Crowdfunding – definition and meaning

Crowdfunding is a system of raising money by asking lots of people to contribute a small amount of money each. The money is usually for a project or venture. However, it may also be for charity or a personal cause. Put simply; you try to get a ‘crowd’ to ‘fund’ you. Most people do this online.

Today’s entrepreneurs often utilize social media and targeted advertising to reach potential contributors, capitalizing on the extensive reach of these platforms.

From few individuals to many

In the past, getting funding for a venture or project meant asking a few large potential donors. For example, budding entrepreneurs would seek out angel investors.

Crowdfunding turns the idea back-to-front. In other words, few individuals become many. Additionally, large individual sums of money become small sums.

If you are seeking funds, you set up a profile of your project on a website. Visitors then look at your proposal and decide whether to contribute.

Advancements in payment technologies have also streamlined the crowdfunding process, enabling instant and secure transactions from anywhere in the world

Crowdfunding – an old concept

Even though the term is relatively new, the actual concept has been around for a while. Many individuals contributed a small amount each towards the creation of the Statue of Liberty.

Michael Sullivan first used the term in 2006. Sullivan attempted to create a medium for people with video blog projects to receive funding.

However, the term didn’t really kick off until the Kickstarter platform came onto the scene in 2009.

There have been various other media for receiving funding via the internet long before Kickstarter. An example of such a platform is ArtistShare, which appeared 2003.

Other online platforms that essentially used crowdfunding before Kickstarter include ChipIn (2005), EquityNet (2005), Pledgie (2006), Sellaband (2006), IndieGoGo (2008), and GiveForward (2008).

There are two main participants in the crowdfunding model:

– the people proposing an idea/project, and

– the people who support the proposals.

These two participants can group up via an online platform (website).

The four types of crowdfunding

There are four main types of crowdfunding:

-

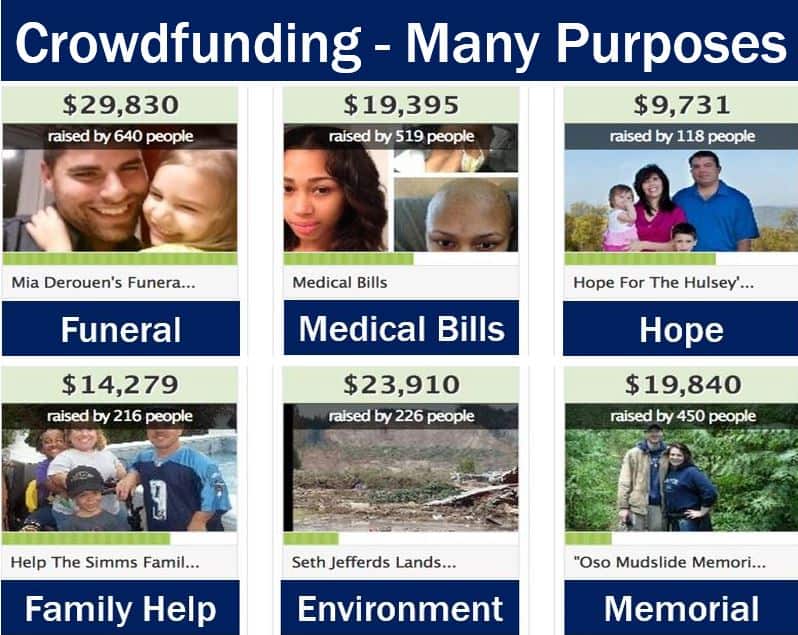

Donation-based

The backers make donations in support of a cause. However, there is no financial return for the contributors. An example would be a family asking for money to help keep up with cancer treatment costs.

-

Reward-based

The supporters make donations backing a project in exchange for a ‘reward.’ In other words, there is a clear monetary value.

-

Credit-based

People make contributions in the form of a credit loan. They then receive interest payments.

-

Equity-based

Those who invest money receive shares of a company.

The pros:

- – It is a way of getting capital without getting into debt or losing equity.

- – The initiator gains market validation.

- – It boosts the producer’s profile and presence.

- – The whole process encourages people to spread the word about the campaign.

- – It allows people to recognize good ideas.

- – Audience engagement and feedback is great for a start-up business.

- – The venture gains attention from media outlets.

The cons:

- – If the public reaction is negative, it can undermine the whole project. However, one could say this is a benefit. If the reaction is negative, that feedback could save you from making a big mistake. In other words, maybe your idea was not such a good one after all.

- – There is a risk of idea theft by publishing the proposal online. In other words, people read about your idea and copy it.

The risks

Crowdfunding can be a brilliant means of generating funds for a project or idea. As a result, some online crowdfunding platforms are currently flourishing.

However, what are the risks involved in crowdfunding? Are there any pitfalls? Yes, there are.

Public disclosure of intellectual property can undermine its legal status. If you submit an idea online for other people to view, you might not be able to complete a patent application.

For example, the US Patent Act says you cannot file a patent if it is in public view for over a year.

Top crowdfunding platforms

Below there is some information about the world’s top seven crowdfunding platform, according to US News & World Report..

-

GoFundMe (founded 2010)

The leading platform for personal fundraising, GoFundMe has helped raise over $9 billion from 120 million donations, supporting causes ranging from medical expenses to community projects.

-

Kickstarter (founded 2009)

Focusing on creative ventures, Kickstarter has become synonymous with artistic and tech project funding, providing an all-or-nothing funding model that has successfully launched over 200,000 projects.

-

Indiegogo (founded 2008)

With its flexible funding model, Indiegogo allows entrepreneurs and innovators to raise funds for almost any idea, offering both fixed and flexible campaigns to accommodate project needs.

-

StartEngine (founded in 2015)

A leading equity crowdfunding platform enabling everyday investors to fund startups and early-stage companies, breaking down traditional barriers to investment.

-

Patreon (founded 2013)

A platform designed for creators and artists to build their membership business, It provides a space for creators to receive funding directly from their fans or patrons on a recurring basis.

-

Classy (founded 2006)

Positioned as a social enterprise platform, Classy provides nonprofits with tools for online fundraising, community engagement, and marketing, and it’s an independent subsidiary of GoFundMe catering specifically to the nonprofit sector.

-

CrowdStreet (founded 2013)

CrowdStreet offers a niche platform dedicated to real estate crowdfunding, allowing investors to directly invest in commercial real estate opportunities, with over $2 billion invested across hundreds of deals.

Video – What is Crowdfunding?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what ‘Crowdfunding’ is using simple and easy-to-understand language and examples.