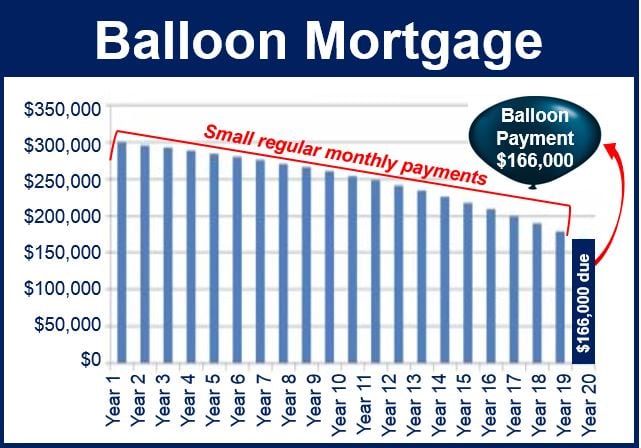

A balloon mortgage, balloon payment mortgage, or balloon loan is a type of home loan. In this loan, borrowers have to make regular payments for a specific period and then settle the remaining balance rapidly. The borrower either makes one huge payment at the end or a few large ones.

In other words, the mortgage does not fully amortize over the term of the note. This means that there is a balance due at maturity.

In some cases, a balloon mortgage may consist of 10-years paying back just the interest. Then, the borrower makes a final ‘balloon’ payment. In other words, they pay one giant installment at the end.

With a balloon mortgage, the borrower has the option of early repayment. In fact, most mortgages have an early-payment option.

Balloon mortgages are more popular with companies than with private individuals. This type of loan may have either a fixed or floating interest rate.

Why choose a balloon mortgage?

Why would a borrower take this type of mortgage instead of a conventional 30-year one? Perhaps the borrower does not expect to own the property in 10 years time.

Some borrowers may expect to have a lot of money in a few years’ time. Additionally, interest rates on this type of mortgage tend to be lower than on other types.

The Consumer Financial Protection Bureau, part of the US government, defines a balloon loan as follows:

“A balloon loan is a mortgage that requires a larger-than-usual one-time payment at the end of the term. This can mean your payments are lower in the years before the balloon payment comes due.”

“Generally, a balloon payment is more than two times the loan’s average monthly payment, and often it can be tens of thousands of dollars.”

If the borrower cannot pay the ‘balloon’

What happens if the borrower does not have the money to make the final balloon payment? Many contracts include a ‘two-step’ mortgage plan or ‘reset option.’ This means that the loan ‘resets’ using current market rates using a fully amortizing payment schedule.

To use the reset option, there are some requirements. The borrower has to continue being the property’s owner/occupant. There must have been no 30-day late payments over the past 12 months. And finally, there cannot be other liens against the property.

For loans without the reset option, the lender expects that the borrower has sold the property. Additionally, the borrower may have arranged a refinancing of the loan by maturity. Therefore, there is a refinancing risk.

In some parts of the world, the lender must continue the loan. In other words, the reset option is obligatory. This means that there is no risk that the lender might refuse to refinance or continue the loan. This is great for the borrower but not for the lender.

Consider carefully before choosing

The Consumer Financial Protection Bureau warns Americans not to assume that they will be able to sell their property or refinance their loan before they have to make a balloon payment.

If the value of the property declines, the borrower might not be able to sell or refinance in time. The same problem may also occur if the borrower’s financial circumstances deteriorate.

“If you’re not sure how you would manage to pay off the balloon payment when it comes due—for instance, out of your savings – consider another type of loan,” the Bureau adds.

A bullet loan is one where the principal is not paid until the end of the term. This type of loan includes balloon mortgages and loans for other purposes.