Chattel mortgage – definition and meaning

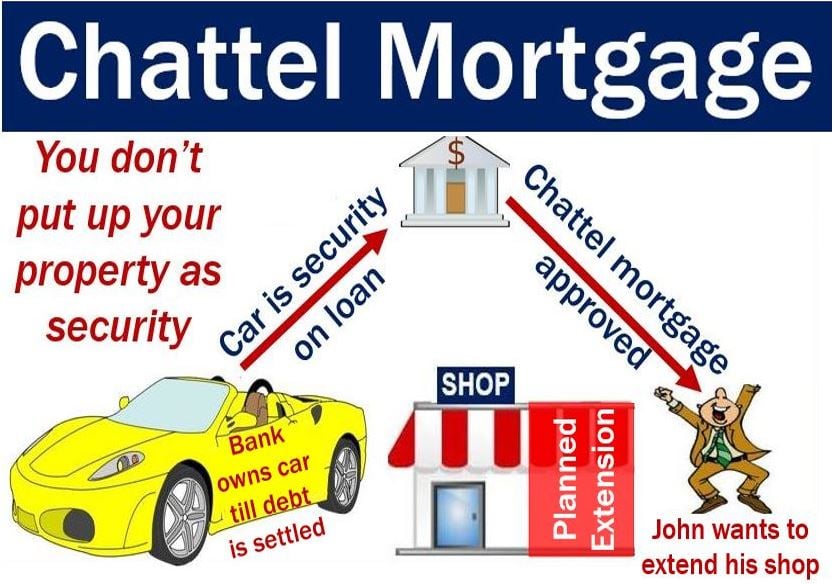

A chattel mortgage is a loan in which the borrower uses a movable personal property as security. The term chattel mortgage has slightly different meanings across the world. In one country it may refer to a car loan. In other countries, on the other hand, people use it for any loan without using freehold land as security.

For example, in Australia, it refers to a car loan. Specifically, a car loan in which the lender owns the vehicle until the borrower has paid off the loan.

If you require leverage for a loan, there are other options apart from using your house. In other words, you do not have to put your home on the line. You can use free standing possessions as security. That is where a chattel mortgage is a useful option.

Chattel is an item of property other than freehold land. For example, cattle, vehicles, boats, trailers, electronic appliances, and leases are chattel. We even consider clothes as chattel.

We sometimes refer to a chattel mortgage as a secured transaction. The lender holds a lien against the chattel until the debt is paid off in full. In fact, the borrower only assumes ownership after the final loan repayment. Chattel in this context means movable property.

According to realtor.com, a chattel mortgage is:

“A loan that can be obtained from a bank or financial institution using some sort of movable personal property – possessions other than land, buildings or any permanent fixture – as security.”

For something to be chattel, it must not cause any damage or change to a freehold real estate property. In other words, it must not change or damage the borrower’s building or land.

Businesses often use chattel mortgages when they need money. Companies use chattel mortgages to buy additional property. In such cases, they use their machinery and vehicles as collateral.

Chattel mortgages convenient for lenders

Lenders like chattel mortgages because if the borrower defaults they can seize the movable security. They subsequently sell that movable security. Lenders know they can sell it rapidly.

Be careful what you put up as security. You should choose a movable possession that you do not need urgently. For example, a laptop with personal files is not a good idea.