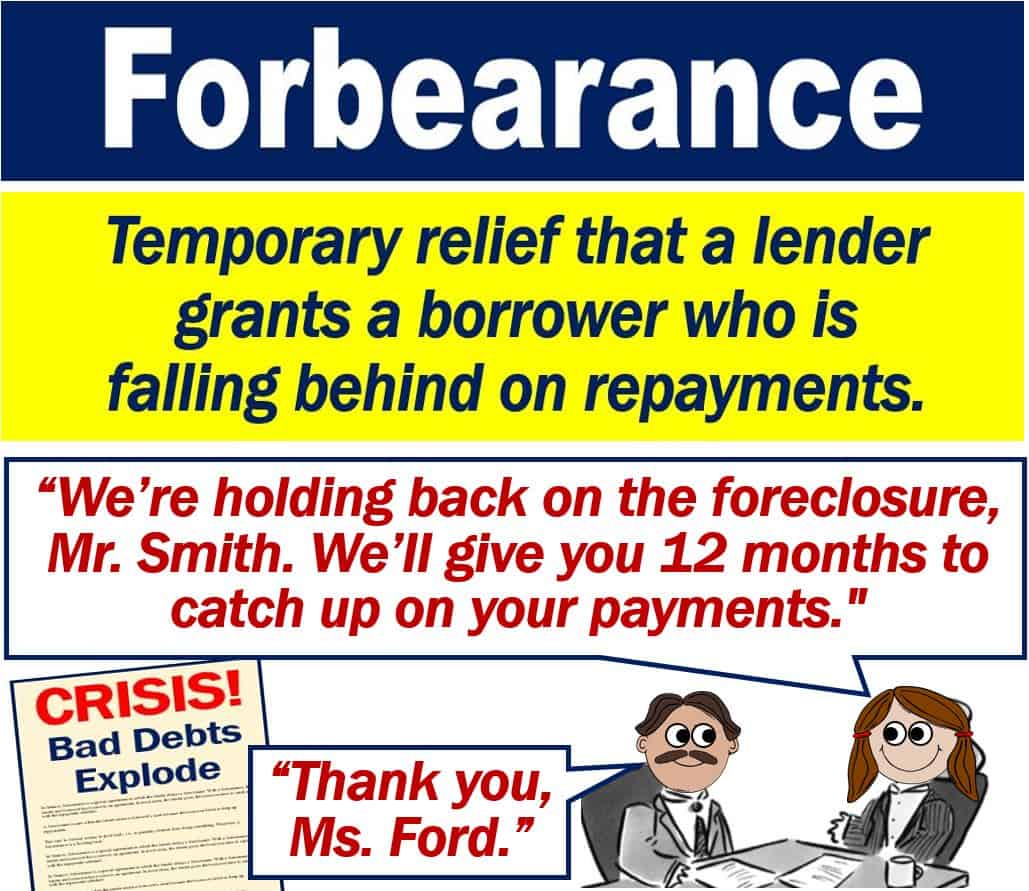

What is forbearance? Definition and examples

In finance, forbearance is a special agreement in which the lender delays a foreclosure. With a forbearance, the lender and borrower have come to an agreement, i.e., an arrangement. In most cases, the lender gives the borrower time to catch up with the repayment schedule.

A foreclosure occurs when the lender seizes a borrower’s asset because the borrower failed to keep up repayments.

The verb ‘to forbear’ means ‘to hold back,’ i.e., to patiently restrain from doing something. Therefore, forbearance is a ‘holding back.’

Forbearance terms

How long the lender gives the borrower in an agreement varies. Neither party wants the loan arrangement to fail. The borrower, if its a mortgage, does not want to lose the property. The lender, on the other hand, prefers not to have to seize the property.

Whether or not the lender grants more time depends on the borrower’s likelihood to be able to catch up with repayments.

If it looks like just a temporary setback for the borrower, the lender will probably forbear.

The lender may grant the borrower a full moratorium, i.e., stop payments altogether for a while. It may, on the other hand, insist that the borrower keeps the interest payments going.

Alternatively, the lender may reduce the interest rate on the loan for a specific period.

Regarding a borrower’s chances of getting extra time from the lender, Wikipedia writes:

“Borrowers in short-term financial difficulty would be more likely to be approved of either a (short term) full moratorium or negative-amortizing deal than customers in long-term financial difficulty.”

Forbearance is not only applicable in situations with a lender and borrower. We can use the term in any situation in which one party refrains from exercising their legal right.

Legal-Dictionary.TheFreeDictionary.com has the following definition of the term:

“Refraining from doing something that one has a legal right to do. Giving of further time for repayment of an obligation or agreement; not to enforce claim at its due date.”

“A delay in enforcing a legal right. Act by which creditor waits for payment of debt due by a debtor after it becomes due.” The debtor is the person or entity that owes money.

Breathing space

Forbearance gives the delinquent borrower time to repay, i.e., breathing space. Delinquent, in this context, refers to a situation in which the borrower is late in paying back money.

Struggling borrowers welcome the additional time. So do the lenders because foreclosures usually mean the loss of money.

Examples

Residential Mortgage Forbearance

Imagine John and Mary Smith, who have a mortgage on their home with ABC Bank. John recently lost his job, and Mary’s hours at work were cut back. They find themselves unable to meet their monthly mortgage payment. Before they fall behind, they approach ABC Bank to discuss their situation. Understanding that the Smiths’ hardship is likely temporary, ABC Bank agrees to a six-month forbearance plan.

During this period, the Smiths are not required to make their usual mortgage payments. Interest, however, continues to accumulate, and the missed payments will be due at the end of the forbearance period. The Smiths are grateful for this ‘breathing space’ as it gives them time to stabilize their finances without the immediate threat of losing their home.

Student Loan Forbearance

Consider the case of Lisa, a recent graduate, who has a federal student loan in the US. After graduation, Lisa struggled to find employment in her field, and her entry-level job doesn’t pay enough to cover her living expenses and student loan payments. After assessing her situation, her loan servicer agrees to a twelve-month forbearance.

During this forbearance, Lisa is not required to make payments on her student loan, but interest continues to accrue. This temporary reprieve allows her to focus on advancing her career and increasing her income. Lisa knows that she’ll have to make the payments and the accrued interest once the forbearance period ends, but the relief from immediate payments helps her manage her finances more effectively in the meantime.

Small Business Loan Forbearance

Tom owns a small bookstore that has been hit hard by an unexpected road construction that blocked the main entrance to his store. Revenue has plummeted, and Tom is struggling to make payments on his small business loan from a credit union. Fearing bankruptcy, Tom meets with the credit union’s loan officer to explain the temporary nature of his setback.

The credit union works out a forbearance agreement that allows Tom to make interest-only payments for three months, with a plan to return to regular payments once the construction is complete and customers can access his store again. This arrangement provides Tom with the necessary leeway to keep his bookstore afloat during a challenging period.

These fictional examples demonstrate the flexibility that forbearance offers to borrowers facing temporary financial difficulties, and how it can provide a lifeline during unforeseen setbacks, allowing them to recover without the immediate pressure of full repayments.