What is commercial paper? Definition and meaning

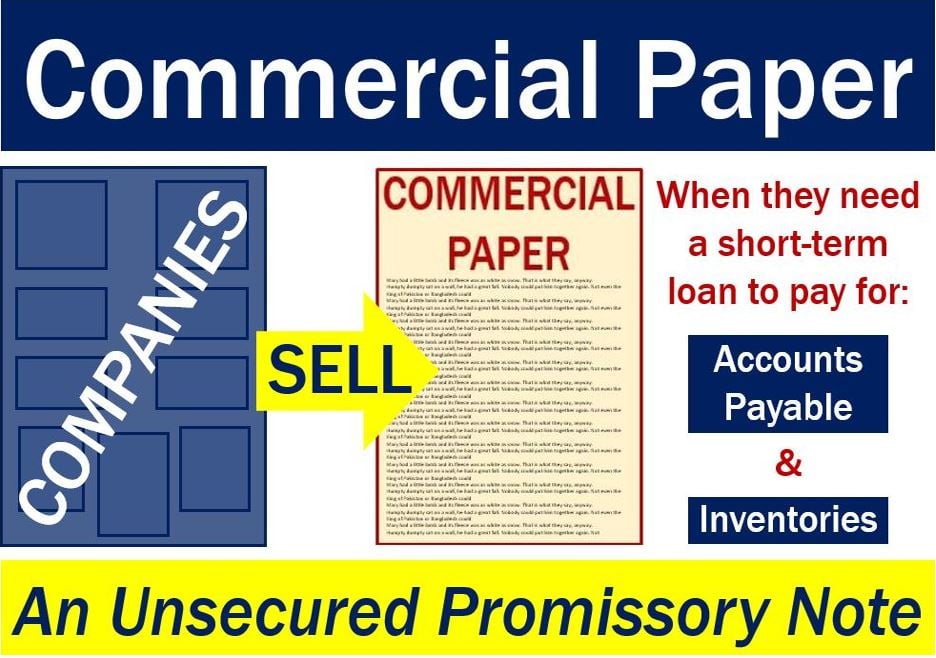

Commercial paper is a short-term loan in the form of IOUs. Just like bonds, you can buy and sell commercial paper.

When a company issues one, it promises to pay a certain amount of money to the payee. The final payment date is no more than 270 days from the date it was issued. The term ‘maturity’ means the final payment date.

Big corporations often issue commercial papers to raise money. In fact, they use them mostly to make short-term debt payments.

As commercial papers do not usually have any security backing, only blue chip companies can sell them. Typically, they sell them at a discount from face value. In some cases, they may have the backing of mortgages or other types of loans.

According to Nasdaq.com, commercial papers are:

“Short-term promissory notes either unsecured or backed by assets such as loans or mortgages issued by a corporation. The maturity of commercial paper is typically less than 270 days.”

The longer the maturity of the paper the higher the interest rate.

For many companies, commercial papers are cheaper alternatives to opening a line of credit with a bank. This is especially so if the firm has a good credit rating.

Commercial paper making a comeback

According to the Financial Times, companies are raising money by selling commercial paper at an increasing rate. In fact, this type of short-term debt virtually died after the 2007/8 global financial crisis.

The US Federal Reserve revealed that the amount of outstanding “non-financial” commercial papers sold by corporations reached $243 billion USD in October 2013. That was a ten-year high.

Experts forecast that the use of commercial papers will increase.

Commercial paper defaults

Defaults on high-quality commercial paper are extremely rare. However, when they do occur they can trigger investor panic.

Penn Central filed for bankruptcy under Chapter 77 of the US Bankruptcy Code in 1970. The company defaulted on commercial papers worth $77.1 million. This triggered a runoff in the market for commercial papers of nearly $3 billion.

The Federal Reserve System had to intervene by permitting commercial banks to borrow at a discount. The Federal Reserve System (Fed) is America’s central bank.

In 2008, Lehman Brothers caused two money funds to break the buck. Subsequently, the Fed had to intervene in money market funds.