Depreciation – definition, meaning and some examples

Depreciation refers to the reduction in the value of long-term assets over time. While it often stems from wear and tear, other factors can also contribute to this decline in value. External market conditions, technological obsolescence, and changes in demand are other culprits that can influence depreciation.

‘Wear and tear’ refers to the gradual deterioration in a product’s quality when we have used it normally and properly.

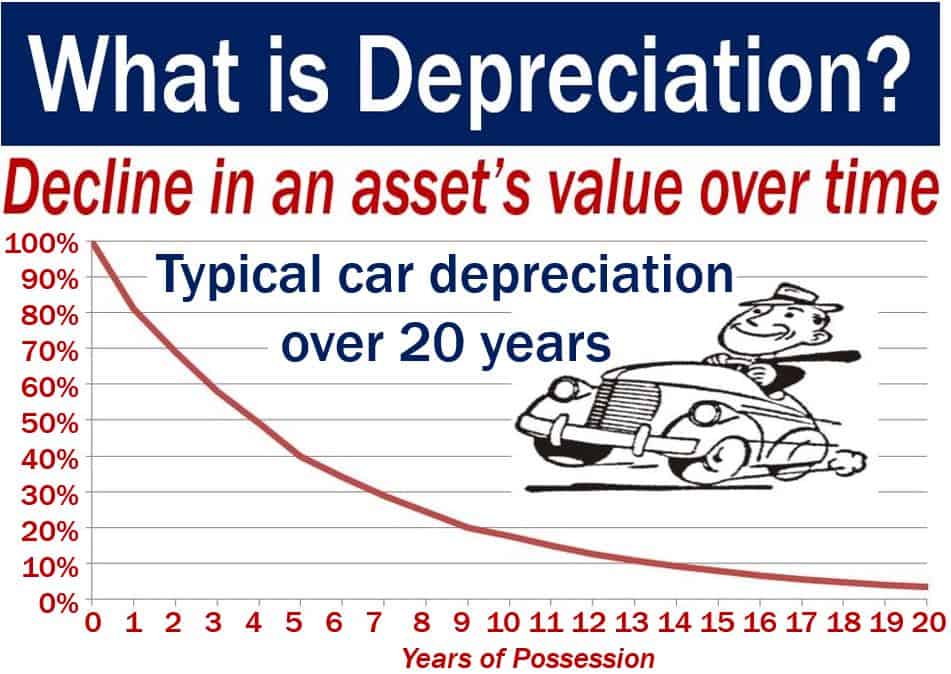

The term refers to when the value of an asset decreases after the date we bought it. It is the opposite of appreciation, i.e., when an asset increases in value over time.

A common example is your car. As soon as you buy it, it starts dropping in value.

Depreciation in business

In business, the term has a more specific meaning. It has a direct impact on the profit figures of a company.

According to Cambridge Online Dictionaries, depreciation is:

“The amount by which something, such as a piece of equipment, is reduced in value in a company’s financial accounts, over the period of time it has been in use.”

The decline in value of a company’s assets reduces its profits. If profits go down, so does the amount of tax it must pay.

Historical Views on Depreciation

The concept of depreciation used to be quite different in the past. In ancient and medieval societies, the idea of assets losing value over time was not universally recognized in formal accounting.

It was only during the rise of industrialization and modern accounting practices that depreciation became a standardized concept. This change occurred as businesses needed to account for the wear and tear of machinery and other equipment over prolonged usage periods.

The understanding and practices surrounding depreciation evolved further with the advancement in financial markets, technology, and the complex nature of modern-day businesses.

Nowadays, depreciation is a fundamental concept in finance and accounting.

Depreciation affects profits

Let’s suppose that John Doe Inc. buys an asset worth $500,000.

Accountants will view the asset and determine how long it will last. If the asset has a five-year life, the accountants adjust the company’s profits.

The accountants will spread the $500,000 over five years when deducting the amount from profits. They do not deduct the whole amount on the day of purchase.

If you divide $500,000 by five years, you get $100,000 per year. Every year, the company deducts $100,000 from profits. The asset’s value declines by $100,000 each year.

Company directors determine how long they believe the asset will be worth. In this case, company estimates have a direct impact on the profits of a company.

Investors sometimes worry about how many judgments the directors make when determining depreciation. Investors want a harder profit figure.

How to calculate depreciation

With the straight-line depreciation method, we divide the cost of an asset by its lifetime.

With the declining balance depreciation method, we multiply the book value of the fixed asset by a factor based on the asset’s life.