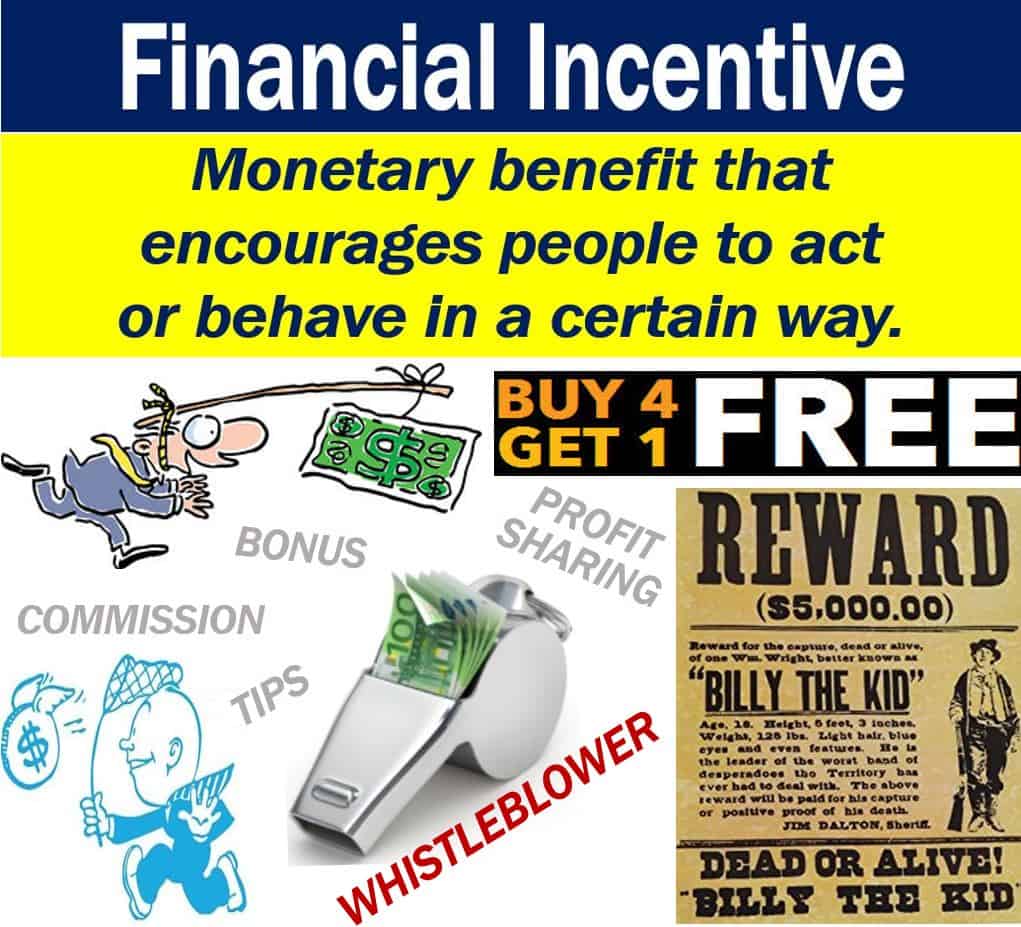

A Financial Incentive is money that a person, company, or organization offers to encourage certain behaviors or actions. Specifically, behaviors or actions that would not otherwise have occurred. The financial incentive, or monetary benefit, motivates certain behaviors or actions.

Psychologically, financial incentives tap into the reward centers of the brain, creating a positive association with certain behaviors and fostering a proactive attitude towards set objectives.

A financial incentive may be a monetary benefit that a company offers its customers or employees. The term may also refer to incentives to encourage members of the public to cooperate or provide information.

Put simply; a financial incentive is money offered to encourage actions or behaviors that would not have occurred otherwise.

TheLawDictionary.com has the following definition of the term:

“A benefit given to customers or companies to get them to do something they normally wouldn’t. It is money offered to get them to try something new offered. The event might not have happened without the incentive.”

Employees – financial incentive programs

Employers have financial incentive programs to encourage greater productivity and loyalty among employees.

Stock options, profit sharing, raises, bonuses, and commissions, for example, are financial incentives.

-

Bonuses and commissions

A bonus is a payment an employer makes to employees in addition to their basic salaries. Bonuses typically occur once per year, per month, or per quarter.

Employees receive extra cash, depending on levels of sales and profits.

Bonuses may reflect how well the company as a whole has done or a certain department. A department manager may get a bonus because his or her department performed well.

Commissions and bonuses are similar. However, commissions are more closely linked to an individual’s performance.

Sales people, for example, are more likely to be on a commission system than accountants. However, accountants might get an end-of-year bonus.

-

Raises

The term ‘raises’ means ‘salary increases’ or ‘wage increases.’

Employees greatly anticipate their raise, which typically occurs once a year.

How much employees’ basic salaries rise by depends on the company’s philosophy, worker performance, and some other factors.

-

Profit sharing

Profit sharing is a system in which a company’s employees receive a direct share of its profits.

It is a financial incentive that awards workers a percentage of the company’s profits. How much employees receive depends on the company’s earnings, i.e., its profits.

Regarding the pros and cons of profit sharing, a King University article says:

“There are both benefits and drawbacks to utilizing a profit sharing program, but when trained human resources professionals are able to plan and execute it effectively, profit sharing can be an ideal way to both improve employee morale and boost the bottom line.”

-

Stock options

A stock option is an employee’s right to purchase stocks of the company at a fixed price. In most cases, the price of the stock is below its market value.

In this context, the word ‘stocks’ means the same as ‘shares.’ Hence, the term ‘stocks and shares.’

Financial incentive to come forward

The government and police force have financial incentives to encourage members of the public to do something.

Governments sometimes encourage whistleblowers to come forward by offering financial rewards and protection.

Today, many governments offer financial incentives to get people and companies to pollute less.

If a criminal is on the loose, the police may offer a reward for information on their capture. A reward is a type of financial incentive.

Financial incentives for customers

A company may have a financial incentive to encourage customers to buy more. For example, if you buy four units, you will get an additional one free.

In this case, the seller wants to encourage consumers to buy in lots of four rather than one or two.

Some companies try to attract more customers by organizing a lottery or raffle. For example, customers check the inside of their chocolate bar wrapper to see if they won a big prize.”

Financial incentives are also a strategic tool in market competition, where businesses employ them to gain a competitive edge by attracting and retaining top talent or securing customer loyalty.

Video – What is a Financial incentive?

This video, from Marketing Business Network, our sister channel on YouTube, explains what ‘A Financial Incentive’ is using easy-to-understand language and examples.