Gap management – definition and meaning

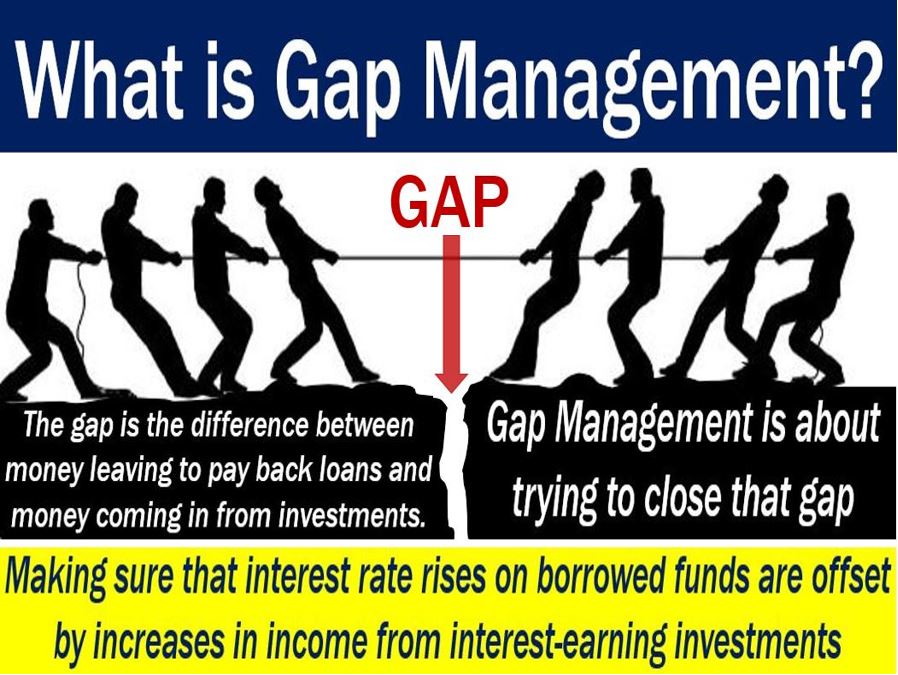

Gap management refers to managing assets and liabilities to balance out any increase in interest rates on loans. In other words, trying to making sure money going out to cover debts is equally offset by income from interest-earning investments. If interest rates on loans go up, and the company owes money, its repayment installments will be higher.

Gap management means ensuring that income from investments makes up for the ‘gap’ that higher interest rates on loans created.

Gap management is, therefore, the control that accountants apply to mitigate the gaps that they identify. What happens if the company pays out more on debt repayments than it earns from investments? There is a ‘gap.’ Gap management involves reducing that gap.

According to BusinessDictionary.com, gap management is:

“Administration of assets and liabilities to ensure that interest rate increases on borrowed funds are offset by equivalent increases in income from interest-earning investments.”

What is duration gap management?

The duration gap is the difference between the duration of liabilities and assets that an entity holds. It is an accounting term that pension funds, banks, and other financial institutions use. ‘Liabilities’ are what the company owes, while ‘assets’ are what it owns.

The duration gap measures the timings of cash inflows and outflows. Duration gap management refers to matching those flows so that the company does not have a cash flow problem.

A positive duration gap exists when assets’ duration is larger than liabilities’ duration. In such a situation, if interest rates go up, assets will lose more value than the company’s liabilities. Consequently, the company’s equity shrinks.

A negative duration gap, conversely, exists when the duration of assets is less than liabilities’ duration. If interest rates go up, the company’s liabilities will lose more value than its assets. Consequently, the company’s equity grows.

Accountants may have difficulty finding liabilities and assets of the same duration. In fact, some liabilities and assets often have cash flow patterns that are erratic. Customer defaults might distort predictions regarding cash flows.