Annual percentage yield (APY) – definition and meaning

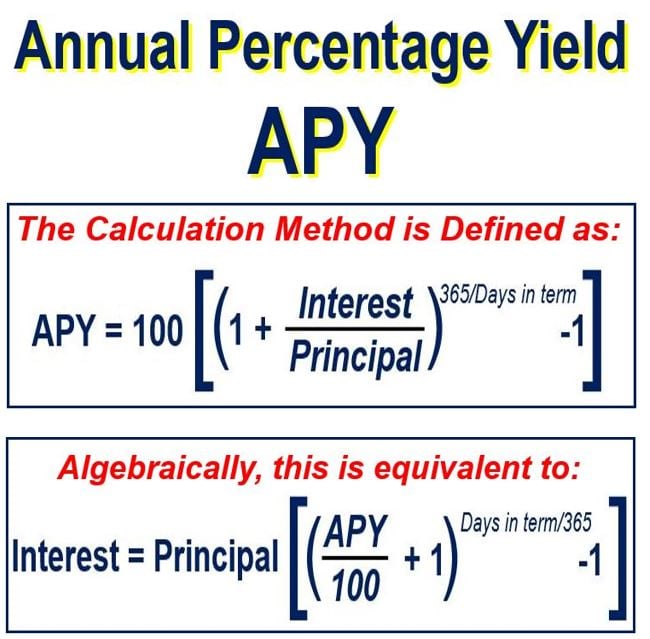

The Annual Percentage Yield or APY is the effective annual rate of interest that investors earn, including the effect of compounding. When we are not considering compounding, we refer to it as the nominal interest rate or simple annual interest rate.

We express the annual percentage yield as an annualized rate and base it on a 365-day year

The annual percentage yield is greater than the periodic interest rate times the number of periods because it is compound.

The APY is a standardized method for calculating compounded interest that an investor earned on an investment or deposit account.

The APY is a standardized method for calculating compounded interest that an investor earned on an investment or deposit account.

Annual percentage yield vs. APR

The annual percentage yield is similar to the annual percentage rate or APR. Lenders use the APR for loans.

With an APR, lenders state the total borrowing costs as a single number, which they express as a percentage. APR total fees include, for example, mortgage insurance, mortgage origination fees, and other closing costs.

Both the APY and APR are standardized measures of interest rates. However, the APY considers only compounding periods and not account fees.

The APY is useful because it standardizes several interest-rate agreements into one annualized percentage figure.

APY refers to the yield that the customer receives. The APR, on the other hand, while the APR refers to the yield that the lender receives. In other words, APY and APR work in opposite directions.

Financial institutions will typically quote the APY rather than APR when promoting financial products that do not involve debts.

Let’s imagine, for example, that a financial institution quotes a **CD with a 4.65% APR. Compounded monthly for eight months, it will quote that CD as a 4.75 APY, rather than a 4.65% APR.

** CD stands for Certificate of Deposit. It is an interest-bearing, short- or medium-term debt instrument that a bank issues.

Example of annual percentage yield

Let’s imagine you placed $1,000 into an account for one year at 1% simple interest. Simple interest means non-compounding.

At the end of the year, you would have $1,010. The APY is 1% – in other words, the same as the interest rate.

Now, let’s suppose that the interest on that account compounded on a daily basis. The total interest you would receive for the year would be $10.05. Therefore, it would give you a total of $1,101.05 at the end of the year.

Hence, in this case, the annual percentage yield is 1.005%.

There are several calculating programs online to help you work out the APY.

According to BusinessDictionary.com, the annual percentage yield is:

“Standardized method for quoting compounded interest earned on a deposit account or investment. In computing APY, it is assumed the funds will remain on fixed deposit or invested for a full 365-day period.”

Video – What is Annual Percentage Yield?

This video explains the difference between APY and APR.