What is the Loan to Value Ratio (LTV Ratio)?

The loan to value ratio (LTV ratio) is used by banks and financial institutions to assess the risk of people wanting to borrow money.

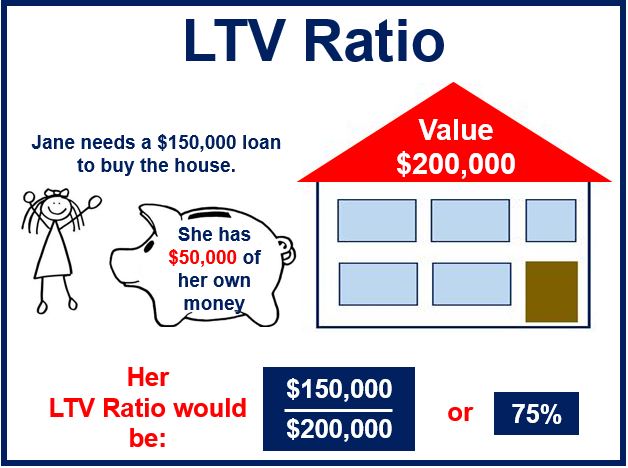

In mortgage applications, banks use the LTV ratio to calculate the ratio of a mortgage to the appraised value of a property – which allows the bank to determine the level of risk of the mortgage contract.

For example, if a house is worth 200,000 USD and the homeowner wants to buy the house by borrowing 100,000 USD from the bank, the bank will calculate the LTV ratio, which in this case is 100,000 USD/200,000 USD, or 50%.

The borrower may already have a mortgage, which is smaller than the value of his or her house. If an application is made for a home equity loan, the bank will probably approve it if the amount is less than the equity value and the applicant has a good credit history and a secure job.

The greater the LTR ratio, the higher the risk (for the lender). Banks (and other financial institutions) always consider the risk of default when they make lending decisions.

Therefore, the lower the amount of equity, the better the lender is able it is to absorb losses.

It is for this reason that sometimes banks may ask people who are taking out a mortgage to buy insurance that protects them from a default.

If Jane has a good credit history and a secure job, she will probably have the loan approved because the LTV Ratio is below 80%.

If Jane has a good credit history and a secure job, she will probably have the loan approved because the LTV Ratio is below 80%.

In the US, Fannie Mae and Freddie Mac have set guidelines that say the LTV ratio should be equal to or less than 80%.

Loans above the an LTV ratio of 80% are allowed, however, they typically require private mortgage insurance (PMI) – insurance to protect the lender.

LTV formula:

LTV Ratio = Loan Value / Value of Collateral