Bridge loan – definition and meaning

A bridge loan, interim loan, or swing loan is a short-term loan. Borrowers usually take out a bridge loan for a period of up to three years. People use the loan to help stay afloat while arranging longer-term financing. Borrowers may also apply for this type of loan when they expect to sell an asset. Additionally, bridge loans are ideal for people who expect to come into some money.

The terms ‘gap financing‘ and in the UK ‘bridging loan‘ have the same meaning as ‘bridge loan.’

A bridge loan is usually more expensive than conventional financing. Lenders say this is because of the additional risk. Interest rates tend to be higher, and the bank amortizes the costs over a shorter period than in other loans. Bridge loans also contain other additional fees.

The lender may also require cross-collateralization and a smaller loan-to-value ratio (LTV). Lenders use LTV to assess borrower-risk. Banks, however, generally arrange bridge loans rapidly with the minimum of paperwork.

Bridge loan – real estate

We commonly use bridge loans for buying commercial real estate, and to save a property from foreclosure. Additionally, the borrower may want to take advantage of a short-term opportunity.

Borrowers typically pay back a bridge loan on a property when they have sold it or arranged to refinance with a traditional lender. They may also pay it back when their creditworthiness improves, or they have completed or improved the property.

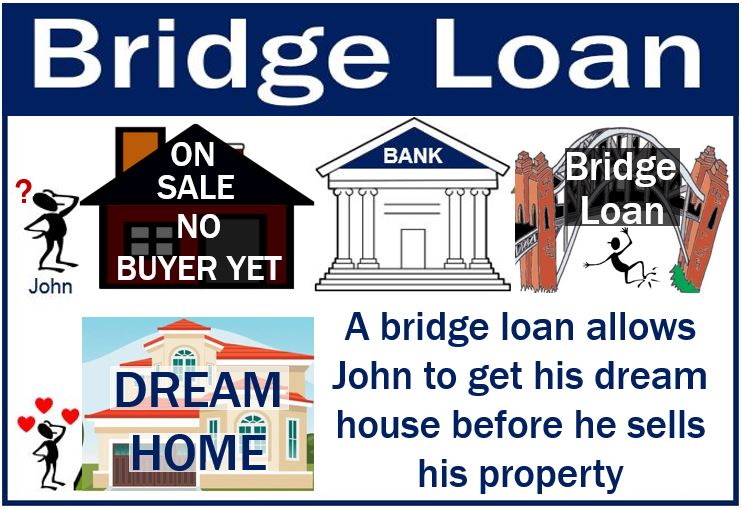

Imagine your house is for sale, but you have not yet found a buyer. You see another house you want to buy. However, you don’t have enough money to purchase it.

You could take out a bridge loan to secure the house purchase. You would subsequently pay back the loan when you have sold your house.

There are closed and open bridge loans. Closed loans are available for a set period, while open ones have no specific payoff date.

Bridge loans – corporate finance

A company may need a bridge loan between successive large private equity financings. Typically, between large consecutive financings, companies run out of cash.

A distressed company looking for an acquirer or larger investor may need a bridge loan. The loan keeps it going until it finds a larger investor or acquirer. However, in such cases, the lender will obtain a significant equity position in connection with the loan.

Just before an acquisition or an IPO, a business may require final debt financing. It will need to secure working capital until the IPO money comes in. IPO stands for Initial Public Offering, in other words, when a private company goes public.

Bridging loans have become more popular in the UK since the 2008 global financial crisis. Gross lending in Britain grew from £0.8 billion in 2011 to £2.2 billion in the year to June 2014. During this same period, mainstream mortgage lending, on the other hand, declined considerably.

According to the Merriam-Webster Dictionary, a bridge loan is:

“Money that a bank lends you for a short period of time until you receive the money that you are getting from another source (such as from selling your house).”

Some bridge loans can be massive. In July 2015, American health insurer Aetna Inc. was lining up a $16.2 billion bridge loan to fund its takeover. Aetna needed the money to buy its smaller rival Humana Inc.

The acquisition went ahead. Aetna bought Humana for $37 billion in cash and stock. In fact, it was the largest-ever acquisition in the insurance industry.