Capital markets – definition and meaning

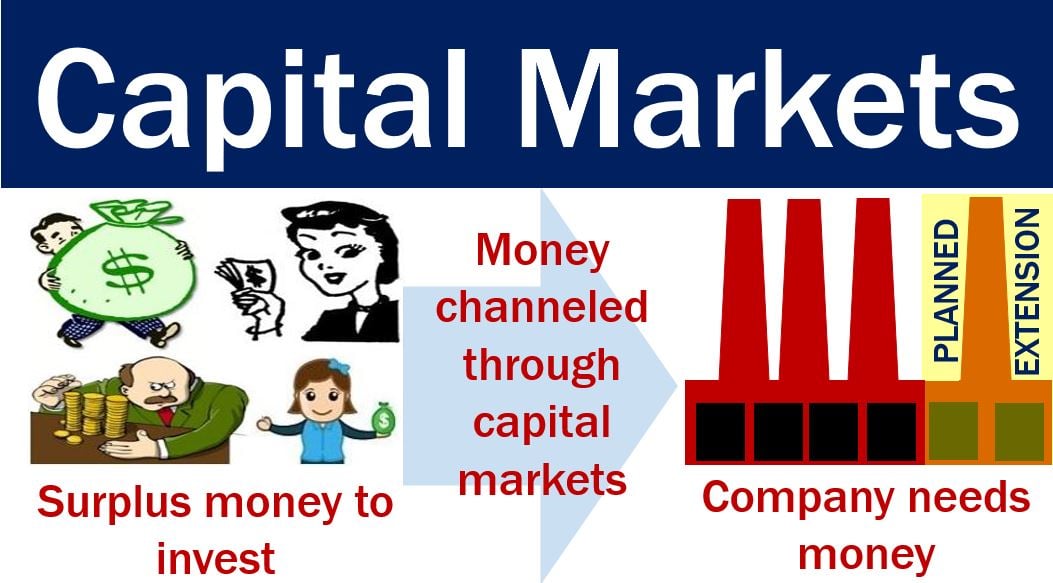

Capital markets are financial markets where people buy and sell long-term debt or equity-backed securities. These markets direct savers’ funds to those who can put them to long-term productive use. For example, governments and corporations making long-term investments are always looking for long-term investors.

A company may issue securities in the form of bonds or shares. They aim to raise money. Regional or national governments may also issue bonds. Put simply; entities in need of long-term cash issue bonds to raise money.

In these markets, companies and governments raise money for a long period. In other words, for longer than one year.

Financial regulators monitor these markets. For example, the US Securities and Exchange Commission (SEC) and the UK’s Bank of England monitor the markets.

You should not confuse the term with money markets. In the money markets, people buy and sell financial instruments with maturities not exceeding one year. Both markets form part of the financial markets.

A financial instrument is a monetary contract between different entities which people can buy and sell.

Capital markets and secondary markets

New stocks and bonds are issued to investors in the primary market, often through a mechanism we call ‘underwriting.’ Investors buy and sell existing securities in the secondary market. Most of the activity in the capital markets occurs in the secondary markets.

Most governments use investment banks to organize the sale of their bonds.

Capital markets are crucial for the proper functioning of an economy. In fact, without capital, there would be no economic output.

Several entities participate in capital markets, including pension funds, mutual funds, other institutional investors, and individual investors. Local and national governments, businesses, as well as banks and financial institutions also participate in these markets.

Investors seek the best possible return for their money. They also want to invest with the lowest possible risk. Issuers of securities, on the other hand, aim to raise capital at the lowest possible cost.

Examples of highly-organized capital markets are the New York Stock Exchange, the London Stock Exchange, NASDAQ, and the Tokyo Stock Exchange.

There is a strong connection between different markets across the world. Any disturbance in a capital market in one nation affects the trading markets in other countries.

The Nasdaq Business Glossary says the following about capital markets:

“Traditionally, this has referred to the market for trading long-term debt instruments (those that mature in more than one year). That is, the market where capital is raised.”

“More recently, ‘capital markets’ is used in a more general context to refer to the market for stocks, bonds, derivatives and other investments.”