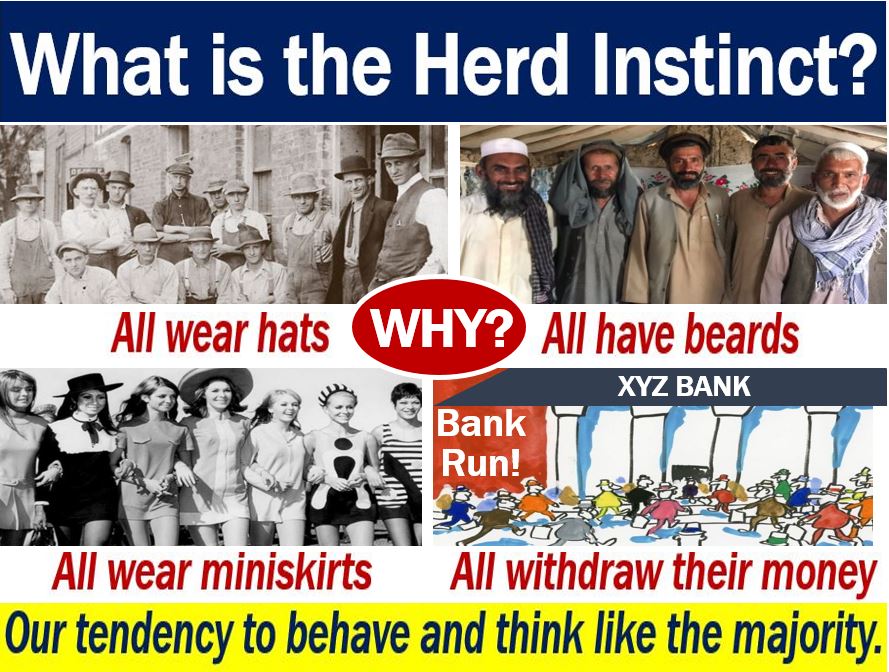

The Herd instinct is a tendency among people and also animals to think or behave like the majority. The term may have a positive or negative meaning. When we use it negatively, it describes a lack of thoughtfulness or individual decision-making.

The herd instinct or herd behavior is evident when humans demonstrate in the streets, go on strike, or attend sporting events. We also see it in episodes of mob violence, opinion-forming, decision-making, and religious gatherings.

In the world of investments, the herd instinct is a common feature. For example, when a group of investors worries about stock prices, that concern can spread rapidly. Soon, many investors feel vulnerable and decide to sell. They sell partly because of their herd instinct or group-minded mentality.

If a man inside a bank sees lots of people withdrawing money and looking worried, he might withdraw his money too. Then a lady sees him do this and gets worried. So, she also decides to take out her money.

Soon, hundreds and then thousands of people are withdrawing their money. We call this a bank run. Bank runs are often caused by our herd instinct.

Investing Answers has the following meaning of the term:

“A herd instinct is emotional pressure to agree with other members of a group.”

“The herd instinct results in failures to think critically about an issue, situation or decision.”

Herd instinct among investors – example

Imagine a group of friends meets regularly to discuss investmet options and their favorite stocks of the week. They are all fund managers for the same company.

They get together regularly not only because it is interesting, but also because they enjoy belonging to a group.

In one meeting, Anne suggests buying John Doe Inc. shares for her fund. In fact, she says she is thinking of making a major purchase. She read a bit about the company and liked its fundamentals.

Anne’s enthusiasm is contagious, and soon most of the others are keen on John Doe shares too. Therefore, when they get back to the office, they all buy John Doe stock.

However, a month later John Doe reports serious liquidity problems and plummeting sales. Its shares subsequently fall by almost forty percent.

The members of the group who meet every week had been victims of the herd instinct. Rather than check out John Doe carefully, they relied on each other’s enthusiasm.

In other words, the herd instinct clouded their judgment and prevented them from doing a proper independent analysis.

Herd instinct in decision-making

We are more likely to eat in a restaurant if we know that it is usually busy. In other words, we like to do what lots of other people do.

Even when nobody tells us a restaurant is good, our herd behavior determines our decision-making. Let’s suppose you walk towards two empty restaurants. You do not know which one to enter.

However, you suddenly see a group of six people enter one of them. Which one are you more likely to enter, the empty one or the other one? Most people would go into the restaurant with people in it.

Let’s suppose you and a friend go into that restaurant. Now, it has eight people in it. Others see that one is empty and the other has eight people in it. So, they decide to do the same as the other eight. We refer to this phenomenon as information cascade.