What is indexation? Definition and meaning

Indexation means making an expenditure, income or any economic variable keep pace with something else. For example, with wages it refers to making sure employees’ income growth keeps up with rising prices, i.e. inflation or the consumer price index (CPI).

People often talk about the indexation of government spending, meaning that if inflation last year was 2%, then government expenditure should match it by rising by 2%.

It allows different types of income, benefits, and expenditures to retain their value in real terms (after allowing for inflation), so that there is no loss of purchasing power.

Not to be confused with indexing, which means either adjusting the terms of a long-term contract to take into account the effects or inflation, or purchasing only securities that are included in a stock market index such as the S&P 500.

Indexation can simply be described as linking economic variables such as income, expenditure, taxes, etc. to the consumer price index, so that the amounts are adjusted for inflation rate changes.

Types of indexation

There are several categories of indexation:

– Wages: employers may use it to match employees’ income with the inflation rate. This is called a COLA (cost of living adjustment).

– Government Debt: the inflation risk is transferred from depositors to the government in an attempt to reduce inflation. The US and UK governments have issued inflation-proof government bonds to reduce their borrowing costs.

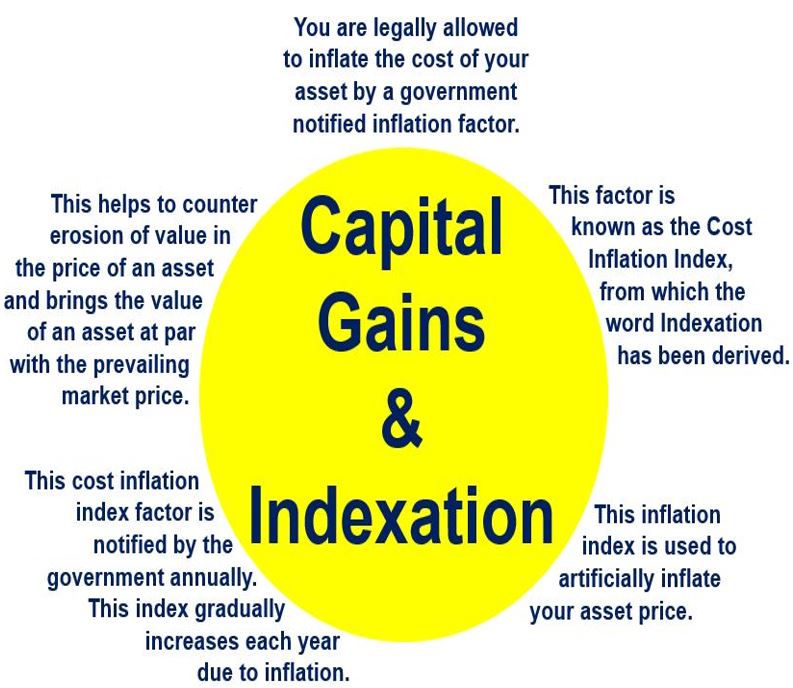

We all have to pay capital gains tax on profits earned from property, mutual fund units, shares, bonds and other investments. With capital gains indexation, the government allows us to adjust the numbers so that the value of our assets keep up with inflation. This usually results on a lower tax bill at the end of the year. (Data Source: slideshare.net/tatamutualfund)

We all have to pay capital gains tax on profits earned from property, mutual fund units, shares, bonds and other investments. With capital gains indexation, the government allows us to adjust the numbers so that the value of our assets keep up with inflation. This usually results on a lower tax bill at the end of the year. (Data Source: slideshare.net/tatamutualfund)

– Exchange Rate: also known as the indexation of currency. A country pegs its currency to a hard currency, such as the US dollar. That country’s central bank buys or sells dollars so as to maintain a stable exchange rate with the US dollar. Many countries, including China, have adopted such a policy.

In the above list, wages, government debt and tax rates are pegged to inflation, while the foreign exchange rates are indexed to another currency.

In economics, any type of indexation is a pre-specified process – all parties involved are aware of how and why the link functions.

Protecting one of the parties from inflation risk means that the price risk has to be shifted to another party. For example, if state pensions are to be adjusted according to the CPI, the price risk is transferred from pensioners to the taxpayers.

Indexation in insurance

In the world of insurance, indexation cover protects people’s policies from the effects of inflation. In most cases, the amount of cover is increased each year by a set percentage. This is useful because the value of money declines as years go by.