Global Investment Performance Standards (GIPS) – definition and meaning

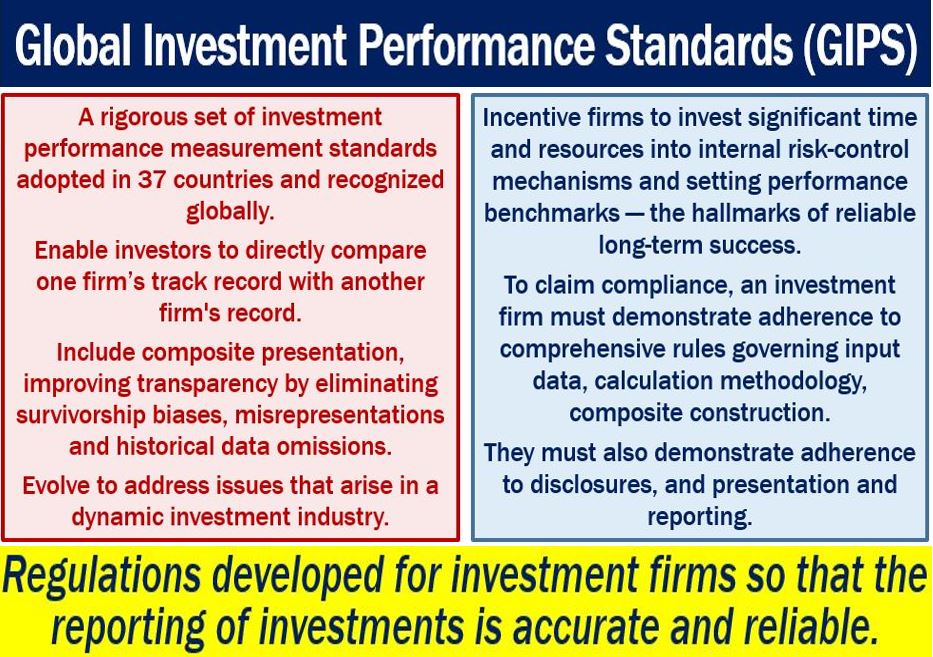

Global Investment Performance Standards or GIPS are a set of investment performance measurement standards for investment firms. Specifically, GIPS refers to investments on publicly traded markets. Thirty-seven countries recognize GIPS and follow its standards. It enables investors to compare one investment firm’s track record with another’s.

Companies that comply with Global Investment Performance Standards strive to eliminate survivorship biases, historical data omissions, and misrepresentations. In other words, their business practices and reports on their performances are relatively transparent.

According to the CFA Institute, when investment firms adhere to global standards for presenting investment performance, it gives investors transparency.

Investors need this transparency, above all, to be able to evaluate and compare investment managers’ reliably. CFA stands for Chartered Financial Analyst. An financial analyst is a person who specializes in studying investments and provides advice to stockbrokers and market traders. They also advise portfolio managers.

The CFA Institute writes:

“The Global Investment Performance Standards is a set of standardized, industry-wide ethical principles that guide investment firms on how to calculate and present their investment results to prospective clients.”

Before Global Investment Performance Standards

Investors, in the past, had enormous difficulty obtaining reliable data on investment performance data. Therefore, it was virtually impossible to compare investment firms properly.

GIPSSSTandards.org says that making apples-to-apples comparisons of investment performance used to be difficult. Performance presentation guidelines were different from country to country.

This need for a set of ethical principles and standards for reporting investment results led the CFA Institute to create and publish a minimal global standard.

With this set of standards, each investment firm could calculate and present its investment results.

The first GIPS standard emerged in 1987 with the creation of the AIMR Performance Presentation Standards (AIMR-PPS). They started off as voluntary performance guidelines for investment management firms in North America.

AIMR stands for Association for Investment Management and Research (known today as the CFA Institute).

So, the first step solved the problem for investors in North America, but there was still a clear need in the rest of the world.

The GIPS committee started work in 1995 to develop a set of standards that countries across the world would accept.

“AIMR published the GIPS standards for public comment in February 1998, after circulating several drafts among industry participants to obtain their acceptance of the concepts of the Standards.”

“After an extensive period of public comment, the AIMR Board of Governors formally endorsed the GIPS standards in February 1999.”

Since 1999, Global Investment Performance Standards has become more and more popular across the world. So far, thirty-seven countries have signed up to it.

Video – GIPS

This Passing Score video explains what the Global Investment Performance Standards are. The video is an introduction for the CFA exam.