Cross holding – definition and meaning

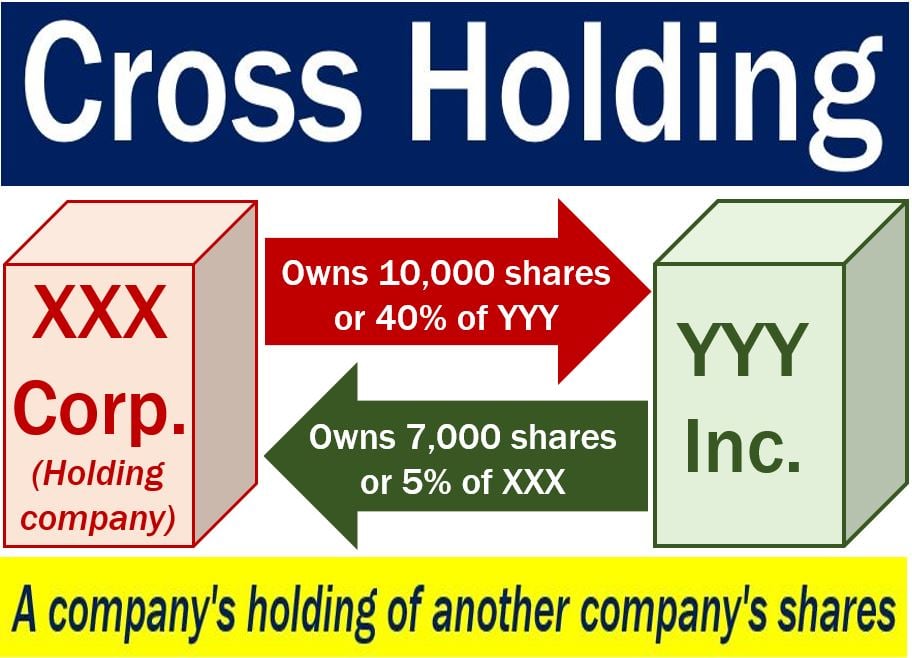

A cross holding is a security that one public company issued but another company in the same listing owns it. In other words, imagine there are two public companies whose shares trade on the same stoke exchange. One company owns shares in the other. Cross holding refers to those shares. The term may also refer simply to a company’s holding of another company’s stock.

Definition of public company: we can buy and sell a public company’s shares on a stock exchange. We cannot do this with a private company. If we want to buy a private company’s shares, we need to come to an arrangement with the owners.

We also call a cross holding a cross shareholding.

Accountants need to be careful when valuing their company on the exchange if there is a cross holding. There is a risk of double-counting of the security’s value. Double-counting would subsequently distort the value of the two corporations.

For example, imagine Company XXX and Company YYY are on the same stock exchange. We need to account for XXX’s cross holdings in YYY to make sure we do not double-count YYY’s value.

In many cases, a company will hold shares in several other companies. The more cross holdings a company has, the harder it becomes to value the companies properly.

We need to carefully consider the role of cross holding in corporate acquisitions and ousting management personnel.

A publicly company that owns shares in another one on the same listing has the same voting rights as other shareholders.

Cross holding and the law

In some countries, it is illegal for major rivals have cross holdings (with each other). In March 2015, British telecom multinational Vodafone had to sell its 4.2% stake in India’s Bharti Airtel to comply with rules that prohibit cross-holding between rivals.

Vodafone said the sale followed the then new unified license regime in India. The regime bans the holding by a group of an interest in more than one licensee company in the same service area.

The Law Dictionary defines cross shareholding as follows:

“Minority stakes held by two companies in each other; this is often done to help strengthen long-term business relationships, and is particularly prevalent in Relationship Model countries such as Germany and Japan.”

Video – cross holding investments

This video looks at a situation in which two companies own each others’ shares, and one of them is the other’s holding company.