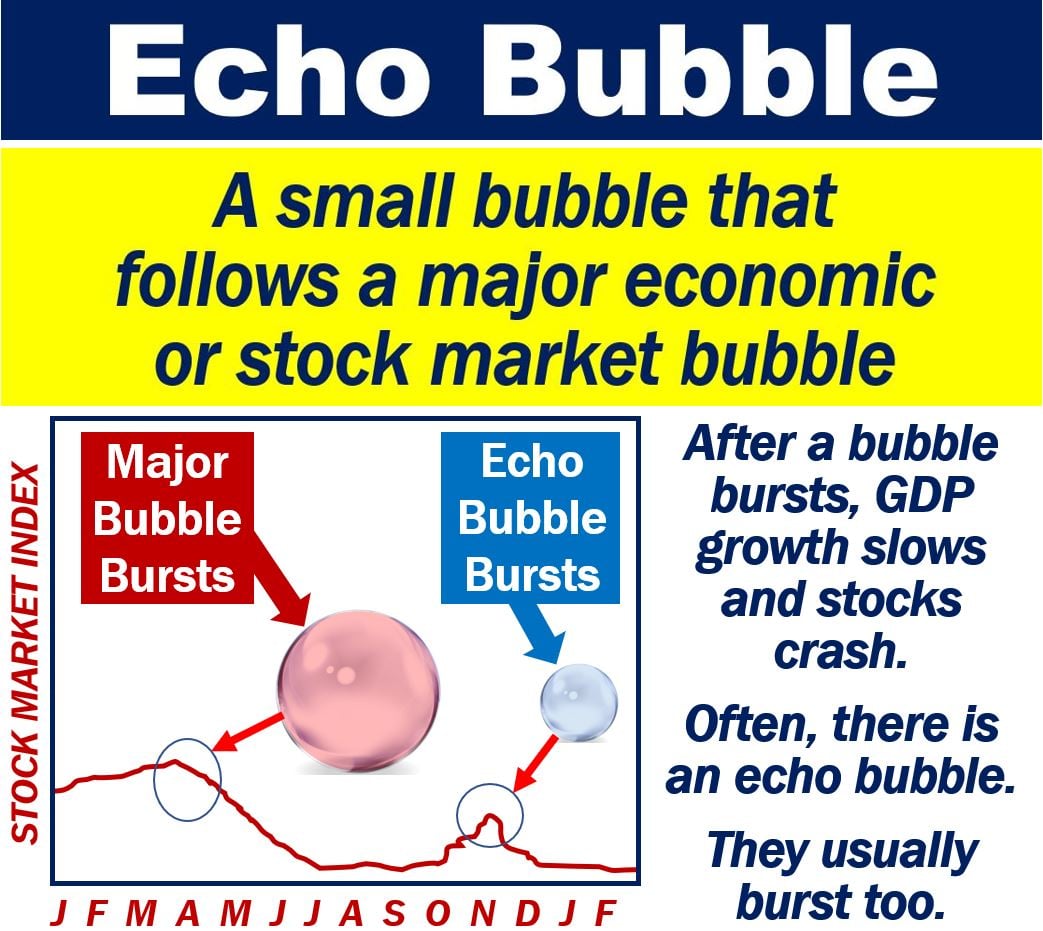

An echo bubble is a small bubble that forms when the stock market begins to recover. However, it recovers prematurely. We can also use the term for a prematurely recovering economy. Investors begin feeling less apprehension and more confident. Perhaps their sentiment is more positive than it should be. The economy or stock market rises, but then bursts, i.e., the echo bubble bursts.

A post-bubble rally can end up becoming a mini-bubble, which eventually bursts.

The term also exists in medicine. In medicine, the term stands’ for ‘echocardiogram with bubble study.’ It is a bubble echocardiogram, but the IV goes into the patient’s arm.

This article focuses on the term when it applies to the economy or stock markets.

Put simply; an echo bubble is a premature rally that eventually becomes another bubble that bursts. However, in this case, it is a smaller.

Echo bubble is weaker

Sonic echoes return much weaker after bouncing off a surface, such as a giant cave wall. Similarly, echo bubbles are smaller than the bubble that preceded them.

Echo bubbles are smaller-scale replays of a real bubble. In other words, they come after the big one pops, but don’t collapse with such a big ‘bang.’

According to ZEAL Speculation and Investment:

“An echo bubble is like a relatively small speculative mania in the same sectors most affected by the preceding historical bubble mania.”

Echo bubble – 1930

After the Wall Street Crash in 1929, there was an echo bubble. It occurred in 1930. Economists often quote it as one of the first.

Corporate securities in the United States experienced one of the greatest speculative bubbles in history between 1927 and 1929.

During those two years, the Dow Jones Industrial Average rose from approximately 160 to over 380.

The Dow Jones Industrial Average or ‘the Dow‘ is a US stock market index. The Dow represents the weighted average of the country’s thirty major stocks. These stocks are tradable in the New York Stock Exchange or NASDAQ stock market.

In October 1929, it crashed to below 200 within a few days. In the first two quarters of 1930, it rose fifty percent to almost 300. However, the rally did not last long, i.e., it was an echo bubble. By the middle of 1932, the Dow Jones had declined to just over 40.