Gilts – definition and meaning

Gilts are UK government bonds, i.e. long-term fixed debt securities. The British government issues gilts through the Bank of England. Investors trade them on the London Stock Exchange (LSE). Gilts are low-risk investments. In fact, investors describe them as the crème de la crème of low-risk investments. A UK gilt is the equivalent of a Treasury security in the United States.

Put simply; gilts are units of debt that the government issues. Specifically, the UK government.

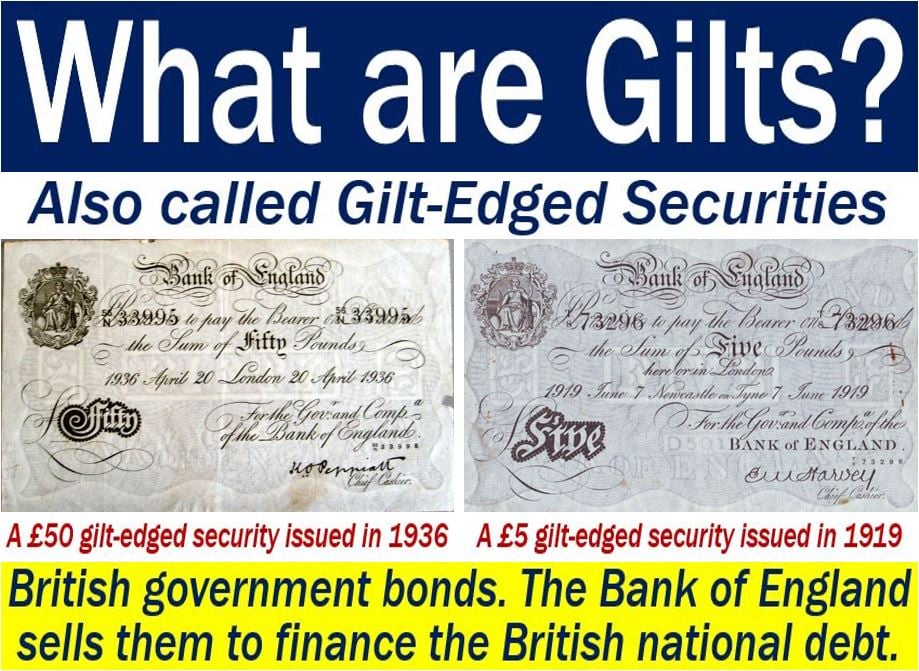

We also call them gilt-edged securities.

They are low-risk investments because the state backs them. However, unlikely, there is always a risk that a financial institution will go bust. For the British government to go bust, however, the risk is negligible.

Historically, the British government issued the certificates with gilded edges, hence the name.

There are two types of gilt-edged securities:

1. A conventional gilt, which the central bank issues in nominal terms.

2. An index-linked gilt, which is similar to US Treasury inflation-protected securities. In other words, it is indexed to inflation.

According to ft.com/lexicon, the Financial Times glossary of terms, gilts are:

“British government bonds sold by the Bank of England, done to finance the British national debt.”

Gilts – government borrowing

If you purchase a gilt, you are effectively lending money to the government. The government promises to pay back the amount in full on a specific date, plus interest.

The amount the government originally borrowed from you is the principal. We refer to the interest as the coupon.

Initially, the Bank of England issues the security at par, i.e., at 100p. One pound sterling (£1) has one hundred pence (‘p’ is short for ‘pence’). Pence means penny. Investors then trade them on the open market.

In other words, if you purchase gilts, you can sell them before their redemption date. However, you might not recover your initial investment.

It also means that you can purchase gilts at below par, i.e., less than 100p. If you then hold on to them, you will make a profit at redemption.

On the other hand, if you buy them at above par, you run the risk of making a capital loss.

Gilts and interest rates

Gilt prices fluctuate. Interest rates affect their value. When the Bank of England reduces the base interest rate, gilt prices rise. Contrariwise, when the base rate rises, their prices decline.

One of the great attractions of government bonds is that the investor can lock into a high yield. That yield will prevail, regardless of how high or low interest rates move.

In an Investors Chronicle article, Beverly Aston writes:

“Gilt prices are also affected by the market’s perception of future interest rates.”

“The longer a gilt has to maturity, the more sensitive it is to changes in interest rates – something known as duration risk.”

Video – What are gilts?

This Investor Trading Academy video explains what a gilt is.