Debts – definition, meaning, and examples

Debts are things that we owe. In most cases, the term refers to money. We call the party that owes the money the borrower. The borrower owes something to the lender. In the physical sense, if you have debts, it could mean money that you owe to your bank, another person, or even a friend. However, in the metaphorical sense, the term may have other meanings.

For example, a ‘debt of gratitude’ does not refer to money. It means you have a good reason to be grateful to someone.

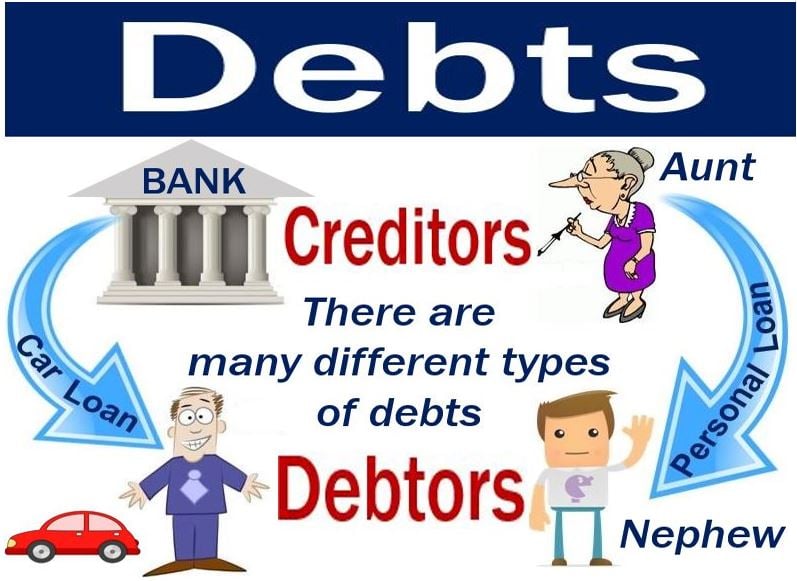

Debtors are people with debts. They owe money to creditors. Debtors and creditors may also be companies or even governments.

Many types of debt have been around considerably longer than money or coinage. Historians say examples of debts date back to about 2,900 years before the invention of coinage. In those days, traders used a barter system.

In ancient civilizations, such as Mesopotamia and Egypt, debts often took the form of obligations to the state or temple, and were recorded on tablets or other early forms of documentation.

Debts – many types

Physical debt today can take many different forms; examples of lenders of monetary debt include credit card firms, banks, payday loan providers, sovereign nations, individuals, and even local governments and councils.

Modern financial systems have diversified debt instruments significantly, introducing various forms such as bonds, debentures, and different types of structured finance, to cater to the varying needs of borrowers and investors.

According to Dictionary.com, a debt is:

“1. Something that is owed or that one is bound to pay to or perform for another (a debt of $50). 2. A liability or obligation to pay or render something (My debt to her for advice is not to be discharged easily).”

“3. The condition of being under such an obligation (His gambling losses put him deeply in debt). 4. Theology; an offense requiring reparation (a sin, a trespass).”

People, companies, and governments use debts for making large purchases. Governments also borrow to complete major projects that under normal circumstances they could not afford.

Interest on loans

In the arrangement of debts, borrowers have permission to take a loan. However, they pledge to pay the debt back at a later date. Debtors pay back either in one sum or at regular intervals. In most cases, borrowers must also pay interest.

Interest is a way to compensate the lender for bearing the risk of the loan. It also encourages the borrower to pay back quickly. Debtors want to keep the total interest down to a minimum.

Today, debts most commonly exist in the form of loans and include checking account overdrafts, and credit card debt. There are also mortgages, student loans, personal loans, small business loans, payday loans, and consolidated loans.

Payday loans are small, short-term loans that workers take out and pay back on pay day. Payday lenders charge very high interest rates.

In fact, debts exist in hundreds of forms.

Good and Bad Debts

Investors and financiers pay a lot of attention to the debts companies have. A firm that has many debts might struggle to pay its interest payments if sales decline. In fact, debt is a common reason why companies go bankrupt.

On the other hand, companies with no debt at all could be missing out on major expansion opportunities.

The optimum amount of debt varies considerably from sector to sector. Utility and financial services companies typically have high debt-to-equity ratios or debts in relation to their equity.

Service industries and wholesalers, on the other hand, have relatively low debt ratios.

Bad debts are those in which the creditors will not get back their money. In other words, the borrower will not pay back the debt, i.e., the creditor has lost the money.

Businesses usually write off bad debts as expenses. We also use the terms bad loans or delinquent loans with the same meaning as bad debts. Expenses are what companies, individuals, and organizations spend.

Defaulting on debts

Borrowers sometimes default on their debt. In other words, they fail to pay back the money or cannot keep up with their repayment installments.

Consequences for defaulting vary, depending on the terms of the debt and the laws of that country.

Borrowers who have defaulted before usually have to pay higher interest rates. They pay higher interest rates because the lender is running a higher risk. The extra interest makes up for that risk.

Banks and other lenders assess the risk of default before making a loan. They usually use a system of credit scores and corporate and sovereign ratings.

Companies and individuals may go into bankruptcy if they are unable to meet the terms of the debt agreement. Experts say that international third world debt has reached a massive scale.

In fact, the only way to prevent a series of global economic crises is to write off some of those loans. To ‘write off’ means to cancel the loan, i.e., treat it as a bad debt.

Compound phrases with ‘debt’

In business, banking, and finance English, there are many compound phrases containing the word ‘debt.’ Let’s have a look at the most common ones.

-

Debt Consolidation

If you have five different debts and you may decide to take out a single loan to pay off those five debts. That is an example of debt consolidation. You have consolidated five debts into one. That new loan you take out is called a ‘consolidation loan.’

-

Debt Financing

Raising funds by either taking out loans or issuing bonds.

-

Debt Ceiling

The maximum amount of money a government is allowed to borrow, as legislated by its governing body. We also refer to it as the debt ceiling.

-

Debt Ratio

A financial ratio that compares a company’s total debt to its total assets. A company’s debt ratio tells us what proportion of its assets that are financed by debt.

-

Debt Settlement

A negotiation or arrangement between a debtor and creditor. In most cases, it involves lowering the size of the debt and/or installments.

Video – What is debt?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what ‘Debt’ is using simple and easy-to-understand language and examples.