Debt equity ratio – definition and meaning

Debt Equity Ratio shows the relative proportion of shareholders’ equity and debt a company uses to finance its assets. It is one of several financial ratios we use to gauge a business’ financial leverage and overall health.

The terms debt-to-equity ratio and D/E ratio mean the same as debt equity ratio.

Debt equity ratio is the most common financial leverage ratio. It is a measure of the relationship between capital that comes from creditors and capital originating from shareholders.

It can also tell us the extent to which stockholders’ equity can meet creditors’ obligations.

In the event of a liquidation, it is important to know what financial obligations stockholders’ equity can meet.

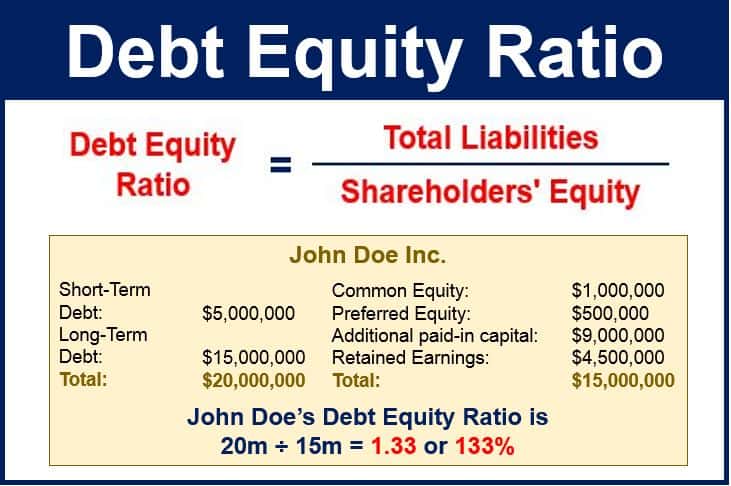

We calculate the debt equity ratio by dividing a firm’s total debts by its stockholders’ equity. Another word for debts in this context is ‘liabilities.’ Stockholders’ equity means the total value of all a company’s outstanding shares.

Debt Equity Ratio = Total Liabilities ÷ Shareholders’ Equity

Debt equity ratio – example

Imagine a company, John Doe Inc., has debts totaling $20,000,000, and stockholders’ equity of $15,000,000.

John Doe’s debt equity ratio is:

20,000,000 ÷ 15,000,000 = 1.33 or 133%

This means that for every dollar of John Doe belonging to its stockholders, it owes $1.33 to creditors.

Many ways to make the calculation

There are several ways to calculate the D/E ratio. Whoever is presenting the result needs to explain what types of debts they used.

They must also explain whether they included the market price or book price for the equity component. Market price means the price now, while book price means the price when it first came out.

Some analysts may include all short-term and long-term fixed obligations. Others, however, might not. Does the company consider preferred stock debt or equity?

Why is this measure important?

A lower ratio usually means that the business is financially healthy. A company with a high debt equity ratio is less likely to generate enough cash to meet all of its debt obligations.

However, if the ratio is very low, it could mean that the firm is not leveraging enough to boost expansion.

Businesses with a lot of assets tend to have higher debt equity ratios compared to companies that are not capital-intensive.

For example, manufacturers or car rental companies have a high debt equity ratio. Tech companies, such as Google, however, do not need lots of physical assets to sell their products. Therefore, tech companies have a low ratio.

When examining a company’s ratio, we must compare it to other businesses in the same industry.

Investors and creditors prefer businesses with low ratios. They prefer low ratios because those companies are more likely to withstand a sudden spike in interest rates. They are also more likely to survive an economic downturn.

The OECD says the following regarding debt-to-equity ratio:

“Firms can finance operations through debt or equity. The debt-to-equity ratio is a measure of a firm’s financial leverage or degree to which companies finance their activities out of equity.”

Beyond balance sheet figures, the debt equity ratio can influence a company’s ability to attract investment and secure favorable lending rates.

The ratio is often adjusted for industry-specific risk factors to provide a more nuanced understanding of financial stability

Video – what is debt equity ratio?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘Debt Equity Ratio’ means using simple and easy-to-understand language and examples.