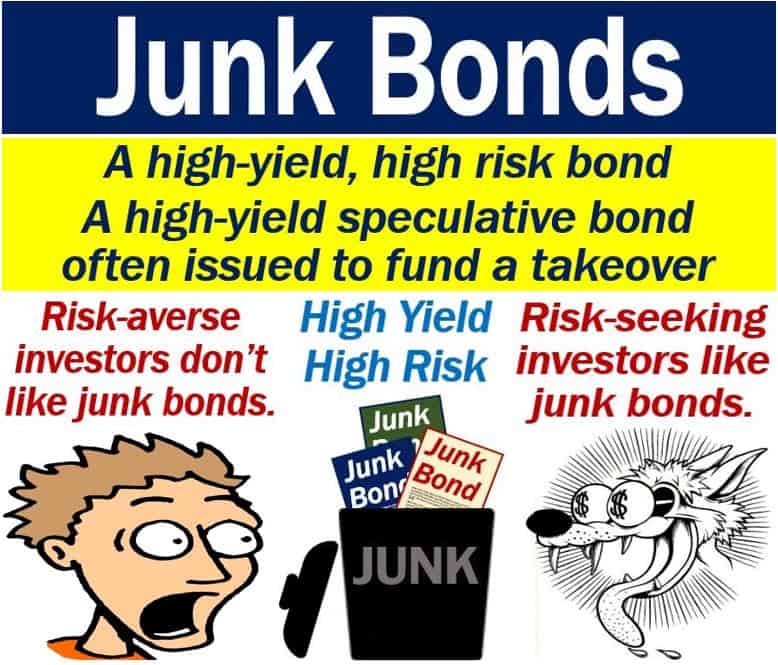

Junk bonds are high-yield bonds that expert investors say are below investment grade. Below investment grade means they have a rating of BB or lower. Less well known or smaller companies issue junk bonds when they need funds for their operations. Sometimes, larger companies issue them to fund leveraged buyouts. They are an option for a company that suddenly needs to borrow a lot of money.

Organizations with a top credit rating issue what we call ‘investment-grade bonds.’ Issuers of investment-grade bonds have a much smaller risk of defaulting (not paying back their debts).

Some issuers, however, have a relatively high risk of defaulting. They issue a low-grade bond, i.e., a junk bond. These companies do not have a long track record.

Investors are less sure about their ability to meet their debt obligations compared to investment-grade bond issuers.

A bond is a loan, a type of debt or IOU. When you buy a bond, you are lending money to the issuer. Companies and governments issue bonds when they need money.

Junk bonds – high yield

We also refer to junk bonds as ‘high-yield bonds.’ They have a higher yield to attract investors. If their yield were the same as investment-grade bonds, nobody would buy them.

Thebalance.com has the following definition of the term:

“Junk bonds are corporate bonds that are high-risk and high-return. They have been rated as not investment grade.”

“Therefore, they tend to have the highest return, compared to other bonds, to compensate for the additional risk. That is why they are also called high-yield bonds.”

Junk bonds – the market

The junk bond market tells us how much risk investors are willing to face. It is an early indication of risk behaviors in the investment community.

If sales of low-grade bonds are high, we know that investors are not feeling risk-averse. Somebody who is risk-averse does not want to take risks. Risk-averse is the opposite of risk-seeking.

When investors are risk-averse, i.e., getting out of junk bonds, they feel pessimistic about the economy. It means that there will probably be a contraction in the business cycle or a market correction.

However, if junk-bond sales are strong, it means that investors are optimistic about the economy. Their behavior may predict an economic expansion or a bull market.

A bull market is one in which investors expect investments to do well. It is the opposite of a bear market.