What is hard currency? Definition and meaning

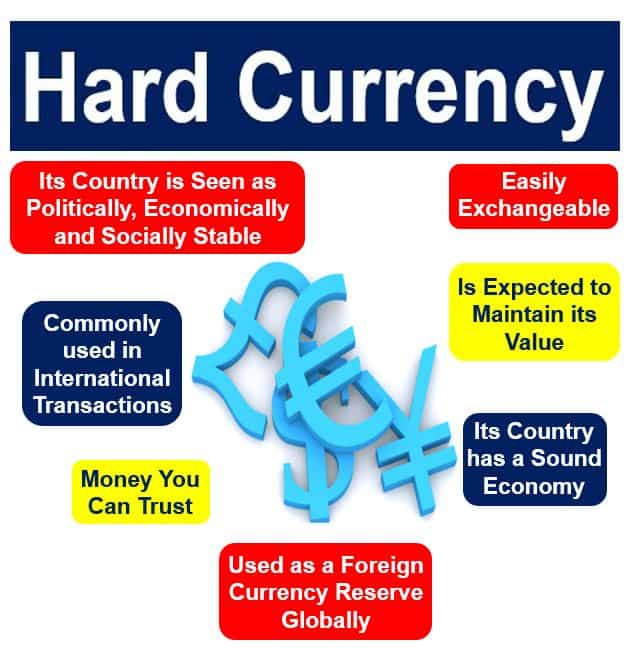

Hard currency is a currency that everybody trusts because they expect it will maintain its value or even appreciate against softer currencies. A hard currency does not suffer from frequent, sharp exchange rate fluctuations. People prefer to use a hard currency for international transactions. It is stable, convertible, and enjoys the confidence of investors, traders, and tourists.

The terms safe-haven currency and strong currency have the same meaning as hard currency. The term can use a countable or uncountable noun, i.e., you can say ‘hard currency’ or ‘a hard currency.’

Major currencies

We sometimes refer to them as major currencies because they are the ones people use for transactions the most. They are also the currencies against which people compare a local currency the most.

According to The Free Dictionary, a hard currency is:

“A currency that is issued by a politically and economically stable country and is therefore well-respected in FX trade.”

“The market to buy and sell hard currencies is especially liquid, even by the standards of foreign exchange trading. The price of a hard currency often remains stable in the short-term.”

The three main factors contributing to a hard currency’s status are:

- the policy position of its central bank,

- its country’s political and fiscal condition and outlook, and

- its long-term stability and purchasing power.

Hard currency vs. soft currency

It is the opposite of a soft currency or weak currency, one that is expected to fluctuate erratically or lose its value against other currencies.

A currency can depreciate because the money supply of that nation increased, or there is a loss of confidence in its ability to maintain a constant value, either because of political, economic or financial concerns.

The Venezuelan Bolivar is a striking example today of a soft currency. Just in November 2016, its black market value declined by 60%, which is an annual rate (when compounded) of 28,000%.

Today’s hard currencies include the US dollar, Euro, British pound sterling, Japanese yen, Swiss franc, Australian Dollar, and Canadian dollar.

You can tell how much a hard currency is favored by looking at the foreign-exchange reserves of nations, which today are (in order): the US dollar, the euro, the British pound sterling, and the Japanese Yen.

The US dollar, the world’s number one foreign reserve currency, is currently used in seventy percent of all international trade transactions.

Different adjectives for currencies

-

Hard Currency

An international currency that is easy to exchange, people have confidence in it, and expect it to keep its value.

-

Soft Currency

One that fluctuates erratically. We expect it to depreciate versus the hard currencies.

-

Hot Currency

Any hard currency that is exciting the Forex markets at the moment. When a country experiences a financial crisis, the dollar, euro, pound or Swiss franc become its ‘hot currency.’ In other words, the currency everybody in that country wants.

-

Heated Currency

A currency that is under pressure of depreciation.

-

Cheap Currency

A term used by British economist John Maynard Keynes (1883-1946). When a government begins repurchasing its bonds before they mature, the money supply increases. As the money supply grows, money becomes cheap – hence its name, ‘cheap money’ or ‘cheap currency’.

-

Dear Currency

When the money supply declines because the government issues bonds, money becomes dearer. It can also refer to a currency that people currently undervalue.

-

Digital Currency

This type of currency only exists electronically. You cannot hold it in your hand, it has no physical form, unlike coins or banknotes. We can use this type of currency to purchase products and services.

A hard loan, as opposed to a soft loan, has to be paid back in a hard currency.

2 Videos

These two interesting video presentations, from our sister YouTube channel – Marketing Business Network, explain what ‘Hard Currency’ and ‘Soft Currency’ are using simple, straightforward, and easy-to-understand language and examples.

-

What is a Hard Currency?

-

What is a Soft Currency?