Capital assets – definition and meaning

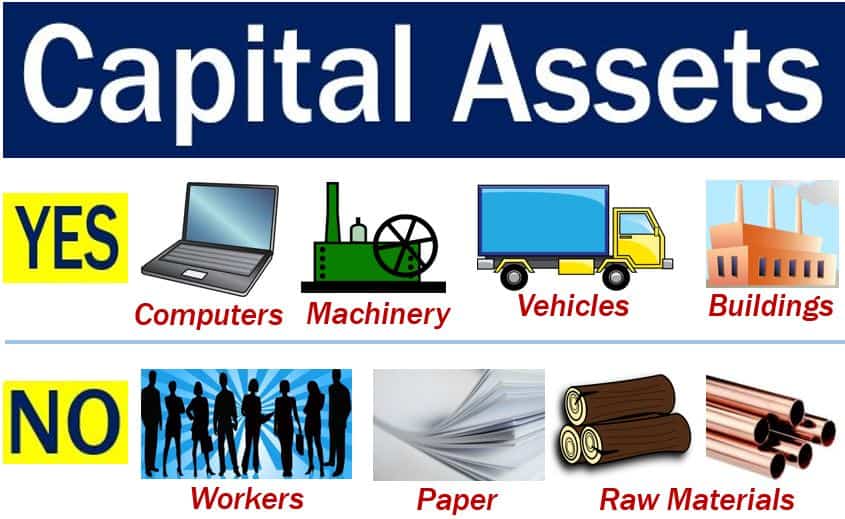

Capital assets include land, buildings, machinery, computer equipment and vehicles. In other words, they are things a business needs to produce goods and services.

The term also refers to an asset on which we must pay capital gains tax if we sell it. For example, imagine you buy a bar of gold for $1 million, and later sell it for $2 million.

You have made a gain of one million dollars. You must pay tax on that gain because gold is a capital asset.

The term initially meant any fixed assets that we hold for a long time. Initially, it also referred to assets we will not into cash for a business’ operation. However, many tax authorities use the term for a wide range of assets. In fact, some authorities even include stocks in the definition.

The benefits we gain from a capital asset are likely to extend for longer than one year.

On a company’s balance sheet, each figure representing equipment, plants, and property represents a capital asset.

Firms seldom sell their capital assets

Companies only sell their capital assets when they are in deep trouble. For example, during bankruptcy proceedings.

In asset-intensive industries, like oil exploration, firms invest a major part of their funds in capital assets.

A capital asset has the following features:

– It is not liquid. In other words, we cannot convert it into cash easily.

– It is a long-term item. Its useful life should last for more than one year,

– We do not sell it. Unlike inventory, we do not sell it as a normal part of business operations,

– Costs. Its cost of acquisition exceeds a company’s capitalization limit.

Capital assets – tax authorities

The US Internal Revenue Service (IRS) says nearly everything we own and use for personal purposes is a capital asset. Things we buy for pleasure and investment purposes are also capital assets.

The IRS says it considers the following items as capital assets:

- shares (stocks) and bonds,

- a home occupied by a person and his/her family,

- timber grown in a person’s home property or investment property, even if they make casual sales of the timber,

- all the furniture within the household,

- a car used for commuting or pleasure,

- stamp or coin collections,

- gold, silver, platinum, and other metals,

- gems and jewelry.

Definition of capital gain: If you buy a capital asset for $10,000, and then sell it one year later for $15,000, you have made a capital gain of $5,000.