Barriers to entry – definition and meaning

Barriers to entry are the obstacles that make it extremely difficult for a new company to break into a market. Small companies, especially, find it particularly difficult to overcome barriers to entry. In a market with large companies dominating market share, it is virtually impossible for newcomers to get a foothold. Not only is it hard to get in, but also difficult to thrive if they manage to enter.

Barriers to entry protect the companies that currently dominate a sector because new rivals are unlikely to appear. Even if some do appear, they will probably remain small. They remain small because the barriers keep them down.

Apart from the size and age of the current dominant players, other barriers include tax benefits and strong brand identity. Additionally, customer loyalty, patents, and the high customer switching costs also protect the major operators. Customer loyalty refers to existing customers coming back and buying more repeatedly.

Five Forces

Barriers to entry are one of the Five Forces. The other four are existing customers, new customers, substitute goods, and suppliers.

The five forces are external factors that affect an industry’s viability.

Barriers to entry can contribute to disproportionately high prices and monopolies because they protect the incumbent companies. If other companies cannot compete, there is less competition than in a free and competitive market. Consequently, prices remain high.

Monopolies typically exist when barriers to entry are insurmountable. If there were no barriers, other companies would have entered such markets. Even lower barriers would be better than giant ones.

When there are barriers to entry, not only do potential competitors lose out, but consumers do too. With strong competition, prices would be lower, and quality would probably be better too.

Additionally, the consumer would have more choice in a free market with no barriers.

According to the Financial Times Lexicon of business terms, barriers to entry are:

“Factors that make it difficult for a company to enter an industry or type of business and compete effectively. These can include incumbents’ high capital investment and strong economies of scale, restrictive government policies, labor unions, etc.”

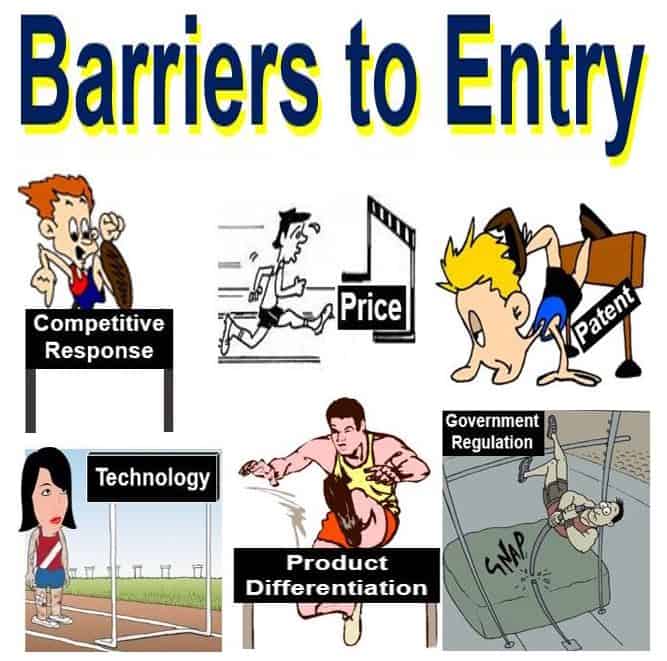

Examples of barriers to entry

Government Regulation

Restrictive licensing requirements or limiting the ability to get raw materials can make it virtually impossible for new players.

For example, in many countries, entrepreneurs wanting to set up a radio network, face government hurdles and huge costs. An entrepreneur is a person who sees an opportunity and creates a business to exploit it.

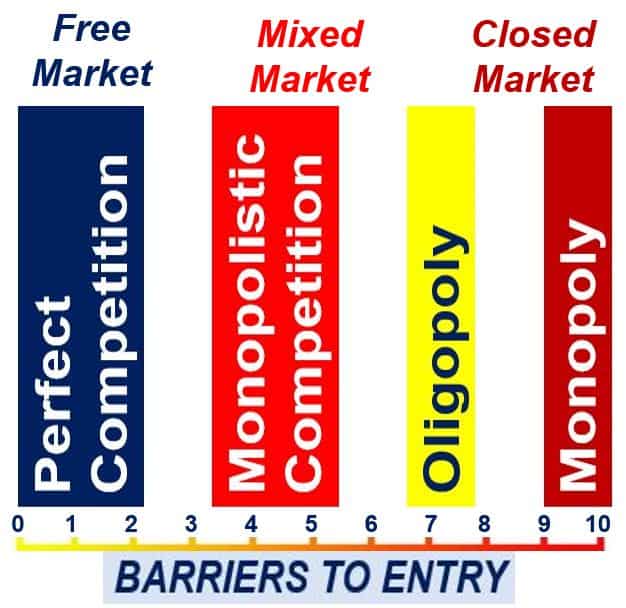

A market with zero barriers to entry has free competition and many competitors. Consumers have the widest choice and best prices. Additionally, they probably enjoy optimum quality. When barriers are at their maximum, there is probably just one supplier. In other words, it is a monopoly with artificially-high prices, poor choice, and inferior quality.

Technology

In some industries, patents block others from operating effectively and successfully. The only way to enter the market is to make a deal with the incumbent companies.

However, if you have to reach a deal, it means you are not a competitor.

You could try to develop the technology yourself, but this is expensive and extremely risky.

Start-Up Costs

Start-up costs refers to how much you need to spend to either create a new business or get into a new market.

The start-up costs for, for example, the car manufacturing business are colossal. This means that for 99.9% of companies, that sector is out of the questions. Manufacturing refers to converting components and raw materials into finished products in a factory on a large scale.

Economies of Scale

This term refers to the overall unit costs of production. In other words, how much it costs to produce each unit. When production increases, for example, the unit costs of production decline. However, when production falls, unit costs of production rise.

You can only produce large quantities if you have lots of orders. However, large orders do not come in straight away when you enter a new market.

Therefore, your initial unit costs are higher than those of the incumbent dominant players. They will be in a better position to beat you on price.

When the dominant players see a newcomer entering their territory, they may raise the barriers to entry. They may cut their prices, thus making the new competitor’s products less competitive.

For the incumbents, lowering prices may be easy, because of their superior economies of scale.

Product Differentiation

Product differentiation refers to making your product stand out. In other words, making your product seem more attractive by contrasting its unique qualities with other competing products.

A newcomer will have to spend a lot of money educating consumers about the unique benefits its products.

Luring away loyal customers from their existing brands or suppliers is not easy.

Access to Distribution Suppliers

If you cannot gain access to vital raw materials, your new business will die. Access to the right distribution channels is also extremely important.

Incumbent firms have long-term contracts with key suppliers, making it hard for newcomers get good prices.

Competitive Response

When considering new potential markets, you are less likely to consider one with two or three giant, aggressive, and territorial players.

You know that they will compete aggressively to stop you from gaining market share. We call that aggressive behavior to newcomers ‘competitive response.’

Competitive response may either kill off new entrants or make their lives hell. In fact, competitive response may put off potential newcomers before they even start.

Barriers to entry – airlines

There are many barriers that make the airline industry extremely uncompetitive. At major airports, there are limits on take-off and landing slots. There are also long-term leases that give airlines the exclusive use of airport gates.

Furthermore, there are regulations prohibiting flights of less than a certain distance. Even fairly established airlines cannot get access to certain airports or routes.

The Internet is changing everything

The development of the Internet has turned old ideas about barriers to entry on their heads. E-commerce is a marketplace that plays by a completely different set of rules. Barriers to entry for e-commerce are much lower than in the offline world.

By operating online, firms can often overcome traditional barriers to entry. Economies of scale, for example, are much less applicable when operations and functions are carried out electronically.

Defining barriers to entry

If the incumbent companies had to overcome those barriers when they were newcomers, are they barriers to entry? Many scholars argue that they are not.

Others insist that an entry barrier is anything that makes it harder to get in. Additionally, anything that has the effect of limiting or reducing competition is a barrier to entry, they argue. Just because I managed to cross a minefield unharmed does no mean that mines are not obstacles.

Experts have been arguing about what the exact definition of barriers to entry is for a long time. Despite all the arguing, they have not succeeded.

The OECD says that because there is still disagreement, there is often confusion regarding the interpretation of studies.

If defining barriers to entry is difficult, it should be virtually impossible to set out competition policy, shouldn’t it? The OECD does not think so. In fact, the OECD says that whether or not it is difficult is irrelevant.

What matters in competition cases is not defining words, but rather determining whether something is or will be a problem.

On its website, the OECD writes:

“Regardless of whether there is a consensus on a definition, or even whether the definition ultimately matters, it is undeniable that the concept of entry barriers plays an important role in a wide variety of competition matters because it is vital to the analysis of market power.”

“Entry barriers can retard, diminish, or entirely prevent the market’s usual mechanism for checking *market power: the attraction and arrival of new competitors.”

* Market power refers to the extent to which a company can influence the price of a product in the market.

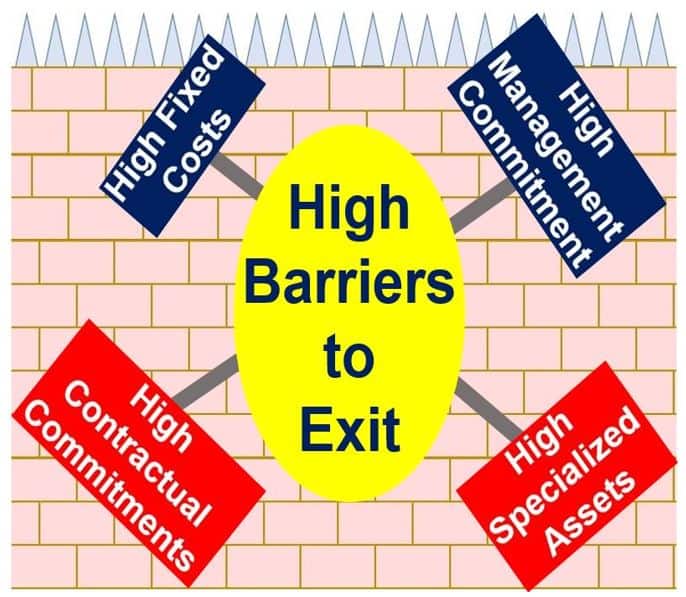

Barriers to exit

There are also markets in which companies might find it extremely difficult to get out. For example, the cost of laying off staff, or contractual obligations might make it impossible to exit.

Imagine you want to get out but have eight years to go on a ten-year rental contract on your premises. So, you go to your landlord and try to negotiate. You will have a serious barrier to exit if the landlord refuses to negotiate. Put simply; you are stuck!

For a large retail bank, the barriers to exit can be significant. Large retail banks have thousands of branches and hundreds of thousands of workers.

Some companies deliberately erect barriers to make it harder for them to get out of a market. In fact, by erecting these barriers, companies could be sending a subtle message to competitors. They are telling others that they are 100% committed and will do what it takes to maintain market share.

Video – barriers to entry

In this video, Jason Delaney talks about oligopolies. An oligopoly is a market with very few companies. They exist because those markets have large barriers to entry.