Annual report – definition and meaning

An annual report is a document that public companies issue to provide shareholders with important corporate information. Potential investors, analysts, and financial journalists also read annual reports. In fact, when a major company like Apple Inc. issues its report, a wide range of people examine it.

The majority of jurisdictions instruct companies to prepare and disclose annual reports. Many firms file their annual reports at the company’s registry.

The main aim of the annual report is to provide a summary of how well (or badly) a company has performed over the past 12 months. Additionally, the document provides a glimpse of things to come.

Creating a compelling annual report today is a real art. In fact, some people call it a science. There are even agencies that specialize in preparing annual reports.

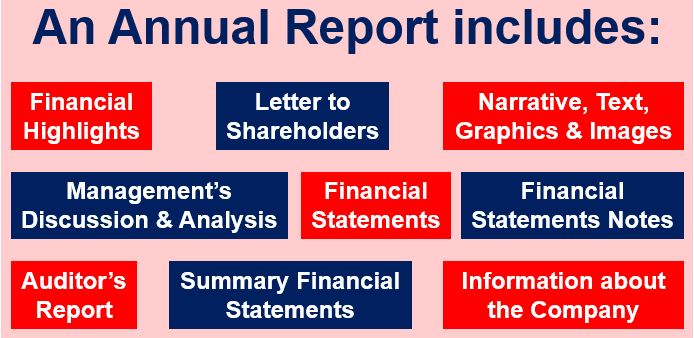

Most annual reports include the themes that appear above.

Most annual reports include the themes that appear above.

Annual report – public companies

In most cases, **public companies usually have to report at more frequent intervals. However, this also depends on the guidelines of the stock exchange where investors buy and sell the company’s shares.

** You can buy and sell public company shares on a stock exchange, but not the shares of a private company.

An annual report usually begins with an opening letter from the Chief Executive Officer, followed by financial data, results of continuing operations, and information about its market. The report authors also write about products that are in the pipeline, as well as the company’s subsidiary activities.

Additionally, many companies, especially the larger ones, include details on their research and development.

Typically, the cover and first few pages of the report contain graphics, photos, and accompanying narrative. The annual report’s first few pages detail what the company has achieved over the past year.

Comprehensive financial and operational information appears in the latter half of the report.

Every year, companies send their annual reports to shareholders. They send the reports when the companies hold their AGMs to elect directors and discuss strategy. AGM stands for Annual General Meeting.

According to the dictionary Merriam-Webster, an annual report is:

“A usually lengthy report issued yearly by an organization giving an account of its internal workings and especially its finances.”

The Wall Street Crash

The Wall Street Crash, which occurred in 1929, was the greatest stock market collapse in US history. After the crash, the US Government passed legislation forcing public companies to publish an annual report.

In the US, companies submit a more comprehensive report, a Form 10-K, to the SEC. SEC stands for the Securities and Exchange Commission.

American companies must file the Form 10-K no more than ninety days after the fiscal year. Additionally, public companies must file a Form 10-Q every quarter.

US companies can submit their annual reports electronically via the SEC’s EDGAR database. This database is also a useful tool, especially when you are researching public companies.