What are I-Bonds? Definition and examples

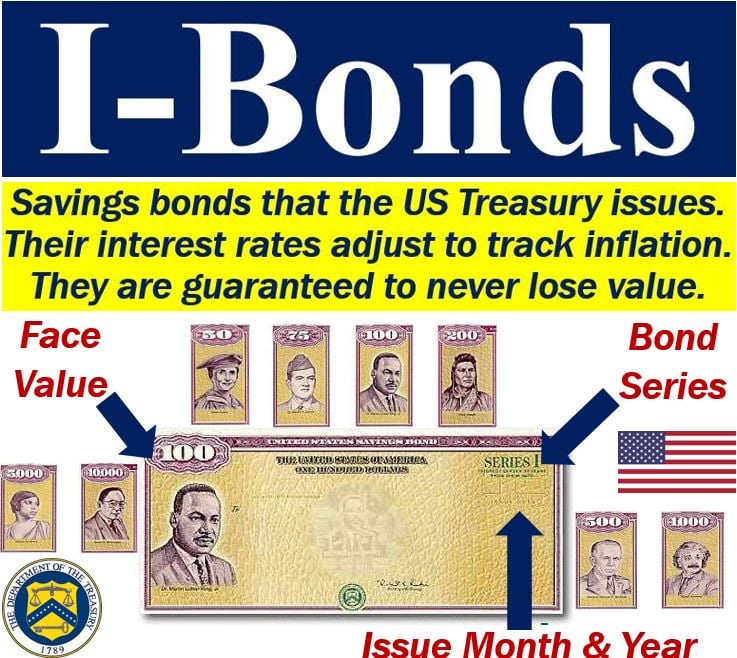

I-Bonds are savings bonds that the United States Treasury issues. These inflation-indexed savings bonds are available in eight denominations. Their denominations range from $50 to $10,000. I-Bonds have a thirty-year maturity. These bonds, unlike other bonds which the US government adjusts for inflation, offer special tax benefits.

If you hold onto your I-Bonds, you may defer paying taxes on any money you earn from them. The US Treasury automatically reinvests earnings, i.e., it adds them to the principal. The ‘principal’ is the original sum of money that somebody puts into an investment. We also call it the ‘par value.’

I-Bonds, like other US Treasury bonds, are exempt from local and state income taxes.

If you redeem your I-Bond to pay for college fees, for example, you may exclude part of the income when calculating your taxes. Sometimes, you may even exclude all of the income.

Nasdaq’s glossary of terms has the following definition of I-Bonds:

“Treasury savings bonds with a 30-year maturity indexed to account for inflation.”

A bond is a loan, an IOU, i.e., a form of debt. Governments sell bonds to investors. Large corporations also issue bonds. Therefore, if you buy a bond, you are lending money to the government or a large company.

I-Bonds – the payout

Two rates determine these bonds’ payouts.

Fixed rate

There is a fixed rate, i.e., a rate that never changes, which may range from about 3% to 3.5%. The Treasury Department sets this rate.

A rate to account for inflation

The US Bureau of Labor Statistics determines this ‘inflation-busting rate‘ every six months.

According to the US Bureau of Labor Statistics, this interest rate reflects any changes in the Consumer Price Index (CPI).

The CPI is an index that represents changes in the price level of a market basket of goods and services that households purchase. In other words, the CPI is the inflation rate for consumers.

EE-Bonds vs. I-Bonds

In the United States, there are two kinds of savings bonds: I-Bonds and EE-Bonds.

EE-Bonds

These bonds have a fixed rate of interest. The government guarantees that they double in value over twenty years.

Savers defer tax on these bonds until they cash them.

The highest denomination savers can purchase is $10,000 per person.

I-Bonds

These bonds have two components: a fixed and a variable component.

The issuer sets the fixed rate when you buy it, while the variable rate has an adjustment every six months.

The adjustments reflect any changes in consumer price inflation.

While the variable rate of I-Bonds may be less than zero, the combined rate is never less than zero. The variable rate may drop below zero in times of deflation.

If you want to purchase US Treasury bonds, you must have a Treasury Direct account. The Treasury will also ask for your social security number and details of your checking or savings account. You will have to provide an email address.

Video – what are I-Bonds?

This ehowfinance video explains what an I-Bond is. The speaker starts by giving us a definition of bonds in general.