What is fair value? Definition and examples

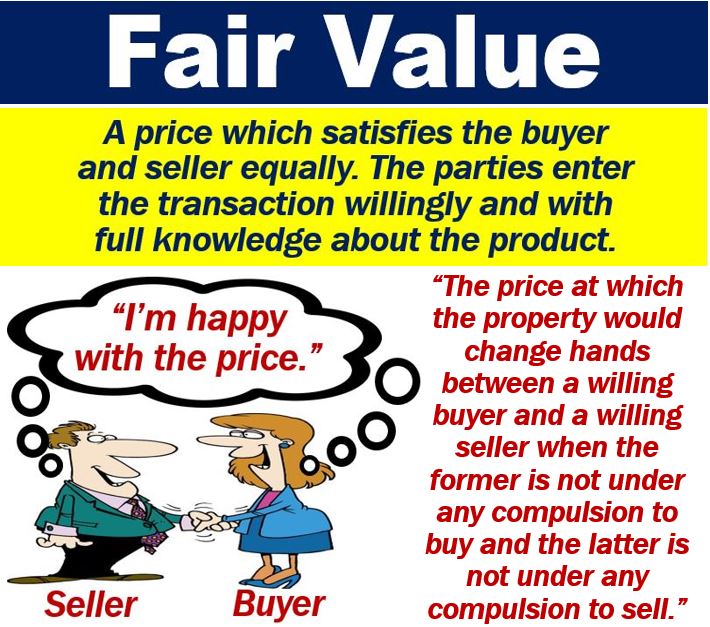

Fair Value is the sale price that both the buyer and seller agree on willingly. The two parties are happy with the price and enter the transaction freely and with full knowledge. The word ‘fair’ suggests that both parties are honest, open, and happy with the transaction.

In accounting and economics, fair value is the rational estimate of the potential price of a product, service, or asset.

It is an unbiased estimate which takes into account several objective factors such as acquisition costs, production costs, and distribution costs. It also takes into account replacement costs, costs of close substitutes, and individual perceived utility.

Fair value considerations often extend to intangible assets, where valuation must capture elements like brand reputation, patents, and proprietary technology.

The Cambridge Dictionary has the following definition of fair value:

“A way of calculating how much the assets of a business are worth based on how much would be paid for them if they were sold.”

Regarding the fair value of a security, InvestingAnswers.com writes: “There is no one way to calculate the fair value for a security, but calculations typically take into account future growth rates, profit margins, and risk factors, among other items.”

Fair value vs. market value

Do not confuse the term with market value. Although the meanings are similar, they are not identical.

-

Market value

We base something’s market value or fair market value on how much it could sell for in an open market. In other words, what people would pay for it in an unrestricted marketplace. In this context, ‘marketplace’ means the same as ‘market’ in the abstract sense.

Fair market value is the standard that most people and businesses recognize. Businesses and other entities commonly use the term for sale and tax purposes.

The IRS (Internal Revenue Service) in the United States defines fair market value as follows:

“The price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.”

-

Fair value

The law states that we can use fair value when valuing business interests in marital dissolution cases or stockholder disputes. ‘Stockholder’ means the same as ‘shareholder’ (stocks = shares).

MBAFCPA.com says the following regarding the term:

“Typically, a valuator uses fair market value as the starting point for fair value, but certain adjustments are made in the interest of fairness to the parties.”

Put simply; market value is all about how much you could sell something for. Fair value, on the other hand, is the price that satisfies both the buyer and seller equally.

Fair value assessments can play a pivotal role in financial reporting, ensuring that company balance sheets reflect true transactional values rather than inflated or undervalued assets.

Educational Video – What is Fair Value?

This video presentation, from our sister channel on YouTube – Marketing Business Network, explains what ‘Fair Value’ is using simple and easy-to-understand language and examples.