

The Japanese economy grew by 1% in 2016. A bump in exports and capital investment were the main divers of GDP growth. GDP data showed four consecutive quarters of growth — the longest expansion since 2013.

However, the annual GDP figure was lower than the 1.2% growth registered in 2015. Additionally, private consumption continued to be quite weak.

Shinzo Abe’s key economic advisor insisted Abenomics is working

In October 2014 Shinzo Abe’s key economic advisor acknowledged the growing concerns about the slowdown in Japanese economic growth. However, he insisted that Abenomics was working. He added that the government would adopt additional measures if necessary to keep growth on track.

Akira Amari, minister in charge of Economic Revitalization, told Institutional Investor in an interview:

“Yes, I know there are concerns shown from various analysts and experts about the growth strategy.”

He added:

“We have a key performance indicator, or KPI, system that examines if policy implementation of the growth strategy is going properly or not”

“Rest assured I will make additional policy adjustments, id necessary, by proper analysis based on the economic data. I am quite willing to implement additional measures when needed to make sure we are on track to meeting our targets. Therefore I am confident that we can overcome the challenges and address the concerns of the public and the outside world.”

Skepticism regarding Abenomics

A Kyodo News poll in July 2016 found that most people continue to support Mr. Abe’s cabinet. However, they are skeptical regarding the effectiveness of Abenomics.

In a telephone survey, 56.4% of respondents said they did not believe Mr. Abe’s economic policy would work. This figure was considerable higher than the 32% who believed in his measures.

Fifty-three percent of respondents said they supported Mr. Abe’s Cabinet. This figure was lower than the May’s 55.3%. Mr. Abe’s Cabinet’s disapproval rating rose to 34.7% compared to 33% in May.

The tragic assassination of Shinzō Abe

On July 8th, 2022, Mr. Abe was delivering a campaign speech at Yamato-Saidaiji Station in Nara.

A man approached him from behind and fired two shots at Mr Abe, using a homemade weapon.

The first shot missed, and Mr. Abe turned around. The second shot was fatal; it hit him in the chest and went through his heart.

Video – What is Abenomics?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘Abenomics’ is using simple and easy-to-understand language and examples.

Resources:

The August 2013 IMF country report provides information on Japan’s goal and strategy for economic recovery.

The Congressional Research Service reported the intricacies of the Trans-Pacific Partnership and how it would be structured.