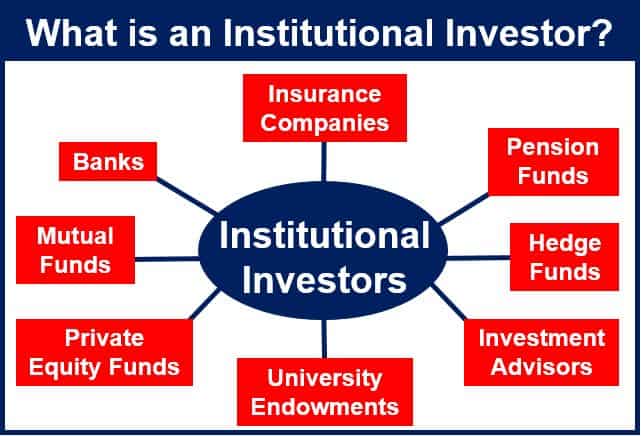

An institutional investor is a company or organization that pools money to buy securities, real estate and other financial assets. Examples include pension funds, hedge funds, mutual funds, endowments, banks, and insurance companies.

They are institutions that make a very large number of big investments in financial markets.

An institutional investor is not expected to be the principal beneficiary of any investment performance. Its business acts broadly as a vehicle through which others may channel investments.

However, institutional investors also use their own money. HM Revenue & Customs, part of the UK Government, writes:

“An institutional investor can invest in two capacities – as an investment channel for others, or strategically/structurally on its own account. In this latter case we would not regard it as investing in its capacity as an institutional investor.”

The institutional investor uses our money

Most investors are ordinary people like you and me. While many of us do not directly own shares or bonds, we do in fact own the majority that are available out there. We own them through institutional investors that invest our savings and pensions plans.

For example, millions of people will have a pension from their employer, who gives each employee’s pension contribution to a pension fund. The fund purchases shares and other financial assets – the pension fund is an institutional investor.

Institutional investors have a powerful influence on the financial markets and economies of countries across the world. They are a major source of capital for publicly listed companies.

Their influence can often determine whether listed companies go under or stay afloat.

Most listed company capital comes from institutional investors

According to Commissioner Luis A. Aguilar, from the U.S. Securities and Exchange Commission, the proportion of US public equities managed by institutional investors has increased steadily over the past sixty years.

In 1950, about 7% or 8% of market capitalization came from institutions, compared to 67% in 2010.

The increase came as more American families took part in capital markets through pooled-investment vehicles, such as ETFs (exchange traded funds) and mutual funds.

Mr. Aguilar added:

“Institutional investor ownership is an even more significant factor in the largest corporations: In 2009, institutional investors owned in the aggregate 73% of the outstanding equity in the 1,000 largest U.S. corporations.”

Many people believe institutional investors have an unhealthy influence on businesses and our planet as a whole. Tim Jackson, a British ecological economist and professor of sustainable development at the University of Surrey, England, said:

“Big companies are reliant on institutional investors on a punishing schedule which leads to ruthless behaviour. This form of capitalism with this structure and incentives will never deliver sustainability.”

“An institutional investor is a company or organization that invests money on behalf of other people. Mutual funds, pensions, and insurance companies are examples.”

Video – Who are the institutional investors?

In this video, founder and CEO of The Mutual Fund Store, Adam Bold, explains that institutional investors are much better at making money on the stock market and financial asset trading generally. For this reason, he believes individual investors (retail investors) would be better off placing their money in mutual funds.