What is an asset class? Definition and meaning

An asset class is a broad group of securities that react similarly in the marketplace. Items in one asset class have similar features and have to comply with virtually identical laws and regulations.

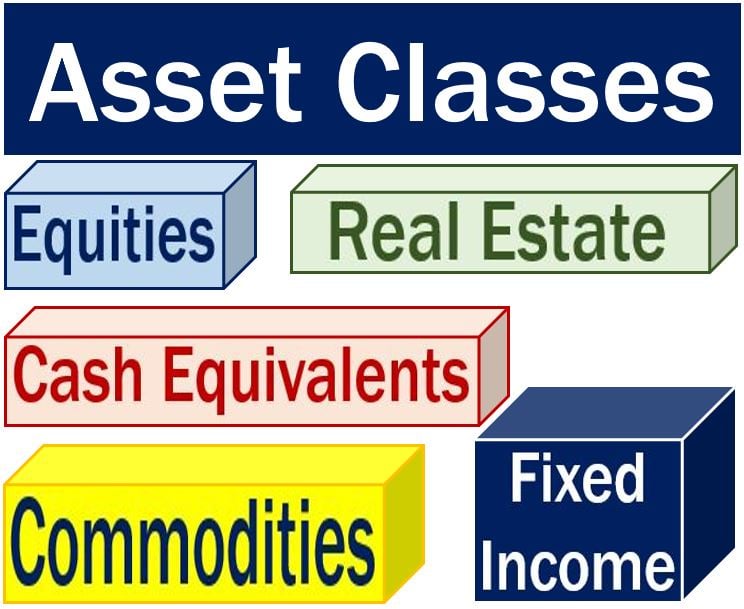

There are three main asset classes:

- securities (stocks & shares);

- fixed-income securities (bonds); and lastly

- money-market vehicles (cash equivalents). Many investors also include derivatives, commodities, and real estate as asset classes.

Investors spread their money in cash, bonds, equities, property, and commodities. Asset allocation refers how you invest in different asset classes. A conservative asset allocation consists mainly of property, bonds, and cash, while a high risk one would comprise mainly shares.

Different asset classes are the building blocks of a diversified investment portfolio.

Different asset classes are the building blocks of a diversified investment portfolio.

Understanding the features of each asset class helps people make better investment decisions.

Financial theory says that investing in several asset classes is less risky for a portfolio than just one class. However, you still maintain a good overall target return.

Which asset class is for you?

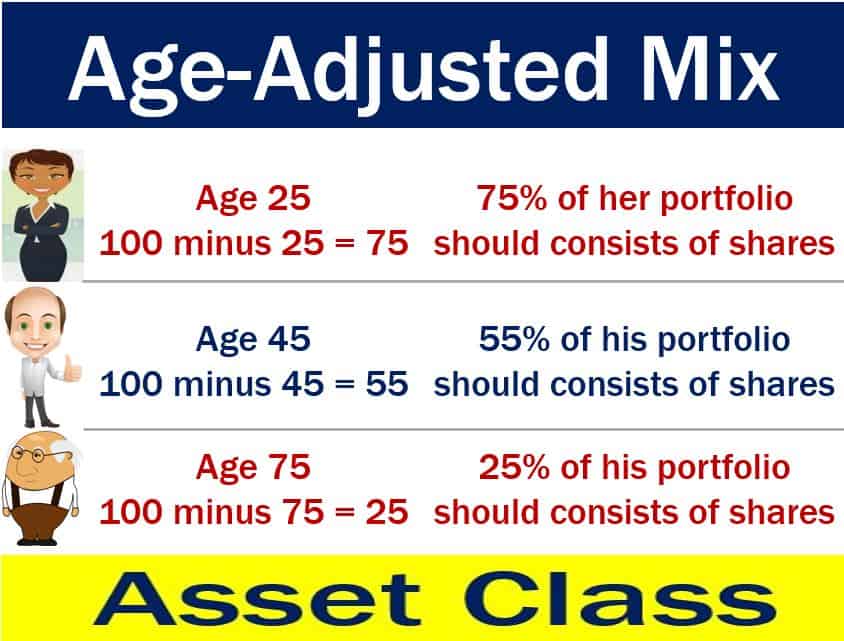

So, which asset class should you choose? A popular way of determining how to diversify your investment portfolio is to use the age-adjusted mix.

With the age-adjusted mix, you first subtract your age from 100. You then turn the result into a percentage. The amount you spend on stocks should be that percentage of your portfolio.

For example, let’s assume that you are 40 years old. Forty minus 100 equals 60. Therefore, you should invest sixty percent of your money in stocks. The rest should go into cash, bonds, and property.

According to the Australian Investors Association, an asset class is:

“A category of investments that exhibit similar characteristics in the market place. The investments within a single asset class are expected to have similar risks and returns, be subject to the same laws and regulations, and perform in a similar manner in particular market conditions.”

Three main asset classes

Cash

Cash includes all types of bank accounts and cash management trusts. This asset class is suitable for people with a short-term outlook. It is also ideal if you have low-risk tolerance. Additionally, you should go for cash during a volatile market.

Cash provides a stable and low-risk income. There is no recommended minimum time frame.

Fixed Interest

Fixed interest assets include corporate and government bonds, mortgages, and hybrid securities. It is a relatively stable class, but less so than cash. Income return is typically in the form of periodic interest payments for a specific period.

The minimum time frame for fixed interest investments ranges from 1 to 3 years.

Young people should have a greater percentage of their portfolio consisting of shares compared to their older counterparts.

Young people should have a greater percentage of their portfolio consisting of shares compared to their older counterparts.

Equities

Equities include domestic and international stocks and shares. Returns generally include capital growth or loss and income through dividends. In fact, ‘equities’ is the most volatile of all asset classes.

With equities, the investor becomes part-owner, in other words, a shareholder of a company. The shareholder can share in a company’s future growth as well as its profits.

However, over long periods equities tend to achieve higher investment returns than the other main classes. The minimum time frame is from 5 to 7 years.

Nevertheless, no asset class is theoretically perfect. Choosing the right one depends on your needs and preferences. Selecting which ones are right is not a question of picking those that are supposedly better than others.