What is a diluted share?

A diluted share refers to the state of a share after a company has added more shares to its pool of stock, i.e. after it has issued more common stock.

If your shares represented a certain percentage ownership of the company, that proportion will be reduced if more shares are issued – your shares will be ‘diluted’.

The increase in the number of shares outstanding may be the result of a primary market offering, including an IPO (initial public offering), the company’s workers exercising stock options, or the conversion of bonds, preferred shares or warrants into common stock. The primary market is where shares are issued for the first time.

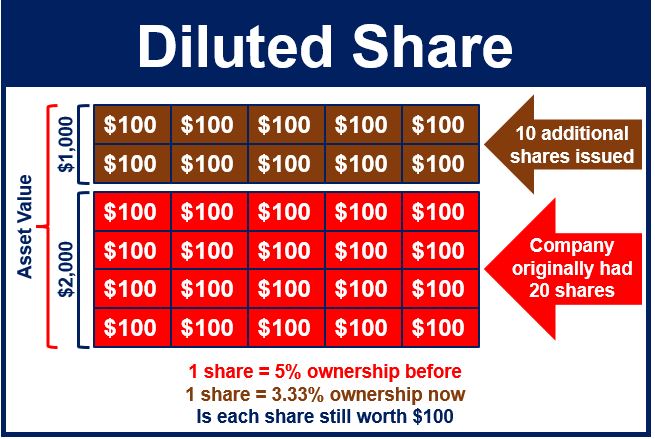

Experts argue that each share is still worth $100. 1/20 of $2000 and 1/30 of $3000 both equal $100.

Experts argue that each share is still worth $100. 1/20 of $2000 and 1/30 of $3000 both equal $100.

If your shares are diluted, they could affect your:

- earnings per share,

- voting control

- share value

- ownership percentage

Example of a diluted share

If you own one share in a company with 1,000 shares issued, trading at $50 each, you own 0.1% of that company.

If that company issued another 1,000 shares, your share would be ‘diluted’ by those new shares. Just like concentrated syrup is diluted when you add water.

If the company has not done anything to increase its value, your share could be worth less – 1/1000 of the business’ total value was worth more than the 1/2000 it is now worth. This means your share would probably no longer have a value of $50.

Many experts challenge this approach, saying that the company now has greater asset value after issuing additional shares, so the value of each share is likely to remain the same. Percentage ownership, earnings per share, and voting rights, however, are definitely diluted.

When a company reports its profits on a ‘fully diluted per share basis’, it means it is taking into account the number of common shares that could exist if the owners of convertible bonds and stock options decided to convert them.

Investors should carefully consider a company’s fully diluted share figure before deciding whether to buy stock. There is a risk the share price could plunge considerably if many option holders or convertible bond holders choose to claim their stock.

According to the FT Lexicon, the term ‘diluted shares’ refers to:

“All the shares of a company considered together, especially after a share issue (when new shares are made available and sold), and dividends are spread over a larger number of shares.”

Share Dilution Scams

Beware of share dilution scams. These occur when a company, which usually trades in an unregulated market such as the Pink Sheets or OTC Bulletin Board, issues a huge number of shares into the market again and again, for no particular reason.

Each time these follow-on offerings occur, the share prices devalue significantly until they are worth virtually nothing. Shareholders lose a lot of money.

Video – Stock dilution

In this video, the speaker argues that the dollar value of each share does not really get diluted when a company issues additional shares.