Bull market – definition and meaning

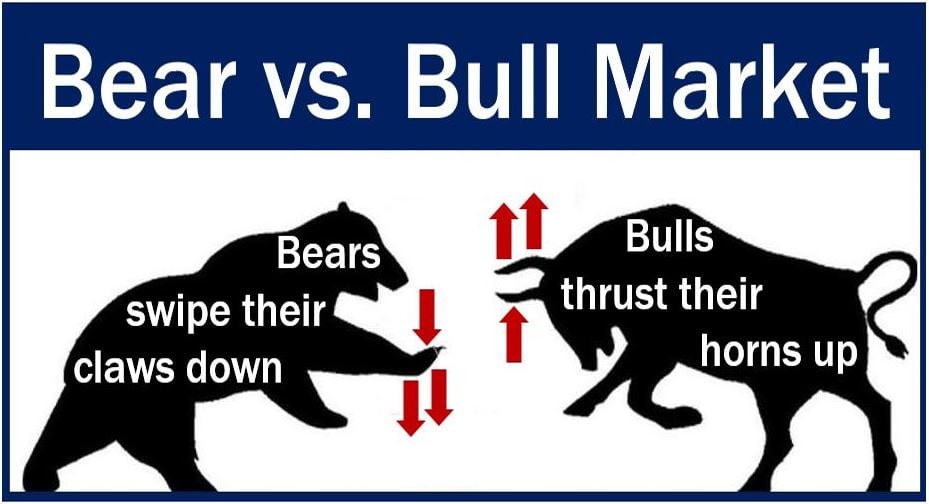

A bull market is one where the prices are rising. For example, in finance and investment, the term means that stocks or bonds are rising in value. We also use the term in commodities markets when gold, silver, oil, or coffee prices are increasing. In fact, bull markets exist anywhere where people are trading things.

A ‘bullish trend’ is typically the result of increasing market optimism and encouraging financial performance.

In a bear market, on the other hand, prices are falling, and there is a feeling of pessimism.

Cambridge Online Dictionaries says a bull market is:

“A period when the price of shares and other investments are higher than usual, and many people invest because they expect to earn large profits.”

According to the Online Etymology Dictionary, the term ‘bull’ for describing a rising market dates back to 1714.

Some linguists suggest the term came from old German. The Germanic root of the word ‘bull’ meant ‘to inflate, swell, blow’, which could describe a rising market.

What causes a bull market?

It is virtually impossible to predict how markets will move accurately. There are psychological and economic factors that influence prices.

Strong demand and weak supply for securities push up prices. In other words, when many people want to buy securities but very few are selling, prices rise.

When there is a strong economy, businesses report stronger profit figures than during a recession.

When there is greater market interest, more people make investments in the hope of making a profit. We refer to this factor as investor psychology.

How to invest in a bullish market

So, what should an investor do during a bullish market? One of the best things to do is take advantage of the rising prices.

You can do this by buying securities early on and holding onto them. You then watch their value increase and subsequently sell them when you believe they have peaked.

But when should you sell?

You need to look for signs that the market is about to become bearish. For example, if there are more poor performance figures or a dip in the economy, be careful.

However, knowing when the perfect time to sell is, is almost impossible to determine. It is impossible to determine accurately because we never quite know when the market will peak. In fact, even the world’s top experts often get it wrong.

Investors in a bullish market worry less about sudden huge losses than those in a bearish market. In other words, the chances of suffering big losses are smaller in bull markets than in bear markets.

Above all, investors should make the best of a bull market. They should try to buy securities before they start to dip.

Contrarian investors behave like bears in a bull market and like bulls in a bear market. A contrarian investor works against the flow.

Video – investing in a bull market

This Howcast video explains how to invest when prices are moving upward. In other words, how to invest in a ‘bull market.’