What is bad credit? Definition and examples

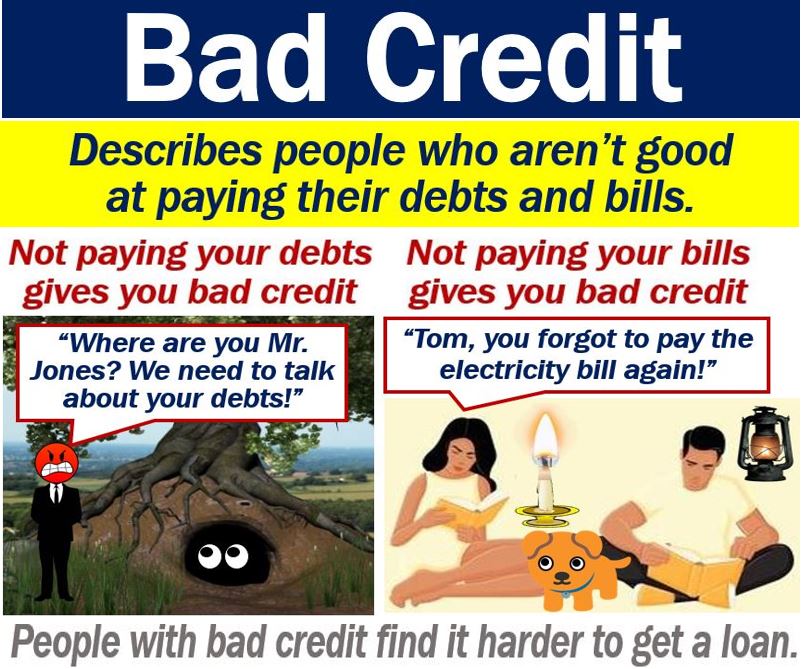

Bad credit refers to a person’s negative credit score. Specifically, a negative credit score that a financial institution or rating agency gives to an individual or company. It represents a person’s or company’s payment history of bills and paying back debts.

We can either say that a person has a bad credit score or simply ‘bad credit.’ In other words, ‘bad credit’ can mean that your credit history is bad, and therefore your score is bad.

If you have a low score, it means that you do not have a good history of meeting your financial obligations. In other words, you have not paid your bills or loan repayment installments on time.

If the score is really bad, it probably means that you have defaulted on some debts (not paid back what you owed). It could also mean that you did not pay a bill at all.

TheBalance.com says the following regarding bad credit:

“Bad credit generally describes a record of past failures to keep up with payments on your credit agreements, resulting in the inability to get approved for new credit.”

Your financial history and behavior determine your credit rating. That history begins as soon as you open a bank account or pay your first bill. From your late teens or early adulthood until you die, agencies will be tracking you. They will be tracking you to determine what kind of credit risk you are.

Your financial history and behavior determine your credit rating. That history begins as soon as you open a bank account or pay your first bill. From your late teens or early adulthood until you die, agencies will be tracking you. They will be tracking you to determine what kind of credit risk you are.

Bad debts

Do not confuse bad credit with bad debt. A bad debt is a loan in which the borrower has defaulted, i.e., they won’t pay back the money.

The term ‘bad debt’ may also refer to an invoice that will not be paid. Companies and lenders have to write off bad debts. They usually write them off as expenses. We also call bad debts delinquent loans or bad loans.

Bad credit and credit scores

The credit report takes into consideration credit history length, types of credit, and any debts or obligations. These financial obligations are typically with financial institutions, utility companies, mobile phone companies, etc.

The report also considers public records such as bankruptcies, monetary judgments, and court records.

We call the firms that gather data on people’s and companies’ financial histories credit reporting agencies. We also call them credit bureaus. Rating agencies give people a score. Some rating agencies are also credit bureaus, i.e., they gather data and rate people.

Rating agencies keep track of people’s credit history. Reports may vary. Some agencies have data that needs updating while others may have errors.

If you have bad credit

When a person has a bad score, financial institutions are less likely to lend money to them. Banks and other lenders regard that person as ‘high risk.’ In other words, they are less likely to pay back a loan than somebody with a good credit score.

Lenders may deny credit or a loan application if you have a bad credit history. If they do approve a loan, there will be certain conditions. Interest rates, for example, will be higher in bad credit loans than on loans for those with a good credit history.

If you have bad credit and want a mortgage, lenders may ask for a large deposit. For example, let’s suppose you want to buy a $200,000 house and apply for a $180,000 mortgage. This means you offer to put down a deposit of $20,000.

Given your bad credit history, the lender may require a $100,000 deposit. In other words, the bank will only lend you $100,000, and you will need to put down $100,000. You may also find that the interest rate on your mortgage is relatively high.

Credit score – USA

In the United States, the most common type of credit score is the FICO score. FICO stands for Fair Isaac Corporation.

The FICO scores range from 300 to 850. Lenders will rate your FICO score as follows:

- 629 or less: Bad Credit or High Risk.

- 630 to 679: Fair Credit or Fair Risk.

- 680+: Good Credit or Low Risk.

The FICO score takes into account data from three different credit rating bureaus: Equifax, Experian, and TransUnion.

Utility providers and mobile phone operators may turn down your application if your score is low. Some may accept you as long as you put down a deposit.

Avoiding bad credit scores

If you want to avoid having a bad credit score, make sure you pay your bills on time. Never fall behind on your loan repayments.

If you think you are going to have problems, contact your lender, utility company, etc. immediately. If you manage to come to an arrangement with them, your credit score may remain intact. However, make sure you stick to the new arrangement.

If you have a bad score, you should check the report for any errors. If you find any, try resolving them.

Video – What is My Credit Score?

Your credit score represents your creditworthiness, i.e., how likely you are to pay back a debt in full and on time. It is not the same as your credit history. Watch this Market Business News video which has a brief description of the term.