Current ratio – definition and meaning

The current ratio is a calculation that shows whether a company has enough resources to cover its debts. Specifically, the ratio looks at the company’s ability to cover debts over the next twelve months. In other words, it is a measure of a firm’s liquidity over the short term.

It compares a business’ current assets with its current liabilities. Current assets include cash and items that the company can convert into cash within twelve months. Current liabilities are debts that the company must pay within a year.

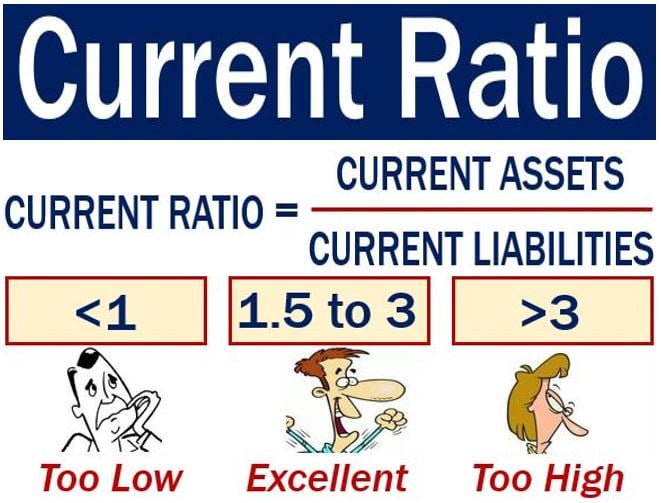

Current Ratio = Current Assets ÷ Current Liabilities

You must not confuse this calculation with the quick ratio, which excludes inventory (stocks) from the equation.

For example, let’s suppose a company has assets of $200 million and current liabilities of $160 million. Its current ratio is:

250 million ÷ 160 million = 1.56

Acceptable current ratios vary from industry to industry. We consider companies with a ratio between 1.5 and 3 as ‘healthy.’ In other words, they have good short-term financial strength.

When current ratios are too high or low

If current ratios are less than one, the company may find it hard to meet its short-term obligations. A low ratio means that its current liabilities are greater than its current assets,

Current ratios greater than three may attract criticism that the management is not using current assets efficiently. Senior managers should be careful about spending, but they should also invest to boost productivity and create new products.

A high ratio might also be a sign of problems in working capital management. If there is too much cash, the company should consider returning some of it to shareholders.

Sometimes, companies may be doing well even though their current ratios are low. For example, a business whose inventory turns over faster than the accounts payable become due may have a low ratio. However, it might be thriving.

A company with a low current ratio might be able to increase it rapidly. It could produce more and boost inventory or take on a long-term debt and boosting cash levels.

Comparing one current ratio with another

We should compare a company’s ratio with those of other businesses in the same sector.

Creditors who expect their money back within a year prefer debtors with high current ratios than low ones.

The Nasdaq Business Glossary defines current ratio as an:

“Indicator of short-term debt-paying ability. Determined by dividing current assets by current liabilities. The higher the ratio, the more liquid the company.”