What is Keynesian Economics?

Keynesian economics comes from the theories of John Maynard Keynes. Put simply; it asserts that economic performance is determined by aggregate demand, i.e., net spending in the economy. Aggregate demand is the total amount of goods and services that consumers, companies and government bodies purchase. Aggregate demands also includes purchasing by foreign participants.

Economists sometimes use the term Keynesian Theory with the same meaning as Keynesian economics.

The central tenet of Keynesian Economics is that government intervention can stabilize the economy.

In Keynesian economics, aggregate demand is not always equal to the productive capacity of the economy. Alternatively, if we determine aggregate demand by some factors, it behaves irregularly, directly affecting employment and inflation.

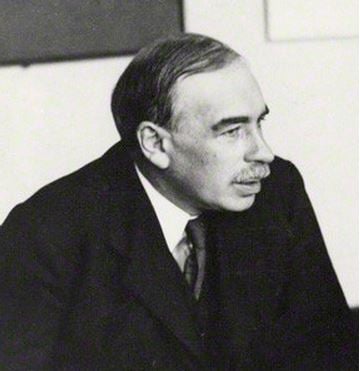

British economist John Maynard Keynes (1883-1946) theorized Keynesian economics during the 1930s. He was trying to determine what had caused the Great Depression.

The Great Depression started in 1929 and lasted more than a decade. It was the most severe, longest-lasting, and most widespread depression of the last century.

From 1929 to 1932, global GDP shrank by 15%. Unemployment in the United States reached 25%. In fact, unemployment reached 33% in some advanced economies.

At the time, Keynes proposed raising government spending and reducing taxes. He believed this would increase demand and subsequently end the Great Depression.

Keynesian economics – spend

Keynes published his thoughts in a 1936 book, titled “The General Theory of Employment, Interest and Money.”

His solution to the Great Depression was to save the economy by:

- Reducing interest rates.

- Increasing government investment in infrastructure.

The central bank should reduce interest rates on money it lends to commercial banks. Subsequently, commercial banks will reduce interest rates on their loans to customers.

With lower interest rates, customers will borrow more. More borrowing boosts the economy.

Keynesian economics advocates a mixed economy with the private sector as the driver. However, it requires the governments to intervene during times of economic decline.

People who follow Keynesian economics say that the private sector can sometimes make decisions that trigger bad macroeconomic outcomes.

When this happens, the public sector must intervene with active policy responses. In other words, the government should respond with monetary policy actions and fiscal policy actions.

Fiscal policy refers to government spending and the collection of taxes.

After the Great Depression, Keynesian economics became the standard economic model in the developed nations. It lost some influence during the stagnation of the 1970s.

However, after the global financial crisis of 2007/8, it made a comeback.

Keynes challenged Adam Smith’s theory

Before Keynes publicized his General Theory, most economists believed that there was a state of general equilibrium in the economy. Economists believed that the needs of consumers were greater than the capacity of producers to satisfy them.

Before Keynes’ General Theory emerged, economists had believed that the free market was self-adjusting. They thought that when goods and services sold at the appropriate price, consumers would buy them. In fact, they believed that consumers would buy all of them.

They also believed that the cyclical swings in economic output and employment would self-adjust naturally.

Keynes’ view that governments have a major role to play in economic management clashed with the laissez-faire economics of Adam Smith. Smith said that economies work best when markets are left free of state intervention.

The International Monetary Fund writes the following about John Maynard Keynes:

“He remembered the lessons from Versailles and from the Great Depression, when he led the British delegation at the 1944 Bretton Woods conference—which set down rules to ensure the stability of the international financial system and facilitated the rebuilding of nations devastated by World War II.”

“Along with U.S. Treasury official Harry Dexter White, Keynes is considered the intellectual founding father of the International Monetary Fund and the World Bank, which were created at Bretton Woods.”

This quote comes from maynardkeynes.org:

“Keynes stated that if Investment exceeds saving, there will be inflation. If Saving exceeds investment, there will be recession.”

“One implication of this is that, in the midst of an economic depression, the correct course of action should be to encourage spending and discourage saving.”

“This runs contrary to the prevailing wisdom, which says that thrift is required in hard times. In Keynes’s words, ‘For the engine which drives Enterprise is not Thrift, but Profit.'”