Credit – definition and meaning

In business, the term credit can refer to money, a product, or a loan facility. It might also denote the act of adding funds to someone’s bank account, as in “We credited your account with $100.” When a bank account has a positive balance, it’s described as ‘in credit.’

If it weren’t for credit, i.e., allowing customers to pay later or lending money, the global economy we have today would not exist.

The opposite of credit is debit or debt.

Origin of the term Credit

The term comes from Latin ‘credere’, which means ‘to believe’ (to give credence). Hence, it is the trust which allows a lender to provide funds to a borrower, who arranges to pay back at a later date.

Credit in Spanish and Portugues is crédito, French – crédit, Italian – credito, German – Kredit, Russian – кредит, Japanese – クレジット, and Chinese – 信贷.

The term may include the provision of money (loan), or goods or services, as in consumer credit. It encompasses any arrangement where people pay later. The party lending the money or service is known as the creditor, while the borrower is the debtor.

Credit Scores and Their Importance

If you have a high credit score, you will find it easer to get loans approved than somebody with a low credit score. A higher score indicates a lower risk for lenders, potentially leading to better loan terms and lower interest rates. On the other hand, a lower score might limit one’s ability to secure loans or might result in higher interest rates.

A credit score is a numerical representation of your creditworthiness, reflecting your history of borrowing and repaying loans.

Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk of lending money to customers.

Regularly reviewing and understanding one’s credit score aids in financial planning and helps maintain good financial health.

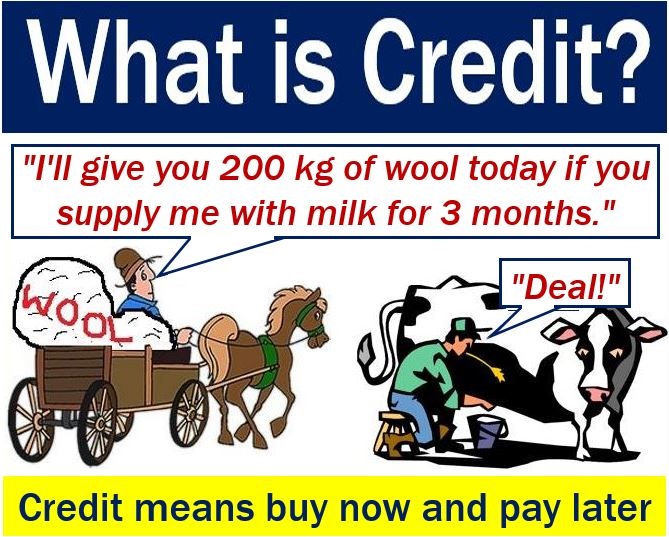

Credit in a barter system

The arrangement might not involve the exchange of money. In a barter situation, for example, the parties deal with goods or services.

For example, one party may provide 200 kilograms of wool while the other delivers milk. However, the second party delivers the milk over a period of three months.

The supplier of wool is the creditor, while the debtor pays back over a set period with daily deliveries of milk.

According to the Financial Times Lexicon, credit is:

“Any sum of money advanced as a loan, or available for loan. Also, money received in an account – a positive accounting entry.”

In many countries, people borrow money to buy everything from clothes, groceries, computers, vacation trips, to cars and homes. According to Debt.org, many people struggle with too much debt.

What is your credit limit?

If you have a credit card, they will tell you what your credit limit is. So will a retailer if you have a retail card. This is the full amount you can borrow.

Your ‘available credit’ means how much you can borrow at the moment. We calculate it by subtracting how much you currently owe from your limit. For example, if your limit is $4,000, and you owe $1,800, you have $2,200 available.

Banks and retailers decide what your limit is according to how long you have been a customer. They also consider how promptly you settle your debts, your income, your current debts, and your age.

Additionally, whether you own a house influences how much they will lend you.

If you manage your account properly, the lender will probably increase your limit from time to time.

Offering countries credit

The International Monetary Fund (IMF) extends loans to countries with financial difficulties.

Countries receiving loans must agree to implement a set of policies. These policies help them get out of their economic problems.

Video – What is Credit?